US Stock MarketDetailed Quotes

CIEN Ciena

- 73.890

- -0.800-1.07%

Trading Mar 4 13:49 ET

10.54BMarket Cap127.40P/E (TTM)

74.259High70.475Low2.05MVolume72.990Open74.690Pre Close147.68MTurnover1.45%Turnover Ratio127.40P/E (Static)142.59MShares101.44052wk High3.74P/B10.45BFloat Cap43.30052wk Low--Dividend TTM141.39MShs Float1056.998Historical High--Div YieldTTM5.07%Amplitude4.980Historical Low71.975Avg Price1Lot Size

Ciena Stock Forum

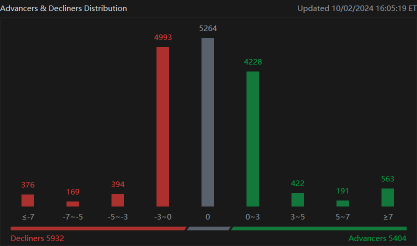

The market fell on Thursday after tech stocks hit all-time highs Wednesday, and inflation in the prices companies pay rose more than expected.

Overall, the market was falling after the Nasdaq hit a record over 20k Wednesday. Past 4:09 pm ET the $S&P 500 Index (.SPX.US)$ traded -0.54%, the $Dow Jones Industrial Average (.DJI.US)$ fell 0.53%, and the $Nasdaq Composite Index (.IXIC.US)$ fell 0.66%.

MACRO

Thursday's macro in numbers showe...

Overall, the market was falling after the Nasdaq hit a record over 20k Wednesday. Past 4:09 pm ET the $S&P 500 Index (.SPX.US)$ traded -0.54%, the $Dow Jones Industrial Average (.DJI.US)$ fell 0.53%, and the $Nasdaq Composite Index (.IXIC.US)$ fell 0.66%.

MACRO

Thursday's macro in numbers showe...

21

1

5

Columns Market Falls Thursday, Producer Inflation Grows, and Tech Pulls Back From Records | LiveStock

Happy Thursday, December 12th. The market fell on Thursday after tech stocks hit all-time highs Wednesday, and inflation in the prices companies pay rose more than expected. Here are the stories you might have missed affecting stocks today:

$Warner Bros Discovery (WBD.US)$ climbed 13%, the highest on the S&P 500 by percentage gain after the firm said Thursday it decided to cut its cable TV business from i...

$Warner Bros Discovery (WBD.US)$ climbed 13%, the highest on the S&P 500 by percentage gain after the firm said Thursday it decided to cut its cable TV business from i...

23

4

3

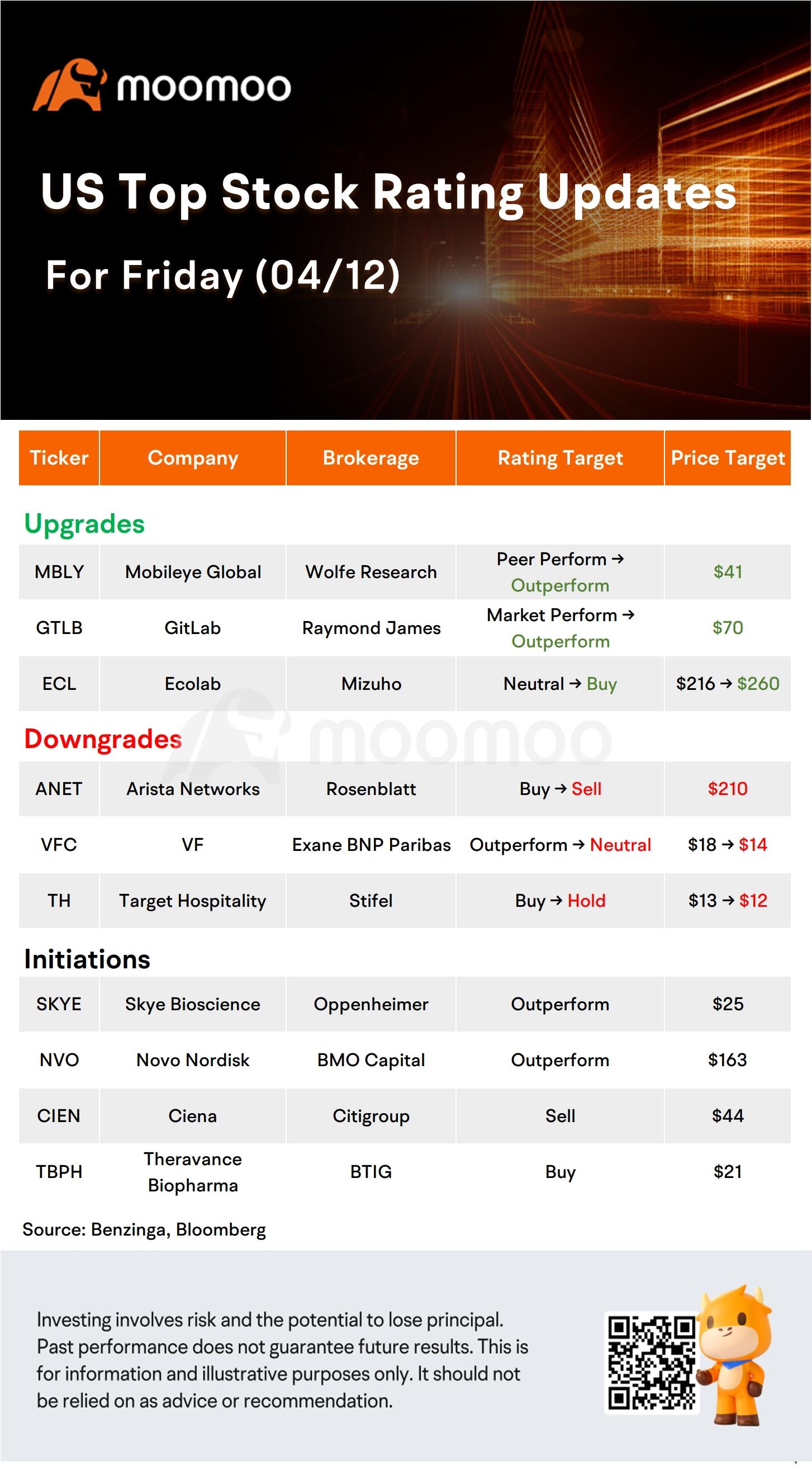

$Ciena (CIEN.US)$ In June 2024, Nokia Corporation announced its agreement to acquire Infinera for approximately $2.3 billion. This strategic move aims to bolster Nokia’s optical networking capabilities.

When considering potential acquisition targets for larger companies like $AT&T (T.US)$ or $Verizon (VZ.US)$ , several factors come into play, including strategic alignment, market position, and financial health. Among the U.S. optical network equi...

When considering potential acquisition targets for larger companies like $AT&T (T.US)$ or $Verizon (VZ.US)$ , several factors come into play, including strategic alignment, market position, and financial health. Among the U.S. optical network equi...

3

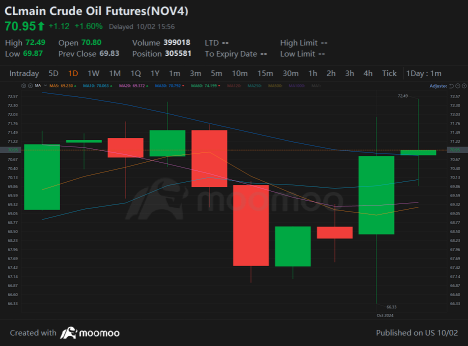

The market fell Wendesday morning, but moved toward a flat sideways crawl by the afternoon.

The $S&P 500 Index (.SPX.US)$ climbed 2 bps, the $Dow Jones Industrial Average (.DJI.US)$ climbed 11 bps, and the $Nasdaq Composite Index (.IXIC.US)$ climbed 6 bps.

MACRO

US September ADP Nonfarm Employment came in at 143,000 vs 124,000 forecasts, higher than last month's 99,000.

Meanwhile, crude oil inventories came in much higher than estimated: firm...

The $S&P 500 Index (.SPX.US)$ climbed 2 bps, the $Dow Jones Industrial Average (.DJI.US)$ climbed 11 bps, and the $Nasdaq Composite Index (.IXIC.US)$ climbed 6 bps.

MACRO

US September ADP Nonfarm Employment came in at 143,000 vs 124,000 forecasts, higher than last month's 99,000.

Meanwhile, crude oil inventories came in much higher than estimated: firm...

38

11

7

Morning Movers

Gapping up

$Citigroup (C.US)$ shares increased by more than 2% after the bank reported revenue of $21.1 billion, surpassing analysts' expectations.

$Blackrock (BLK.US)$ 's stock grew by 2% following a quarterly report that exceeded expectations, with earnings per share of $9.81 on revenue of $4.73 billion.

$Globe Life (GL.US)$ shares surged approximately 9% in extended trading on Friday, recovering from a more than 50%...

Gapping up

$Citigroup (C.US)$ shares increased by more than 2% after the bank reported revenue of $21.1 billion, surpassing analysts' expectations.

$Blackrock (BLK.US)$ 's stock grew by 2% following a quarterly report that exceeded expectations, with earnings per share of $9.81 on revenue of $4.73 billion.

$Globe Life (GL.US)$ shares surged approximately 9% in extended trading on Friday, recovering from a more than 50%...

27

1

6

Despite lukewarm market response, Ciena's earnings potential may be stronger than perceived due to robust free cash flow and higher earnings per share. A comprehensive understanding of the company's performance requires more factors to be considered.

2

Despite Ciena's reinvestment of its capital, the returns it's generating haven't increased. Given the underlying trends, it's unlikely to be a multi-bagger going forward.

Daryanani predicts Ciena's earnings per share could reach $3.50 or more in fiscal 2024, surpassing the $2.90 consensus estimate. He views Ciena as a 'very attractive asset', the best-in-class optical vendor, and expects the stock to rise due to a 'series of beat and raises coupled with multiple expansion'.

The market's prediction of continued strong earnings growth is reflected in Ciena's high P/E ratio. Shareholders' reluctance to sell the stock indicates an anticipation for a prospering future, making a significant share price drop unlikely.

Ciena's revenue spike may signify aptly handling pandemic-induced demand. The CEO's aim to corner cloud customers aligns with market trends. However, the low telecom demand reflects an industry-wide tendency.

No comment yet

imma sink a bit in there!

imma sink a bit in there!

103677010 : noted