US Stock MarketDetailed Quotes

CB Chubb Ltd

- 301.990

- +5.550+1.87%

Close Mar 31 16:00 ET

- 303.690

- +1.700+0.56%

Post 19:58 ET

120.92BMarket Cap13.30P/E (TTM)

303.655High297.220Low2.46MVolume297.230Open296.440Pre Close740.39MTurnover0.66%Turnover Ratio13.30P/E (Static)400.41MShares303.65552wk High1.89P/B112.16BFloat Cap235.73852wk Low3.59Dividend TTM371.42MShs Float303.655Historical High1.19%Div YieldTTM2.17%Amplitude8.375Historical Low301.529Avg Price1Lot Size

Chubb Ltd Stock Forum

$Chubb Ltd (CB.US)$ does anyone experience that the dividend payout by this company is not taxed? So far other companies are taxed except this.

1

1

Berkshire Hathaway’s most recent portfolio update, based on filings as of Q3 2024, reveals several key holdings and recent changes:

Top Holdings:

1. $Apple (AAPL.US)$ 26.2% of the portfolio, valued at $69.9 billion. Despite recent trimming of the stake, Apple remains the largest holding.

2. $American Express (AXP.US)$ 15.4%, valued at $41.1 billion.

3. $Bank of America (BAC.US)$ 11.9%, worth $31.7 billion, though the stake was reduced by 23% in Q3.

4. $Coca-Cola (KO.US)$ 10.8%, va...

Top Holdings:

1. $Apple (AAPL.US)$ 26.2% of the portfolio, valued at $69.9 billion. Despite recent trimming of the stake, Apple remains the largest holding.

2. $American Express (AXP.US)$ 15.4%, valued at $41.1 billion.

3. $Bank of America (BAC.US)$ 11.9%, worth $31.7 billion, though the stake was reduced by 23% in Q3.

4. $Coca-Cola (KO.US)$ 10.8%, va...

17

3

12

Price at 276.50, Sold csp at nov 5/24, 44 dte dec 20/24, Premium 290, strike at 260, delta -0.208, iv 21.4%, Annualised Return 9.25%. Price at 288.73, Buy to close on nov 18/24 at 50c x 100 = $50, collected 240 premium 83% (ex fee) of 290 premium and still have 32 dte left. At times you can close out contract in 1 week , 2 weeks and etc. By default, we tried to collect 75% of premium. This is not a must, if happy and collected 50% in 2 weeks, can also close it. Th...

7

$SPDR S&P 500 ETF (SPY.US)$ $Chubb Ltd (CB.US)$

Wow did they deliberately mislead us so insituitions can get in cheaper? Morning never mention revenue but said sales miss est by a bit.

Next big thing where price havent went up yet. A stock still inside Warren buffett portfolio.

Superb guidance btw

Wow did they deliberately mislead us so insituitions can get in cheaper? Morning never mention revenue but said sales miss est by a bit.

Next big thing where price havent went up yet. A stock still inside Warren buffett portfolio.

Superb guidance btw

2

A few Investors' performance stands out.

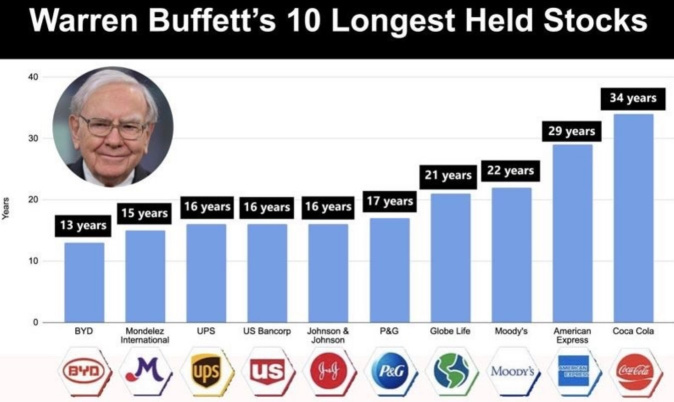

* Warren Buffett achieved 23% over 54 years(!)

* Shelby Davis achieved 22% over 45 years (!)

* Walter Schloss achieved 20% over 49 years (!)

So, how much has your portfolio compounded?

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Bank of America (BAC.US)$ $Chubb Ltd (CB.US)$ $Coca-Cola (KO.US)$ $Johnson & Johnson (JNJ.US)$

* Warren Buffett achieved 23% over 54 years(!)

* Shelby Davis achieved 22% over 45 years (!)

* Walter Schloss achieved 20% over 49 years (!)

So, how much has your portfolio compounded?

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Bank of America (BAC.US)$ $Chubb Ltd (CB.US)$ $Coca-Cola (KO.US)$ $Johnson & Johnson (JNJ.US)$

3

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Apple (AAPL.US)$ $Bank of America (BAC.US)$ $Coca-Cola (KO.US)$ $Citigroup (C.US)$ $American Express (AXP.US)$ $Chubb Ltd (CB.US)$ $DaVita (DVA.US)$ $The Kroger Co. (KR.US)$ $Moody's (MCO.US)$ $The Kraft Heinz (KHC.US)$ $Occidental Petroleum (OXY.US)$ $Chevron (CVX.US)$ $VeriSign (VRSN.US)$

8

1

$Chubb Ltd (CB.US)$

Chubb's Digital Payments and Cyber Scams Survey Finds Growing Impact of Fraud on Consumers; Harms Trust in Payment Methods | CB Stock News

Chubb's Digital Payments and Cyber Scams Survey Finds Growing Impact of Fraud on Consumers; Harms Trust in Payment Methods | CB Stock News

$September Stock Picks$

In light of our first stop loss hit for Sep picks, we have our first Spotight pick.

$Chubb Ltd (CB.US)$

Current Pice: 288.35

Target: 355

Stop loss: 255

In view of prospects for annual earnings growth over the next several years higher multiple is warranted. The current valuation is 12.2 times 2025 EPS and my target valuation is 14.8 times 2025 EPS. If achiveved it will offer investors a prospect of nearly 24% return, including its dividen.

As a...

In light of our first stop loss hit for Sep picks, we have our first Spotight pick.

$Chubb Ltd (CB.US)$

Current Pice: 288.35

Target: 355

Stop loss: 255

In view of prospects for annual earnings growth over the next several years higher multiple is warranted. The current valuation is 12.2 times 2025 EPS and my target valuation is 14.8 times 2025 EPS. If achiveved it will offer investors a prospect of nearly 24% return, including its dividen.

As a...

5

Take a look at my super boring non-tech portfolio. I feel like such a dork.

9

19

No comment yet

kenljv : I was wondering the same thing. Noticed that for some other stocks as well