No Data

CSCO Cisco

- 62.060

- -1.880-2.94%

- 62.310

- +0.250+0.40%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Trump's policies scare Wall Street! Economic concerns intensify, and U.S. stocks and other risk Assets are undergoing a "bloodbath."

As economic concerns sweep across Wall Street, investors are pulling out of nearly all types of risk Assets, intensifying the decline in the USA stock market.

Express News | Shares of Communication Equipment Stocks Are Trading Lower Amid Recession Worries Due to Uncertainty Regarding Tariffs and Trade Policy. President Trump Said There Is a "Period of Transition." Economic Uncertainty Could Drive a Rotation Out of Growth...

'What Were You Thinking?' The Dot-Com Boom Peaked 25 Years Ago -- WSJ

What the Options Market Tells Us About Cisco Systems

Cisco Put Volume Heavy and Directionally Bearish

Macroeconomic pressure on micro aspects! Goldman Sachs: For U.S. Technology stocks, the "recession storm" is more important than the "Earnings Reports being good or bad."

Goldman Sachs stated that despite the economic pain in the US stock market, the overall sentiment remains one of "gritting teeth to get through" rather than a complete shift to a "2022-style sell-off." In the coming weeks, the macroeconomic data from the USA and policy changes from the Trump administration will largely shape the sentiment in the US stock market. If the data stabilizes and policy uncertainties decrease, it may drive a market recovery in the second half of the year.

Comments

How Cisco's Exclusive NVIDIA Partnership Could Reshape Enterprise AI Networks

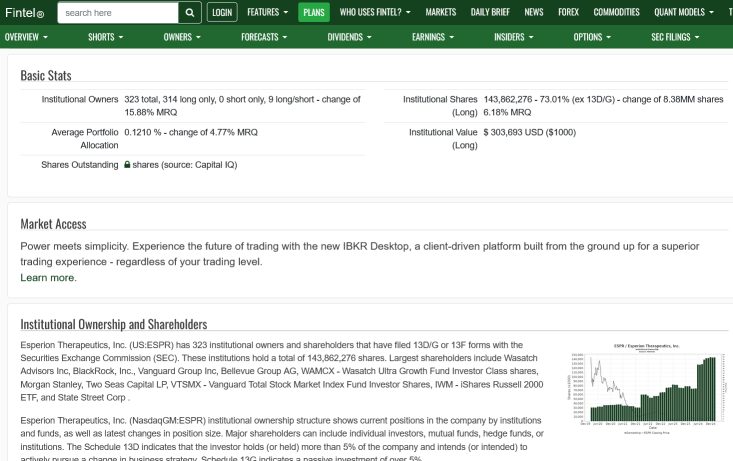

Esperion Therapeutics (ESPR), currently trading under $2 per share, has been attracting considerable attention from analysts. Recently, three analysts reaffirmed strong "Buy" ratings, with price targets ranging from $5 to $16 per share. Among the nine analysts covering Esperion, seven h...

Unlock the Full List