No Data

CPNG241206C31000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

The Nasdaq index reached a new high, French stocks rose, the south korea etf narrowed after a 7% drop, and the offshore yuan briefly fell below 7.31 yuan.

South Korean President Yoon Suk-yeol abruptly declared a state of emergency, boosting safe-haven assets such as U.S. Treasury bonds, Japanese yen, and gold, while cryptos on the South Korean exchange plunged. The South Korean parliament quickly passed a resolution to lift the state of emergency, with the Ministry of Finance and the central bank actively working on market rescue measures. After a 2.7% drop to a two-year low, the won’s decline was cut in half, South Korean etfs fell by 1.6%, and the yield on 10-year U.S. Treasury bonds turned to increase after hitting a new low in over a month. France is set to vote on dissolving the government as early as Wednesday, with French stocks following European markets upward, although they had previously declined during the day. The Dow Jones, small cap stocks, and semiconductor indices fell, while the China concept index once rose by 1.9%. The yuan hit a new low in a year during the day, and U.S. oil rose nearly 3% testing the $70 mark.

Top Gap Ups and Downs on Tuesday: ACN, DB, X and More

Coupang Options Spot-On: On December 3rd, 71,228 Contracts Were Traded, With 298.25K Open Interest

Eli Lilly, Coupang Among Tuesday's Market Cap Stock Movers

Korean Stocks Hammered After Declaration of Martial Law

Express News | Coupang Down 5.4%, Posco Holdings Down 5.9%, KT Corp Down 3%, KB Financial Down 2.6%

Comments

$Coupang (CPNG.US)$ $iShares Bitcoin Trust (IBIT.US)$ $T-Rex 2X Long MSTR Daily Target ETF (MSTU.US)$ $SPDR Gold ETF (GLD.US)$ $JPMorgan (JPM.US)$ $Uber Technologies (UBER.US)$ $Netflix (NFLX.US)$ $Kratos Defense & Security Solutions (KTOS.US)$

-Billionaire investor Stanley Druckenmiller told Bloomberg on Wednesday that selling all his Nvidia stock this year was a “big mistake.”

-Nvidia was Druckenmiller's top holding a year ago, but he sold it after the stock tripled in 2023.

-The shares are up another 174% this year, and Druckenmiller has missed much of the continuing rally.

Stanley Druckenmiller is an American billionair...

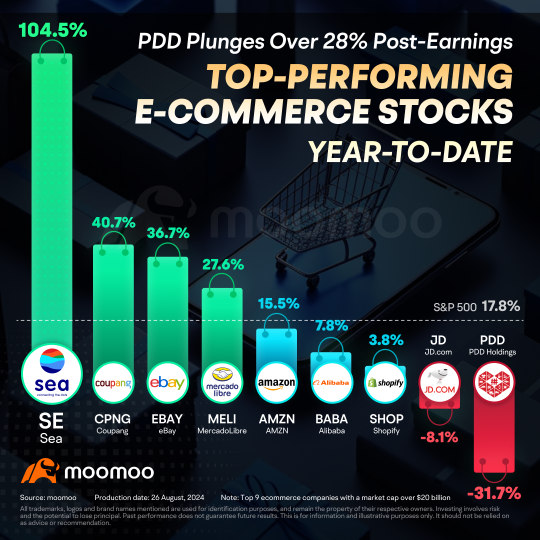

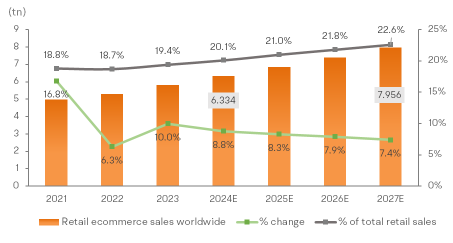

Global e-commerce sales are expected surpass $8T & account for ~30% of total retail sales by 2027 -- let's take a look at where the top companies stand based on 2025 FCF

$Sea (SE.US)$ $Shopify (SHOP.US)$ $MercadoLibre (MELI.US)$ $Global-E Online (GLBE.US)$ $Amazon (AMZN.US)$ $Coupang (CPNG.US)$ $Pinterest (PINS.US)$ $Etsy Inc (ETSY.US)$ $Alibaba (BABA.US)$ $BABA-W (09988.HK)$ $Pinduoduo Concept (LIST0724.SH)$ $PDD Holdings (PDD.US)$

All major e-commerce firms have now reported their second-quarter results, highlighting a stark contrast in performance. $Amazon (AMZN.US)$ and $JD.com (JD.US)$ have fallen 6% and 2% respectively this month, while Sea, MercadoLibre, and $Shopify (SHOP.US)$ have jumped more than ...