No Data

C250103P77000

- 6.04

- 0.000.00%

- 5D

- Daily

News

Barclays Maintains Citigroup(C.US) With Buy Rating, Maintains Target Price $95

Citigroup: Raised the Target Price for MAOYAN ENT to HKD 9.2, rating "Buy".

Citigroup released a research report stating that it has raised the Target Price for MAOYAN ENT (01896) by 2.2%, from 9 HKD to 9.2 HKD, and included it in the top picks of the movie Industry, with a rating of "Buy." Additionally, the company's revenue forecast for 2025 to 2026 has been adjusted upward by 2% to 3%; adjusted net profit has been increased by 5% to 9%. The bank indicated that the company's worst times may be behind it. As the largest movie ticketing platform, it is expected to benefit from better movie supply this year, and the films it is releasing are still abundant. The next catalyst will be the Lunar New Year holiday release period. The bank predicts that the total box office in mainland China will reach 50 billion RMB in 2025, and

Express News | Citigroup : Truist Securities Initiates Coverage With Buy Rating; Price Target $85

Citi: gives CHINA LONGYUAN a "Buy" rating, Target Price adjusted to 7.2 Hong Kong dollars.

Citi has released a research report stating that, based on the latest data from CHINA LONGYUAN (00916), the pure profit forecasts for this year and next year have been lowered by 4.1% and 9.2%, respectively, due to competition leading to a reduction in electricity prices and delays in the commissioning of new capacity. The bank has lowered the Target Price for CHINA LONGYUAN by 10% to HK$7.20. A 'Buy' rating is given, based on a forecast PE of 7.1 times and a forecast PB of 0.6 times, indicating cheap valuation. Citi predicts that CHINA LONGYUAN's pure profit will grow by 2.9% year-on-year to 6.381 billion RMB last year, and the impairment loss in the fourth quarter has decreased year-on-year and improved compared to the first three quarters, but the bank has a lower profit forecast for the company last year.

EAST BUY rebounded nearly 4%, and Citibank is bullish on the company's ability to fully grasp the surge in demand for seasonal gifts during the Spring Festival.

EAST BUY (01797) experienced a rebound of nearly 4% in the early session, after a cumulative drop of nearly 13% in the previous two trading days. As of the time of writing, the stock price is up 2.55%, currently at HKD 16.08, with a transaction amount of HKD 82.8761 million. Citigroup published a Research Report stating that EAST BUY is in a favorable position to fully capitalize on the surge in demand for seasonal gifts during the Spring Festival, citing reasons such as the company's potential to leverage the power of the WeChat social commerce platform; the first-mover advantage of having new gifting features within WeChat's vast ecosystem; and WeChat's friendly measure of lowering the technical service fee threshold from 5% to 2%. However, with the expansion of the merchant base and increased competition.

Citigroup Options Spot-On: On January 6th, 126.86K Contracts Were Traded, With 2.22 Million Open Interest

Comments

Tax-Loss Harvesting: Investors often sell off underperf...

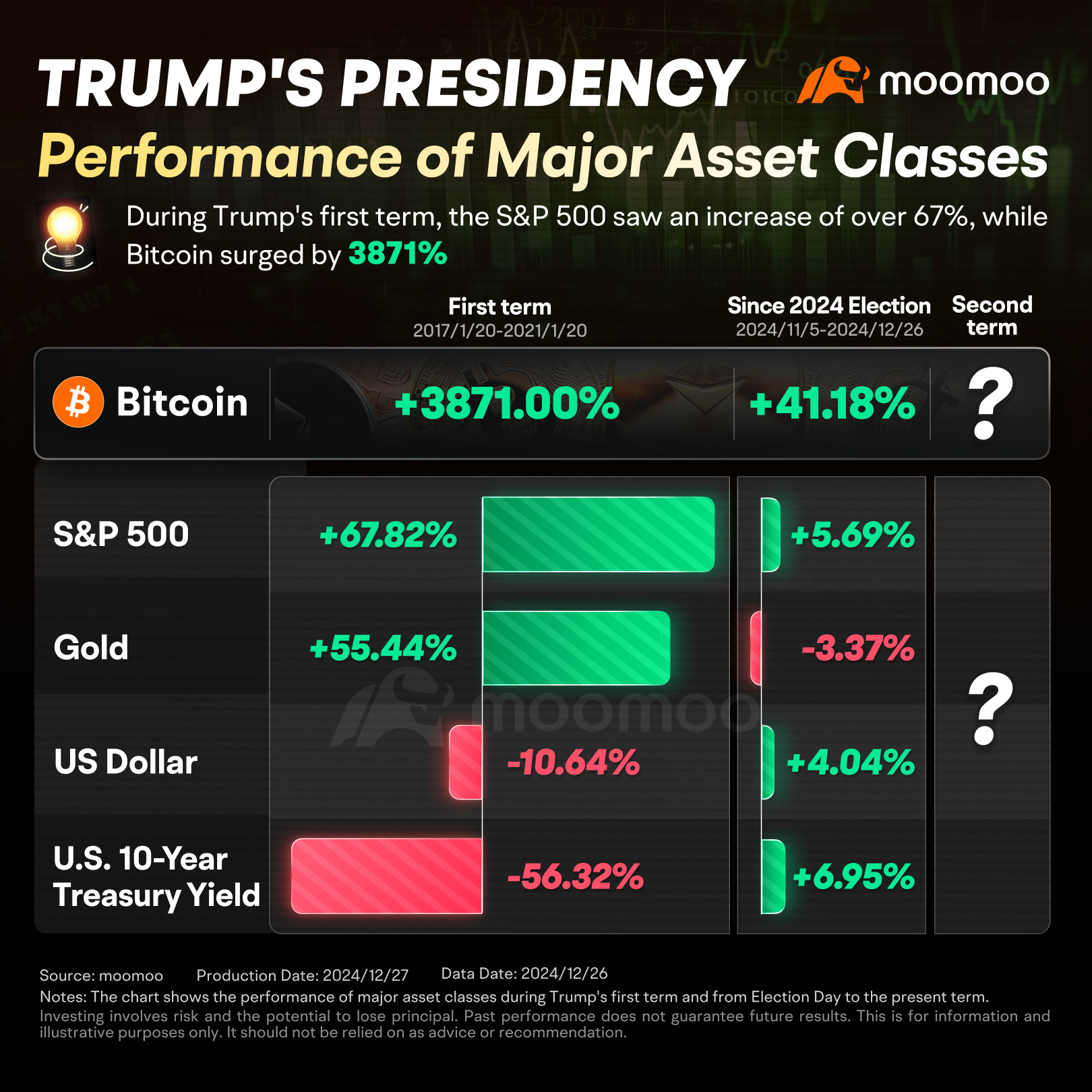

Since Election Day on November 5, 2024, up to December 26, 2024, the S&P 5...

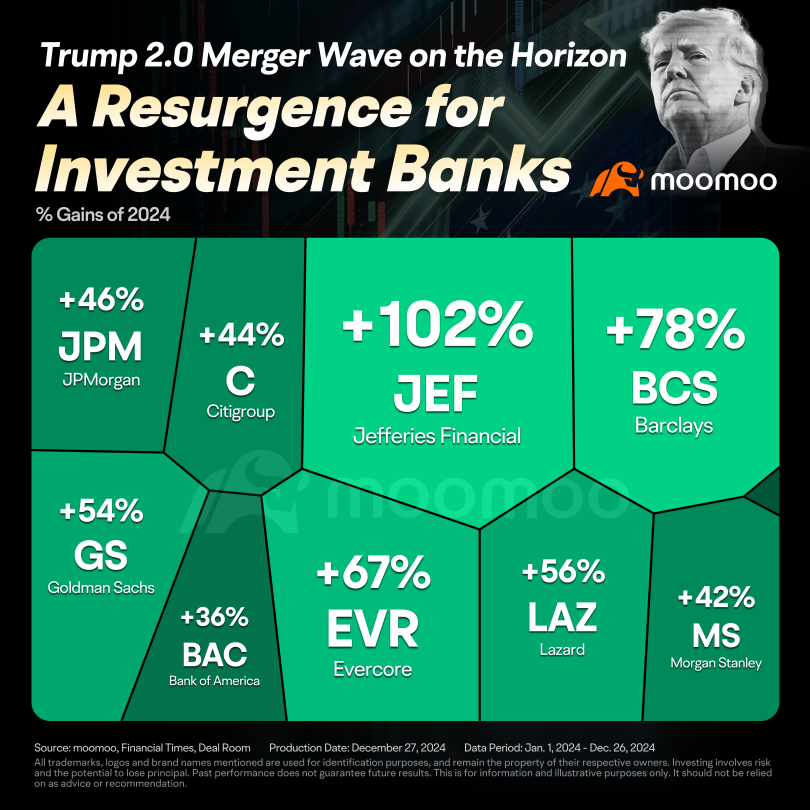

M&A activity is already showing signs of recovery. According to Dealogic, announced M&A deals in 2024 surpassed $1.4 trillion, up from $1.32 trillion in 2023, though slightly bel...

Buy n Die Together❤ :

103575541 :

104088143 : What happened?