US Stock MarketDetailed Quotes

CHWY Chewy

- 33.410

- +0.080+0.24%

Close Nov 29 13:00 ET

- 33.550

- +0.140+0.42%

Post 17:01 ET

13.63BMarket Cap40.25P/E (TTM)

34.020High33.110Low2.28MVolume33.450Open33.330Pre Close76.42MTurnover1.76%Turnover Ratio371.22P/E (Static)407.90MShares39.10052wk High28.01P/B4.34BFloat Cap14.68552wk Low--Dividend TTM130.03MShs Float120.000Historical High--Div YieldTTM2.73%Amplitude14.685Historical Low33.492Avg Price1Lot Size

Chewy Stock Forum

Hi mooers! ![]()

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!![]()

For more details, check out the earnings calendar and economic calendar!

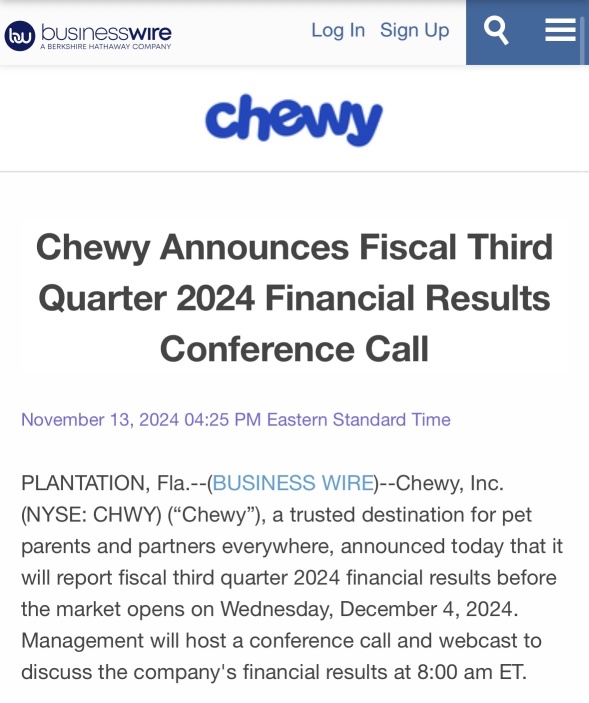

This week, various companies including $Salesforce (CRM.US)$ , $Lululemon Athletica (LULU.US)$ , and $Chewy (CHWY.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For mor...

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!

For more details, check out the earnings calendar and economic calendar!

This week, various companies including $Salesforce (CRM.US)$ , $Lululemon Athletica (LULU.US)$ , and $Chewy (CHWY.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For mor...

4

1

$Chewy (CHWY.US)$ December 4th are earnings for chewy. last quarter when the earnings came out there was a real lag before the stock took off so earnings were released it only traded up like 50 to 75 cents it really did nothing and then all of a sudden when the market opened it took off like a rocket ship and went straight up. a good quarter exceeding expectations I expect we could see the same type of vertical Spike, we could see 36.70.

5

We just heard Elon Musk $Tesla (TSLA.US)$ Is going to push for Cannabis Legalization in the U.S under President Trump, We heard rumor behind the scenes "Not only is good for the economy & contribute to U.S Tax revenues, it is good for the people"

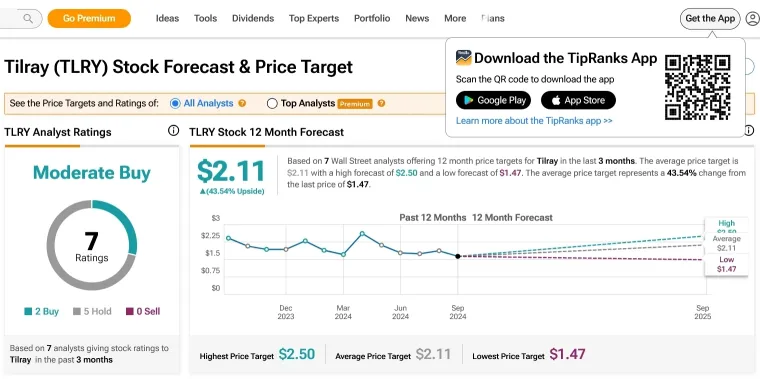

$Tilray Brands (TLRY.US)$ TLRY current stock price offers more upside reward than downside risk at current levels. TLRY is growing revenues &...

$Tilray Brands (TLRY.US)$ TLRY current stock price offers more upside reward than downside risk at current levels. TLRY is growing revenues &...

11

11

$BARK Inc (BARK.US)$ Finally, it is ur turn. When can it return the start price $12? $Chewy (CHWY.US)$

1

1

$Chewy (CHWY.US)$ upgrade today!

$AMC Entertainment (AMC.US)$ $GameStop (GME.US)$ $Koss Corp (KOSS.US)$ $Chewy (CHWY.US)$ WOW JUST WOW THEY HAVE CONTROL OF THE MARKET THE AFTER MARKET AND THE AFTER DARK MARKET AND PRE MARKET INTO BACK REGULER MARKET THATS HOW POWERFUL THEY ARE INSANE

4

2

No comment yet

Analysis

Price Target

No Data

Heat List

Overall

Symbol

Latest Price

% Chg

No Data

today and everyday. Attitude of Gratitude

today and everyday. Attitude of Gratitude  365

365

104712493 : When comparing the earnings prospects of Lululemon, Salesforce, and Chewy, the outlook for each varies based on sector performance and company fundamentals:

Lululemon: The athletic apparel company has shown resilience, with expected earnings growth of 7.5% next year. The company anticipates revenue growth of 8-9% in fiscal 2024, driven by strong brand loyalty and international expansion. However, challenges include high valuation and slowing momentum in some key markets

Salesforce: The cloud computing leader has raised its full-year earnings guidance, reflecting strong performance amid continued digital transformation. Its expected annual earnings per share (EPS) range of $10.03-$10.11 demonstrates robust growth, supported by strategic shifts to improve profitability, including a focus on artificial intelligence

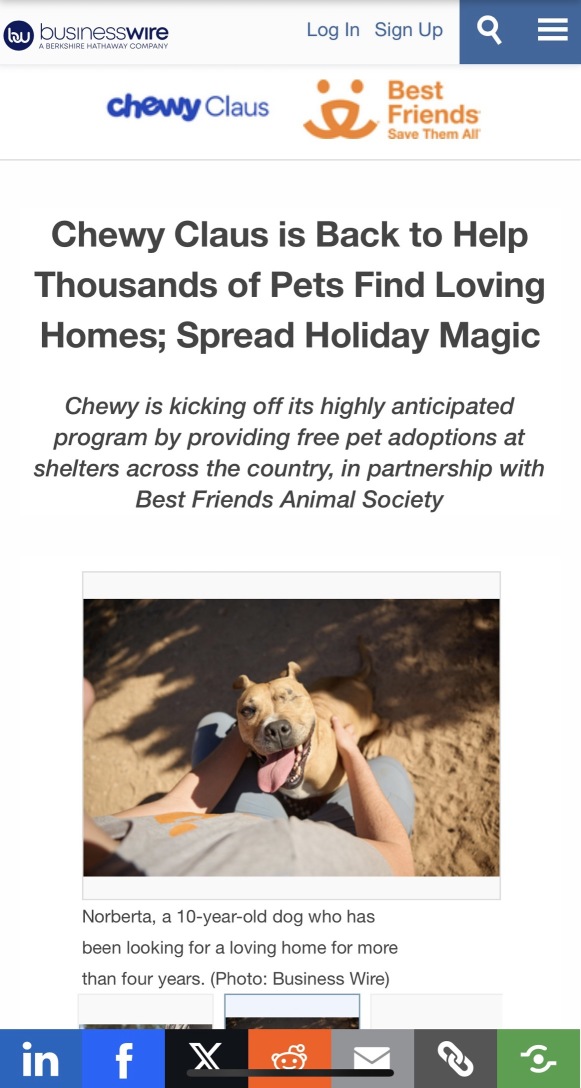

Chewy: The pet e-commerce giant has rebounded from profitability challenges and expects steady demand in its niche market. While its growth is attractive, its earnings depend on maintaining competitive pricing and managing logistics costs effectively

Conclusion:

Salesforce offers the strongest earnings growth potential due to its leadership in a high-growth sector and strategic focus on AI.

Lululemon has solid fundamentals but faces valuation concerns.

Chewy shows promise but operates in a more volatile niche.