US OptionsDetailed Quotes

CAVA241213C129000

- 0.30

- -1.15-79.31%

15min DelayClose Dec 12 16:00 ET

1.45High0.30Low

1.10Open1.45Pre Close361 Volume110 Open Interest129.00Strike Price31.82KTurnover56.65%IV3.13%PremiumDec 13, 2024Expiry Date0.00Intrinsic Value100Multiplier1DDays to Expiry0.30Extrinsic Value100Contract SizeAmericanOptions Type0.1383Delta0.0681Gamma557.20Leverage Ratio-0.4695Theta0.0004Rho77.04Eff Leverage0.0126Vega

CAVA Group Stock Discussion

$CAVA Group (CAVA.US)$

A few days ago, when CAVA’s stock price dropped over 10%, one of the bears on YF was trying to advance the narrative that the drop was the result of a feta cheese shortage. This explanation doesn’t make sense, because there are quite a few close substitutes for feta cheese that can be used in a pinch:

Live Eat Learn: 19 Substitutes for Feta Cheese (Ranked From Best To Worst)

Also, feta cheese is only aged for 2 to 12 months, so any feta shortage wo...

A few days ago, when CAVA’s stock price dropped over 10%, one of the bears on YF was trying to advance the narrative that the drop was the result of a feta cheese shortage. This explanation doesn’t make sense, because there are quite a few close substitutes for feta cheese that can be used in a pinch:

Live Eat Learn: 19 Substitutes for Feta Cheese (Ranked From Best To Worst)

Also, feta cheese is only aged for 2 to 12 months, so any feta shortage wo...

2

$CAVA Group (CAVA.US)$ this is another cliffhanger ..daily chart is broken weekly you're talking right about a hundred bucks for support

1

$CAVA Group (CAVA.US)$

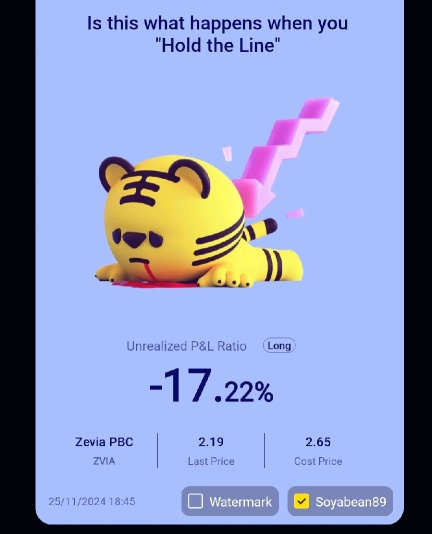

$Zevia (ZVIA.US)$

patiently wait... price paid for fomo

hope the return to office, RFK reform usfda as catalyst

$Zevia (ZVIA.US)$

patiently wait... price paid for fomo

hope the return to office, RFK reform usfda as catalyst

1

$CAVA Group (CAVA.US)$ Cava Stock Swing Trade Before Earnings $200 Profit No Option 📉

https://youtu.be/MVZIfz9TUD4

https://youtu.be/MVZIfz9TUD4

Morning Movers

Gapping up

$Rivian Automotive (RIVN.US)$ experienced a significant increase of 8.7% after announcing that Volkswagen would boost its investment in their joint venture.

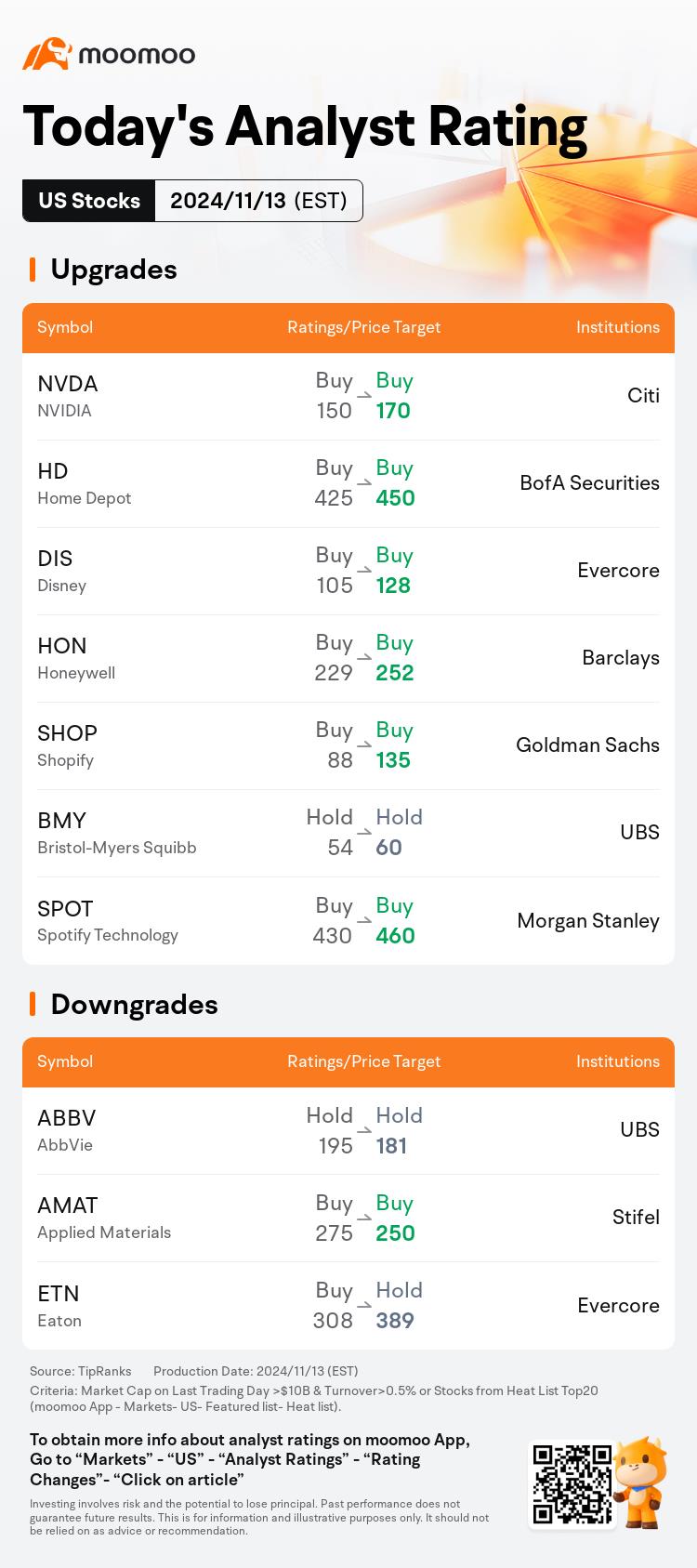

$Spotify Technology (SPOT.US)$ 's shares went up by 8.5% following a report of robust subscriber growth in the September quarter and a promising annual forecast.

Shares of $CAVA Group (CAVA.US)$ jumped 16.2% after the company outperformed earn...

Gapping up

$Rivian Automotive (RIVN.US)$ experienced a significant increase of 8.7% after announcing that Volkswagen would boost its investment in their joint venture.

$Spotify Technology (SPOT.US)$ 's shares went up by 8.5% following a report of robust subscriber growth in the September quarter and a promising annual forecast.

Shares of $CAVA Group (CAVA.US)$ jumped 16.2% after the company outperformed earn...

24

5

10

$CAVA Group (CAVA.US)$ I'll give credit where credit's due.

Cramer very early this year when the stock was 31-32. He said this is going to be the next Chipotle.

and it looks like so far he is correct.

Cramer very early this year when the stock was 31-32. He said this is going to be the next Chipotle.

and it looks like so far he is correct.

3

4

No comment yet

The wolf of Toronto : It’s insiders selling more what the mkt can take.

Chad Dunbar OP : Seeing that we are about halfway through December, people should expect some insider selling. If they are holding options that expire at the end of the year, they can either place a broker trade to convert the options into shares or they can sell the options without taking on broker trade fees. Some of them probably had limit sell orders that triggered when the price got above a certain level. So it probably wasn’t a case of insiders actively sitting in front of their computers and manually hitting the sell button. That’s why I generally don’t prioritize paying much attention to insider selling. The few times that I do, it has more to do with CEOs dumping larger than normal amounts right before an earnings call, as it signals a lack of public perception awareness and strategic thinking, which in turn suggests that leadership of the company is suboptimal. I don’t see any real issue with CAVA right now, and they have a lot of growth ahead of them.