No Data

US Stock MarketDetailed Quotes

CMA Comerica

- 59.065

- +0.345+0.59%

Close Mar 31 16:00 ET

- 59.060

- -0.005-0.01%

Post 16:03 ET

7.75BMarket Cap11.77P/E (TTM)

59.370High57.115Low1.28MVolume57.510Open58.720Pre Close74.62MTurnover0.98%Turnover Ratio11.77P/E (Static)131.21MShares71.76052wk High1.26P/B7.69BFloat Cap43.07852wk Low2.84Dividend TTM130.28MShs Float86.733Historical High4.81%Div YieldTTM3.84%Amplitude7.412Historical Low58.465Avg Price1Lot Size

Post-Market

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Unit: --

Capital Trend

IntradayDayWeekMonth

No Data

News

Comerica Price Target Cut to $64.00/Share From $66.00 by Stephens & Co.

Comerica (CMA) Gets a Hold From Morgan Stanley

Stephens Downgrades Comerica to Equal Weight From Overweight, Adjusts Price Target to $64 From $72

Comerica's Hold Rating: Balancing Strong Performance With Economic and Strategic Challenges

Consumers Are Worried About the Economy. Why It Isn't All Gloom and Doom. -- Barrons.com

Beyond The Numbers: 12 Analysts Discuss Comerica Stock

Comments

The S&P 500 and Nasdaq Composite are down 1.26% and 2.87%, respectively, heading into Friday. On the other hand, the Dow is up 1.66% and the small cap Russell 2000 is up 2.33%.

That divergence has been encouraging to some Wall Street pros who had worried that the market rally was becoming too dependent on a handful of massive tech stocks.

“The internals of the market are very healthy,” Evercore ISI strategist J...

That divergence has been encouraging to some Wall Street pros who had worried that the market rally was becoming too dependent on a handful of massive tech stocks.

“The internals of the market are very healthy,” Evercore ISI strategist J...

1

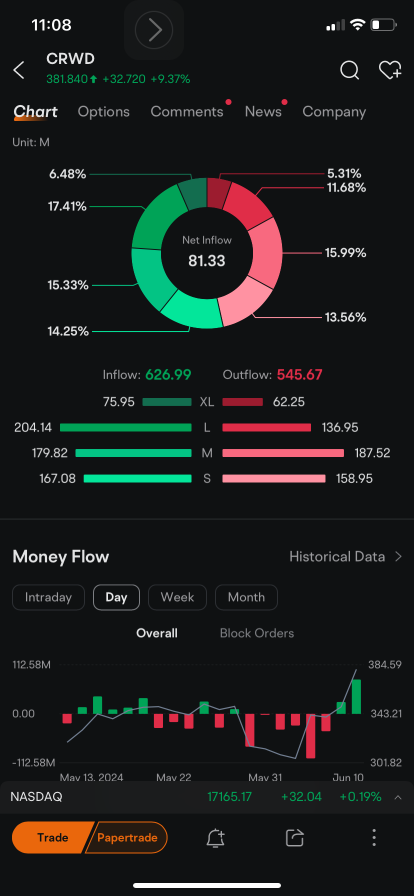

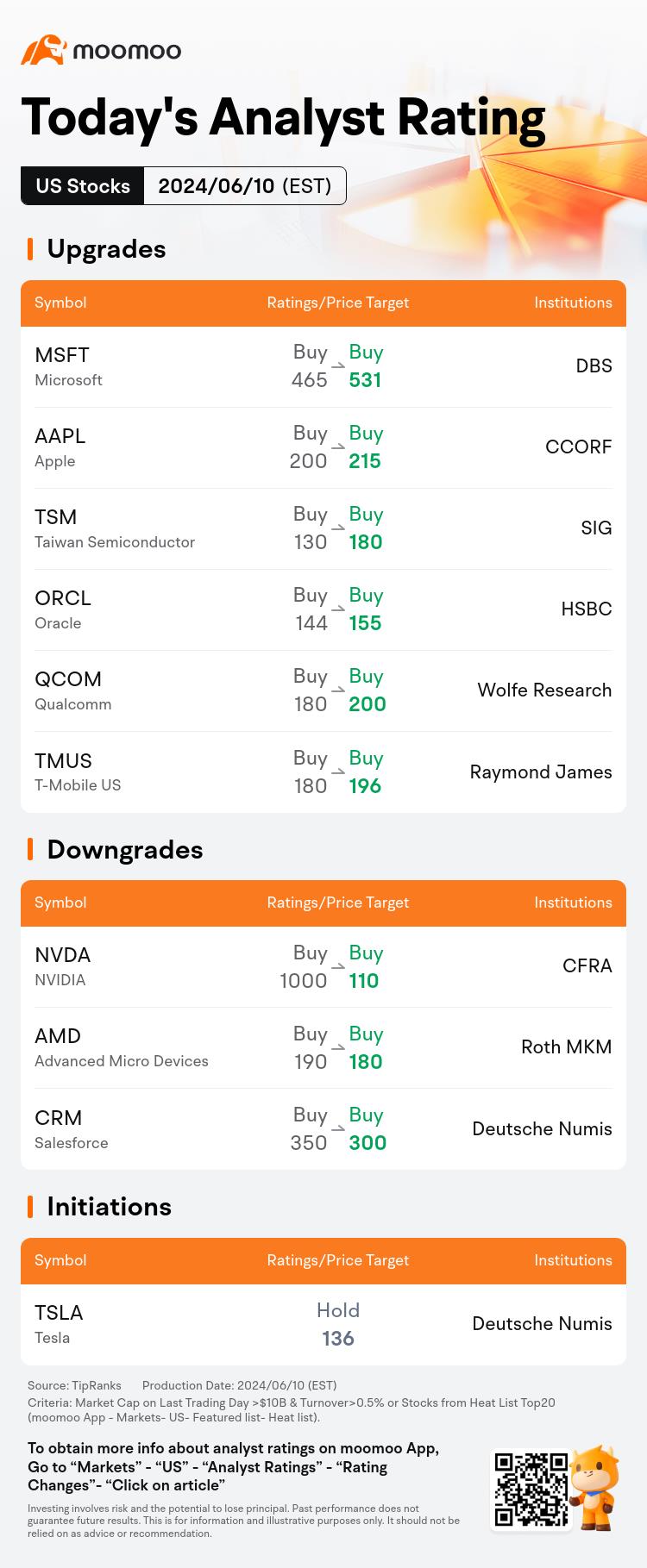

$CrowdStrike (CRWD.US)$ shares climbed to a record Monday and the trading activity in the stock options signal optimism that the rally may have more room to run.

The rally was ignited by an announcement late last week that the cybersecurity company will be added to the S&P 500 Index on June 24. CrowdStrike, $KKR & Co (KKR.US)$ and $GoDaddy (GDDY.US)$ will replace $Comerica (CMA.US)$, $Robert Half (RHI.US)$ and $Illumina (ILMN.US)$ in the be...

The rally was ignited by an announcement late last week that the cybersecurity company will be added to the S&P 500 Index on June 24. CrowdStrike, $KKR & Co (KKR.US)$ and $GoDaddy (GDDY.US)$ will replace $Comerica (CMA.US)$, $Robert Half (RHI.US)$ and $Illumina (ILMN.US)$ in the be...

23

1

6

Morning Movers

Gapping up

$KKR & Co (KKR.US)$ , $CrowdStrike (CRWD.US)$ , and $GoDaddy (GDDY.US)$ saw their shares rise, with KKR jumping over 8%, CrowdStrike increasing by 6%, and GoDaddy growing by 3%. These gains come as all three companies are set to join the S&P 500 on June 24, following the index's quarterly rebalance.

$Southwest Airlines (LUV.US)$ s' stock soared more than 8% after reports that Elliott Investment Managemen...

Gapping up

$KKR & Co (KKR.US)$ , $CrowdStrike (CRWD.US)$ , and $GoDaddy (GDDY.US)$ saw their shares rise, with KKR jumping over 8%, CrowdStrike increasing by 6%, and GoDaddy growing by 3%. These gains come as all three companies are set to join the S&P 500 on June 24, following the index's quarterly rebalance.

$Southwest Airlines (LUV.US)$ s' stock soared more than 8% after reports that Elliott Investment Managemen...

Expand

Expand 24

1

11

The CMA fears that the merger could lead to higher prices and lower investment in UK mobile networks, and may hinder smaller mobile 'virtual' network operators from negotiating good deals.

1

Read more