US OptionsDetailed Quotes

CRM241129C322500

- 8.25

- -0.72-8.03%

15min DelayClose Nov 29 13:00 ET

8.25High7.58Low

7.58Open8.97Pre Close2 Volume147 Open Interest322.50Strike Price1.58KTurnover1259.82%IV0.23%PremiumNov 29, 2024Expiry Date7.49Intrinsic Value100Multiplier-2DDays to Expiry0.76Extrinsic Value100Contract SizeAmericanOptions Type0.9088Delta0.0274Gamma40.87Leverage Ratio-637.3805Theta0.0000Rho37.14Eff Leverage0.0008Vega

Salesforce Stock Discussion

Hi mooers! ![]()

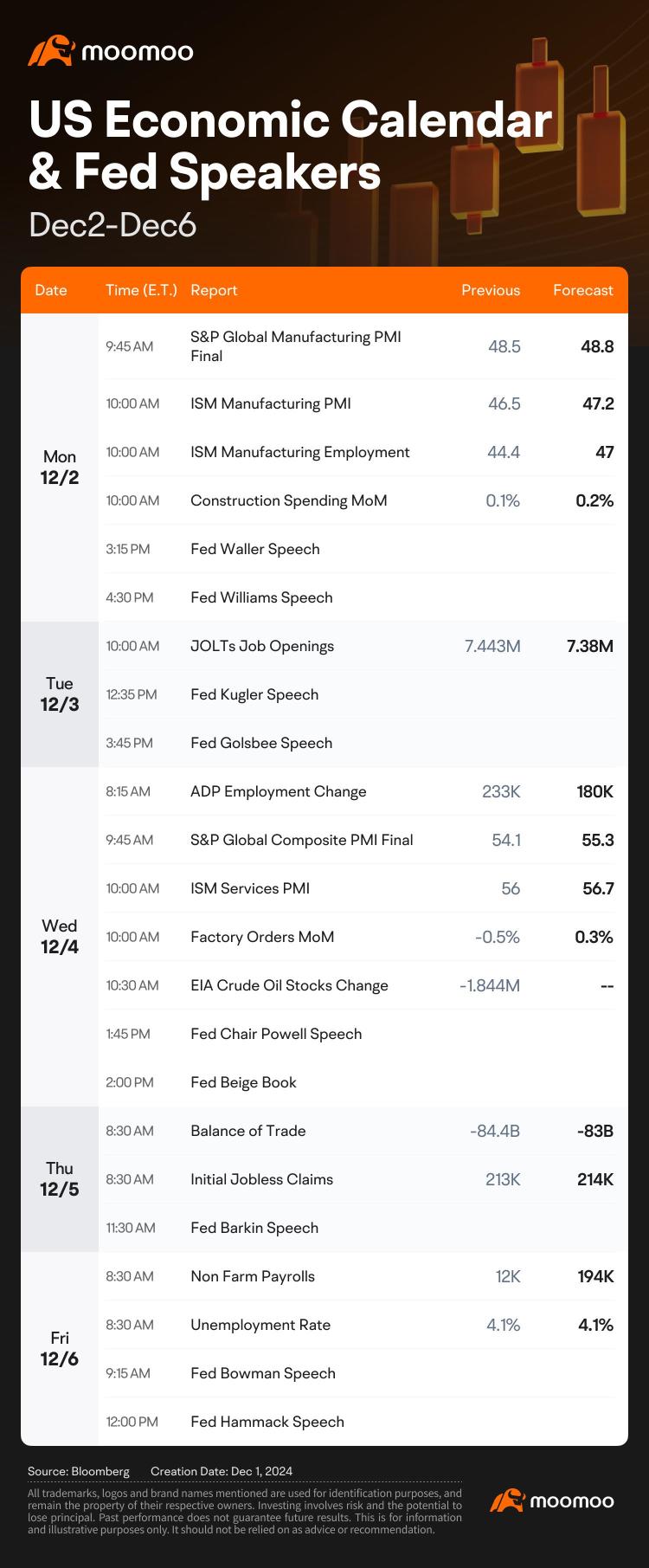

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!![]()

For more details, check out the earnings calendar and economic calendar!

This week, various companies including $Salesforce (CRM.US)$ , $Lululemon Athletica (LULU.US)$ , and $Chewy (CHWY.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For mor...

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!

For more details, check out the earnings calendar and economic calendar!

This week, various companies including $Salesforce (CRM.US)$ , $Lululemon Athletica (LULU.US)$ , and $Chewy (CHWY.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For mor...

10

4

$Salesforce (CRM.US)$ is scheduled to release its fiscal third-quarter 2025 results on 03 Dec 2024.

Salesforce is projecting the total revenues between $9.31 billion and $9.36 billion (midpoint $9.335 billion). Market consensus estimates for the revenue is expected at $9.34 billion, which indicates an increase of 7.1% from the year-ago quarter’s reported figure.

Salesforce anticipates their non-GAAP earnings per share in the b...

Salesforce is projecting the total revenues between $9.31 billion and $9.36 billion (midpoint $9.335 billion). Market consensus estimates for the revenue is expected at $9.34 billion, which indicates an increase of 7.1% from the year-ago quarter’s reported figure.

Salesforce anticipates their non-GAAP earnings per share in the b...

+6

16

$Salesforce (CRM.US)$ Their previous major loss, well two ago. Has me feeling it will be a miss

Earnings Preview

Earnings reports this week will come from software provider $Salesforce (CRM.US)$ and $Marvell Technology (MRVL.US)$, as well as $RBC Bearings (RBC.US)$, $The Toronto-Dominion Bank (TD.US)$, and $Bank of Montreal (BMO.US)$.

On Tuesday, Salesforce is set to release its earnings report, amid analysts' optimistic views on the company's advancements in artificial intelligence...

Earnings reports this week will come from software provider $Salesforce (CRM.US)$ and $Marvell Technology (MRVL.US)$, as well as $RBC Bearings (RBC.US)$, $The Toronto-Dominion Bank (TD.US)$, and $Bank of Montreal (BMO.US)$.

On Tuesday, Salesforce is set to release its earnings report, amid analysts' optimistic views on the company's advancements in artificial intelligence...

+4

88

23

Hey everyone! Like I mentioned in the last post, everyone’s welcome to join our new server on Moomoo! We’ll have weekly stock picks and other updates. Here’s the link: Join the server Trader’s Tavern with us !

Now for the big November update! Here are some stocks with upcoming earnings that I think have great potential to grow. Make sure to do your own research before jumping in! Let’s get it!

(E = Entry, T= Target)

$Jakks Pacific (JAKK.US)$ E = 28 - 28.8 T = 33.5 - 34

A mul...

Now for the big November update! Here are some stocks with upcoming earnings that I think have great potential to grow. Make sure to do your own research before jumping in! Let’s get it!

(E = Entry, T= Target)

$Jakks Pacific (JAKK.US)$ E = 28 - 28.8 T = 33.5 - 34

A mul...

$Salesforce (CRM.US)$

Salesforce Q3 2025 earnings conference call is scheduled for December 3 at 5:00 PM ET /December 4 at 6:00 AM SGT /December 4 at 9:00 AM AEST. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from Salesforce's Q3 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what managements have to say!

Disclaimer:

This presentation is for inf...

Salesforce Q3 2025 earnings conference call is scheduled for December 3 at 5:00 PM ET /December 4 at 6:00 AM SGT /December 4 at 9:00 AM AEST. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from Salesforce's Q3 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what managements have to say!

Disclaimer:

This presentation is for inf...

Salesforce Q3 2025 earnings conference call

Dec 3 16:00

Book

Book 8

1

Investors have long view the semiconductor sector as a leader in market performance in recent years, but we have seen it faced significant headwinds in recent months, especially after mid-October.

After semiconductor sector did an impressive run in 2023 and through most of first half of 2024, we saw it getting a sharp hit in July when expectations for Fed rate cut grew and also the infamous Japan carry trade unwinding. That per...

After semiconductor sector did an impressive run in 2023 and through most of first half of 2024, we saw it getting a sharp hit in July when expectations for Fed rate cut grew and also the infamous Japan carry trade unwinding. That per...

+3

53

1

$Salesforce (CRM.US)$ We still need to see whether it benifits from AI booming based on 3rd Dec earnings

US stock market tumbled last Friday as the post-election rally faltered, likely due to the latest inflation data and Jerome Powell’s slightly hawkish stance.

The market has already given up half of the post-election gains. So! Is the post-election rally over?

$Bitcoin (BTC.CC)$ $S&P 500 Index (.SPX.US)$ $E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ $Vanguard S&P 500 ETF (VOO.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $Salesforce (CRM.US)$ $Super Micro Computer (SMCI.US)$ $Advanced Micro Devices (AMD.US)$ $Taiwan Semiconductor (TSM.US)$ $Broadcom (AVGO.US)$ $Johnson & Johnson (JNJ.US)$ $Arm Holdings (ARM.US)$

The market has already given up half of the post-election gains. So! Is the post-election rally over?

$Bitcoin (BTC.CC)$ $S&P 500 Index (.SPX.US)$ $E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ $Vanguard S&P 500 ETF (VOO.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $Salesforce (CRM.US)$ $Super Micro Computer (SMCI.US)$ $Advanced Micro Devices (AMD.US)$ $Taiwan Semiconductor (TSM.US)$ $Broadcom (AVGO.US)$ $Johnson & Johnson (JNJ.US)$ $Arm Holdings (ARM.US)$

From YouTube

11

5

No comment yet

104712493 : When comparing the earnings prospects of Lululemon, Salesforce, and Chewy, the outlook for each varies based on sector performance and company fundamentals:

Lululemon: The athletic apparel company has shown resilience, with expected earnings growth of 7.5% next year. The company anticipates revenue growth of 8-9% in fiscal 2024, driven by strong brand loyalty and international expansion. However, challenges include high valuation and slowing momentum in some key markets

Salesforce: The cloud computing leader has raised its full-year earnings guidance, reflecting strong performance amid continued digital transformation. Its expected annual earnings per share (EPS) range of $10.03-$10.11 demonstrates robust growth, supported by strategic shifts to improve profitability, including a focus on artificial intelligence

Chewy: The pet e-commerce giant has rebounded from profitability challenges and expects steady demand in its niche market. While its growth is attractive, its earnings depend on maintaining competitive pricing and managing logistics costs effectively

Conclusion:

Salesforce offers the strongest earnings growth potential due to its leadership in a high-growth sector and strategic focus on AI.

Lululemon has solid fundamentals but faces valuation concerns.

Chewy shows promise but operates in a more volatile niche.

Lucas Cheah : $Salesforce (CRM.US)$

Salesforce’s earnings prospects are strong due to its leadership in cloud-based customer relationship management (CRM) solutions. Its focus on AI-driven tools, like Einstein AI, and its Slack integration enhance customer engagement and productivity, driving upselling opportunities. Growing demand for digital transformation across industries supports subscription revenue growth. However, cost-cutting efforts may pressure innovation.

$Lululemon Athletica (LULU.US)$

Lululemon continues to expand its product lines (e.g., men’s wear and Mirror home fitness) while benefiting from global brand recognition and direct-to-consumer channels. Growth in international markets, especially in China, adds significant upside. The women’s activewear category remains a key revenue driver, supported by premium pricing and loyal customers. Supply chain challenges could pose short-term risks.

$Chewy (CHWY.US)$

Chewy’s subscription-based model (e.g., Autoship) drives consistent revenue, supported by strong demand for pet products. Its expansion into high-margin categories like pet healthcare services (Chewy Health) boosts growth potential. The increasing number of pet owners post-pandemic supports revenue growth, though rising logistics costs and consumer spending pressures remain challenges.

In summary:

• Salesforce: Strong in cloud CRM and AI integration, with solid subscription growth potential.

• Lululemon: Expansion in men’s wear and international markets enhances growth despite supply chain risks.

• Chewy: Consistent revenue from subscriptions and healthcare services, though costs may weigh on margins.

musang queen :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

redevilgiggs :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)