No Data

COP ConocoPhillips

- 99.990

- -1.100-1.09%

- 99.990

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Preparing for "Trump 2.0"? Hedge funds are increasing their Call on oil prices.

Bull positions in Crude Oil have increased by 41% over the past three weeks, with net long positions reaching the highest level since August of last year. For traders more focused on fundamentals, Trump's tough stance on Iran has made them reluctant to short; Trump's potential tariff policies raise inflation concerns, which has also prompted traders to hedge risks by going long on oil.

Market Climbed Monday Just Past Santa Rally High Water Mark | Wall Street Today

U.S. Natural Gas Rebounds as Lasting Cold Weather Seen -- Market Talk

High Quality Cyclical Stocks According to Morgan Stanley

CES Tech Conference Week Starts with Nvidia and Chips Climbing | Live Stock

Oil Extends Strong Start to 2025 on Signs of Strong Demand for Mideast Crude

Comments

why down? No "Drill baby drill"? 🤔

1. Who’s on Trump’s team? What are their primary responsibilities?

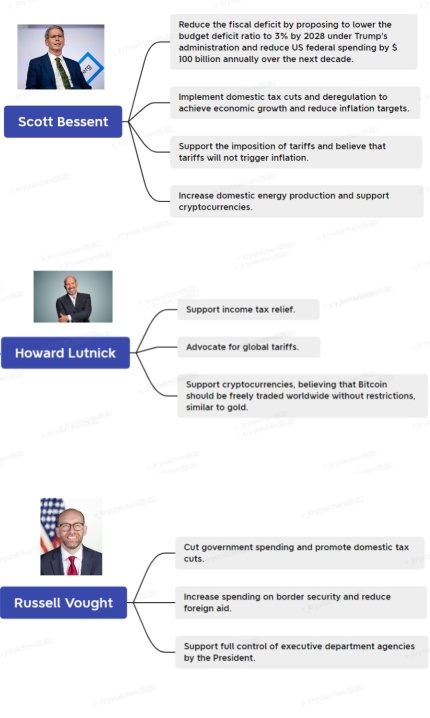

2. Economic ideologies of Cabinet members in policy-related roles

3. Economic ideologies of non-Cabinet members in policy-related roles

4. Impacts...

Analysts predict Trump's second-term policies could echo his first, but with a swifter pace and more assertive domestic and foreign agendas. Expectations are for a stronger application of the "A...

Why is Portfolio Diversification Important?

1. Risk Reduction:

Diversification...

No Data