No Data

CRWD241213C160000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Microsoft, Meta Among Leaders in Monetizing GenAI Heading Into 2025: Mizuho

Weekly Buzz: Tech stocks hit high scores on ominous day

Market Mixed on Friday the 13th | Livestock

Is CrowdStrike's (CRWD) AI-Driven Platform the Future of Cybersecurity?

The Nasdaq fell to 0.02 million points, Adobe plummeted more than 13%, the China concept Index rose against the trend, and Bitcoin dropped below 0.1 million dollars.

In November, USA PPI inflation exceeded expectations, with the market betting on a pause in interest rate cuts in January next year. The Dow has fallen for six consecutive days, with NVIDIA experiencing the largest drop of 2.5%. Tesla, Meta, Google, and Amazon have moved away from their highs, uranium mining stocks have declined, but Apple reached a new high. Broadcom rose nearly 5% in after-hours trading, and Chinese stocks Baidu and PDD Holdings increased by over 1%. Bond yields in Europe and the USA have risen significantly, and after the European Central Bank cut interest rates, the euro fell to a one-week low, before rebounding. The dollar reached a two-week high, while the offshore yuan once rose over 200 points, breaking through 7.26 yuan. Commodities generally fell, with spot gold down over 2% and spot silver down over 4% during the session.

Thursday Ends in Index Declines | Wall Street Today

Comments

Remember when the Crowdstrike update fiasco had all the bears hysterically spreading FUD while claiming that it was the end and everyone should dump their shares? Well, during that drop is where I bought in. I’m up 35.88% on my position already, before the year’s end. Fear is the mind-killer…

Cybersecurity firms are no exception, demonstrating that innovation in security is keeping pace with broader enterprise trends.

As Al shifts from hype to application, a pivotal moment has emerged. Autonomous Al agents are driving enterprise innovation, automating pro...

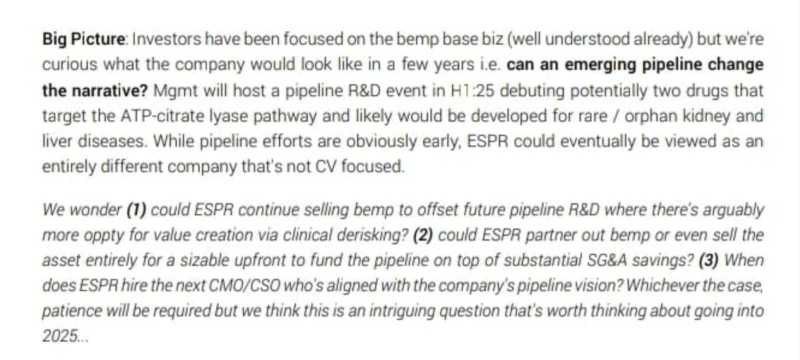

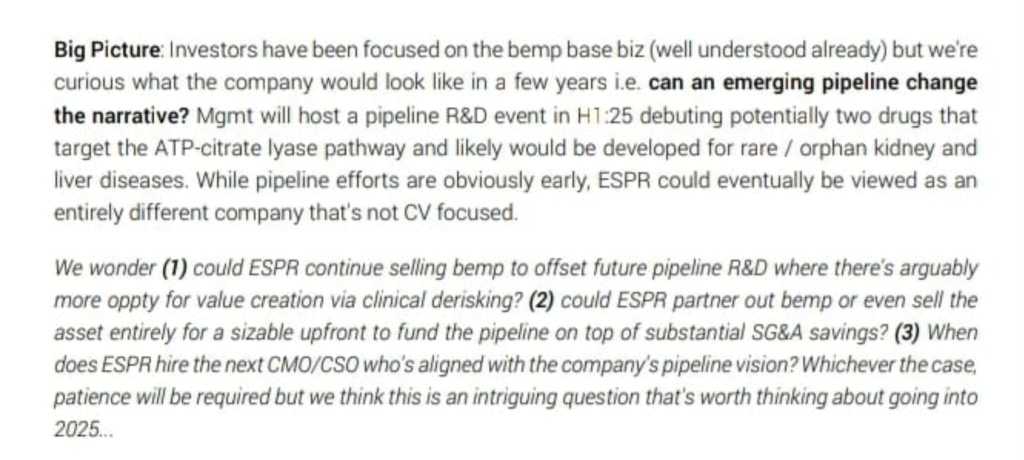

10xStockPicks OP : This is the correctly edited research report. Previous article has a few typos. Special thanks to Fund manager John for his notes. Please do your own research. I firmly believe ESPR will be a solid bet.