No Data

CA Stock MarketDetailed Quotes

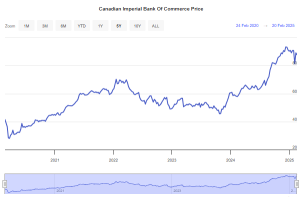

CM Canadian Imperial Bank of Commerce

- 82.990

- +0.120+0.14%

15min DelayMarket Closed Mar 26 16:00 ET

78.01BMarket Cap10.78P/E (TTM)

83.400High82.530Low2.62MVolume83.000Open82.870Pre Close217.79MTurnover94.49852wk High0.28%Turnover Ratio940.02MShares61.81852wk Low7.7EPS TTM77.93BFloat Cap94.498Historical High11.40P/E (Static)939.06MShs Float1.829Historical Low7.28EPS LYR1.05%Amplitude3.67Dividend TTM1.39P/B1Lot Size4.42%Div YieldTTM

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Unit: --

Capital Trend

IntradayDayWeekMonth

No Data

News

Canadian Imperial Bank of Commerce To Go Ex-Dividend On March 28th, 2025 With 0.97 CAD Dividend Per Share

Canadian Imperial Bank of Commerce To Go Ex-Dividend On March 28th, 2025 With 0.72352 USD Dividend Per Share

Bank of Canada Officials Divided on Need for March Rate Cut, Minutes Say

UBS on Canadian Banks -- "Crowding Data Suggests Sentiment Has Inflected More Positive"

Canadian Stock Movers for Wednesday | BRP Inc Was the Top Gainer; Interactive Media Led Gains

From Common Ground to Making Progress With Purpose, the Inaugural CIBC Ambitions Index Explores the Heart of Canadian Ambitions

Comments

$Canadian Imperial Bank of Commerce (CM.CA)$ Does anyone know why there is always a big volumn appear at the last minute of the day recently?

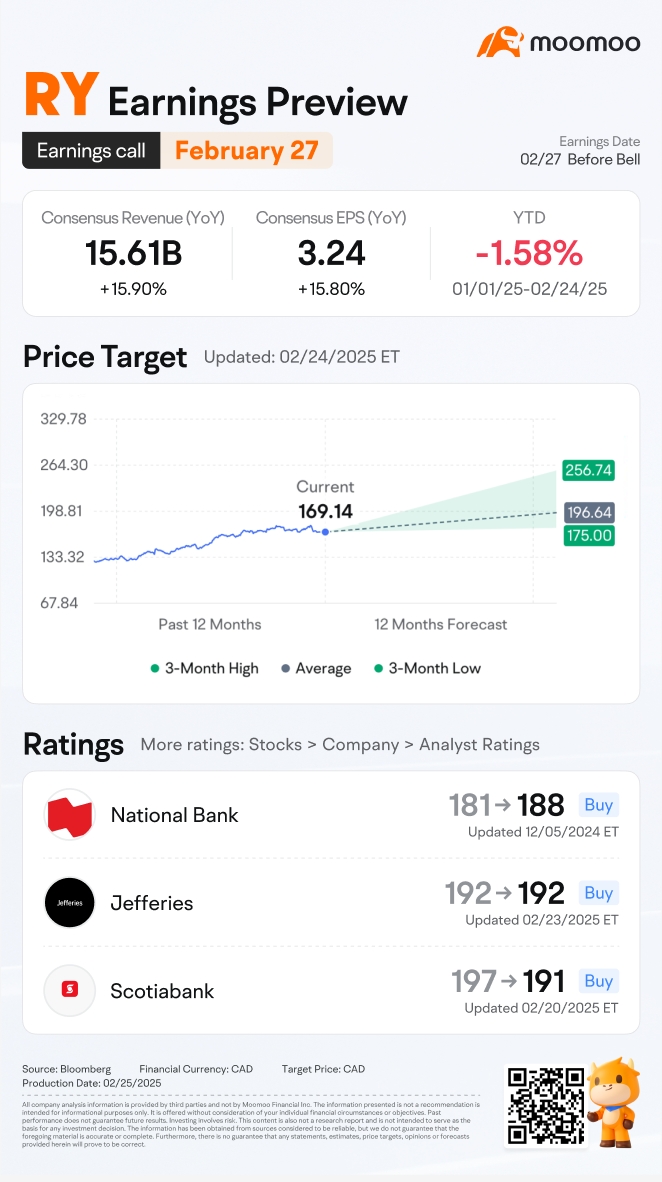

The Royal Bank of Canada is set to release its earnings for fiscal Q1 2025, ending January 31, on February 27. Bloomberg data shows that analysts expect RY's revenue to grow by 15.9% to C$15.61 billion, and EPS to increase by 15.8% to C$3.24. Notably, analyst forecasts for RBC have consistently leaned conservative, with the bank outperforming market expectations in all quarters of 2024.

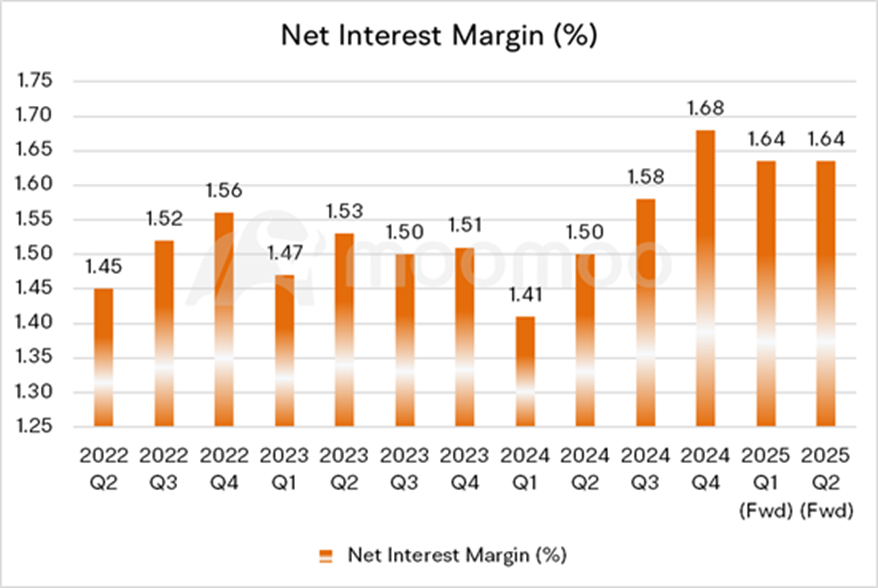

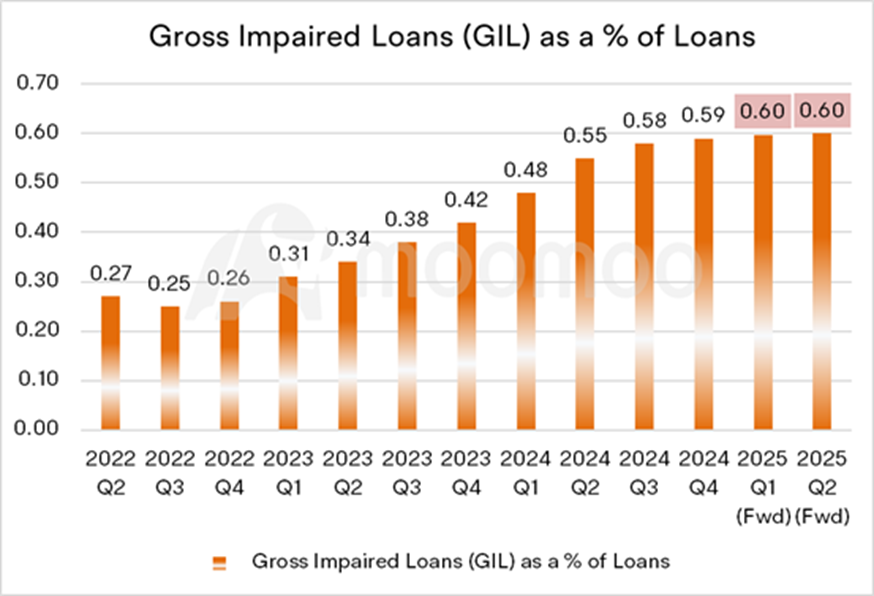

Investors will be closely monitoring the f...

Investors will be closely monitoring the f...

+3

7

3

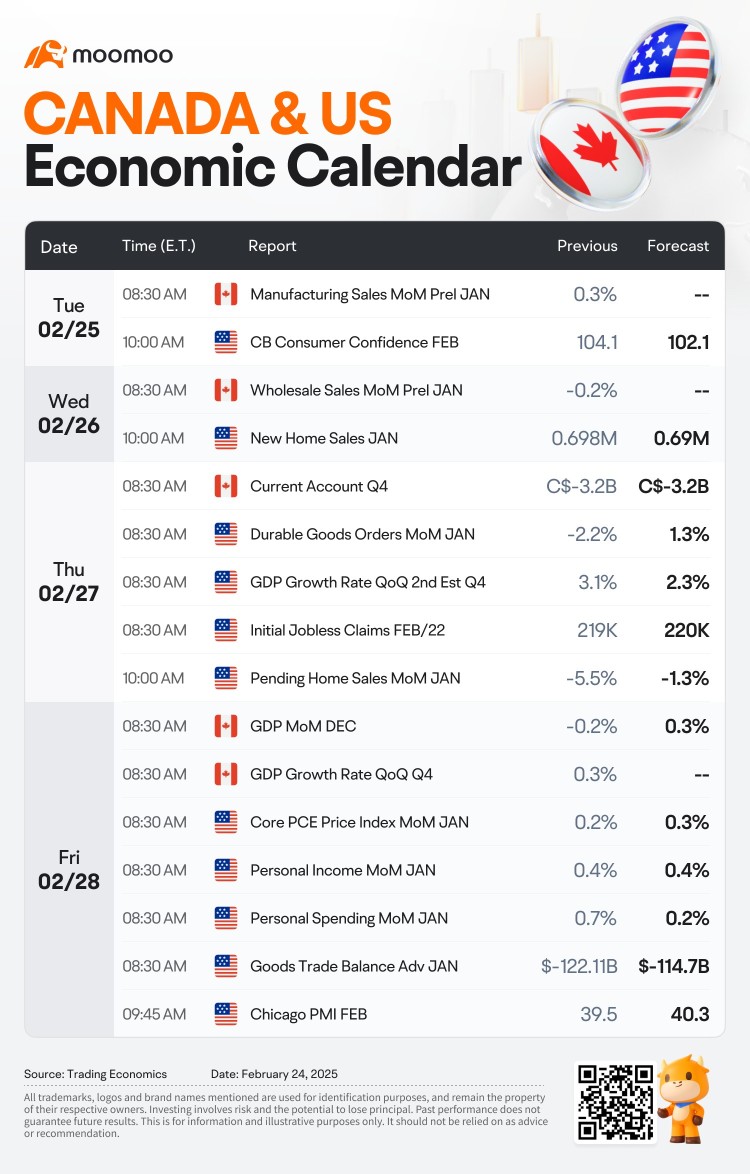

Columns The Week Ahead: Earnings from NVDA, CRM and Canada's Big Banks; US PCE Data and CA GDP in Focus

Earnings Preview

The earnings calendar for the upcoming week features a lineup of significant players and AI-related companies in the stock market.

$NVIDIA (NVDA.US)$ is set to release its Q4 2025 financial results, with analysts forecasting $38.13B in revenue (up 72.52% YOY) and $0.80 EPS (up 61.83% YOY). The company's AI-driven data center growth remains a key focus, despite geopolitical concerns abou...

The earnings calendar for the upcoming week features a lineup of significant players and AI-related companies in the stock market.

$NVIDIA (NVDA.US)$ is set to release its Q4 2025 financial results, with analysts forecasting $38.13B in revenue (up 72.52% YOY) and $0.80 EPS (up 61.83% YOY). The company's AI-driven data center growth remains a key focus, despite geopolitical concerns abou...

+2

5

3

$Canadian Imperial Bank of Commerce (CM.CA)$ One of CIBC’s biggest selling points is its high dividend yield. The bank has historically offered one of the most attractive dividend payouts among Canadian banks, making it a reliable income-generating stock. Moreover, CIBC’s revenue comes from a mix of personal and commercial banking, wealth management, and capital markets, ensuring stability even during economic downturns.

While primarily a Canadian bank, CIBC has been expanding its presence in the...

While primarily a Canadian bank, CIBC has been expanding its presence in the...

2

3

1

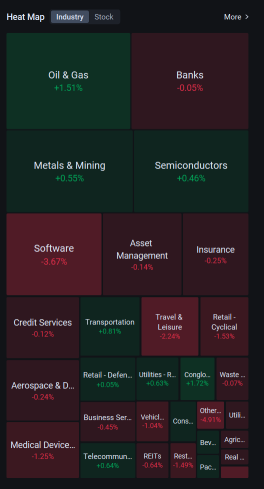

Canadian stocks dip, tracking declines in the U.S. as gains in metals and oil and gas sectors weren't enough to offset declines in tech, finance, and retail sectors.

The $S&P/TSX Composite Index (.SPTSX.CA)$ closed 0.3% lower at 24,929.89, reversing earlier gains. The blue chip $S&P/TSX 60 Index (.TX60.CA)$ also slipped 0.3% to 1,494.34.

$Shopify Inc (SHOP.CA)$ slumped 6.3% amid a wider tech sell-off that hit the main exch...

The $S&P/TSX Composite Index (.SPTSX.CA)$ closed 0.3% lower at 24,929.89, reversing earlier gains. The blue chip $S&P/TSX 60 Index (.TX60.CA)$ also slipped 0.3% to 1,494.34.

$Shopify Inc (SHOP.CA)$ slumped 6.3% amid a wider tech sell-off that hit the main exch...

3

Read more

Market Insights

Dividend Kings of Canada Dividend Kings of Canada

Dividend Kings In Canada are companies that have increased their Dividend per share for the most consecutive years, reflecting a strong business model and robust financials, and are likely to outperform the market with less volatility. Dividend Kings In Canada are companies that have increased their Dividend per share for the most consecutive years, reflecting a strong business model and robust financials, and are likely to outperform the market with less volatility.