US ETFDetailed Quotes

DIA SPDR Dow Jones Industrial Average Trust

- 443.160

- +4.190+0.95%

Close Nov 22 16:00 ET

443.570High439.320Low

443.570High439.320Low5.49MVolume439.590Open438.970Pre Close2.43BTurnover6.38%Turnover Ratio--P/E (Static)86.09MShares444.59952wk High--P/B38.15BFloat Cap347.08352wk Low6.44Dividend TTM86.09MShs Float444.599Historical High1.45%Div YieldTTM0.97%Amplitude52.081Historical Low441.819Avg Price1Lot Size

US stock market tumbled last Friday as the post-election rally faltered, likely due to the latest inflation data and Jerome Powell’s slightly hawkish stance.

The market has already given up half of the post-election gains. So! Is the post-election rally over?

$Bitcoin (BTC.CC)$ $S&P 500 Index (.SPX.US)$ $E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ $Vanguard S&P 500 ETF (VOO.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $Salesforce (CRM.US)$ $Super Micro Computer (SMCI.US)$ $Advanced Micro Devices (AMD.US)$ $Taiwan Semiconductor (TSM.US)$ $Broadcom (AVGO.US)$ $Johnson & Johnson (JNJ.US)$ $Arm Holdings (ARM.US)$

The market has already given up half of the post-election gains. So! Is the post-election rally over?

$Bitcoin (BTC.CC)$ $S&P 500 Index (.SPX.US)$ $E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ $Vanguard S&P 500 ETF (VOO.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $Salesforce (CRM.US)$ $Super Micro Computer (SMCI.US)$ $Advanced Micro Devices (AMD.US)$ $Taiwan Semiconductor (TSM.US)$ $Broadcom (AVGO.US)$ $Johnson & Johnson (JNJ.US)$ $Arm Holdings (ARM.US)$

From YouTube

11

5

Last week was one of the most pivotal and influential weeks of the year - it could affect the US economy and stock market in the next few years.

So far, things have turned pretty well as we saw a week of records galore. S&P500 hit yet another all time high. This time, it did it in a nice fashion as it crossed the landmark level of 6,000.

But as the market gets overbought, should we be a little wary now?

$KraneShares CSI China Internet ETF (KWEB.US)$ $GameStop (GME.US)$ $Palantir (PLTR.US)$ $Disney (DIS.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $GameStop (GME.US)$ $CrowdStrike (CRWD.US)$ $Snap Inc (SNAP.US)$ $Spotify Technology (SPOT.US)$ $Cloudflare (NET.US)$ $Salesforce (CRM.US)$ $Palo Alto Networks (PANW.US)$ $Nike (NKE.US)$ $Lululemon Athletica (LULU.US)$

So far, things have turned pretty well as we saw a week of records galore. S&P500 hit yet another all time high. This time, it did it in a nice fashion as it crossed the landmark level of 6,000.

But as the market gets overbought, should we be a little wary now?

$KraneShares CSI China Internet ETF (KWEB.US)$ $GameStop (GME.US)$ $Palantir (PLTR.US)$ $Disney (DIS.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $GameStop (GME.US)$ $CrowdStrike (CRWD.US)$ $Snap Inc (SNAP.US)$ $Spotify Technology (SPOT.US)$ $Cloudflare (NET.US)$ $Salesforce (CRM.US)$ $Palo Alto Networks (PANW.US)$ $Nike (NKE.US)$ $Lululemon Athletica (LULU.US)$

From YouTube

9

4

Macro Event: On Nov 6, 2024, Republican presidential candidate Trump announced his victory in the US presidential election.

Market Performance: The global market reacted with a return to the Trump trade 2.0. The USD, US stocks, BTC, and UST yields rose, while gold and oil prices fell.

Policy Implication: With the Republican Party securing the Senate and leading in the House, Trump's policy framework faces less resistance.

Key policies include:

Trade: Imp...

Market Performance: The global market reacted with a return to the Trump trade 2.0. The USD, US stocks, BTC, and UST yields rose, while gold and oil prices fell.

Policy Implication: With the Republican Party securing the Senate and leading in the House, Trump's policy framework faces less resistance.

Key policies include:

Trade: Imp...

Expand

Expand 12

5

Indexes:

S&P 500: +2.1% $SPX $SPY

Dow 30: +2.6% $DJI

Nasdaq 100: +1.8% $NDX $QQQ

Russell 2000: +5.9% $RUT

Industries down:

Solar

Renewable Energy

Electric Vehicles (excl. Tesla)

Chinese stocks

Cannabis

Industries Up:

Banks

Technology

Cryptocurrencies

Small caps

Most other sectors

$iShares Russell 2000 ETF (IWM.US)$ $MARA Holdings (MARA.US)$ $iShares Bitcoin Trust (IBIT.US)$ $Valkyrie Bitcoin Fund (BRRR.US)$ $VanEck Bitcoin Trust (HODL.US)$ $ARK 21Shares Bitcoin ETF (ARKB.US)$ $Trump Media & Technology (DJT.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $NIO Inc (NIO.US)$ $Alibaba (BABA.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $Invesco QQQ Trust (QQQ.US)$

S&P 500: +2.1% $SPX $SPY

Dow 30: +2.6% $DJI

Nasdaq 100: +1.8% $NDX $QQQ

Russell 2000: +5.9% $RUT

Industries down:

Solar

Renewable Energy

Electric Vehicles (excl. Tesla)

Chinese stocks

Cannabis

Industries Up:

Banks

Technology

Cryptocurrencies

Small caps

Most other sectors

$iShares Russell 2000 ETF (IWM.US)$ $MARA Holdings (MARA.US)$ $iShares Bitcoin Trust (IBIT.US)$ $Valkyrie Bitcoin Fund (BRRR.US)$ $VanEck Bitcoin Trust (HODL.US)$ $ARK 21Shares Bitcoin ETF (ARKB.US)$ $Trump Media & Technology (DJT.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $NIO Inc (NIO.US)$ $Alibaba (BABA.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $Invesco QQQ Trust (QQQ.US)$

2

We are going to have a very busy week ahead with a few key economic reports and companies’ earnings lining up.

5 out of the Mag 7 are reporting this week - Meta, Amazon, Apple, Google and Microsoft.

On the economic calendar front, 2 huge data this week - Fed’s preferred inflation gauge - the PCE price index (Thurs)

Finally, on Friday, the October jobs report will come out.

$ProShares UltraPro QQQ ETF (TQQQ.US)$ $Enphase Energy (ENPH.US)$ $McDonald's (MCD.US)$ $Starbucks (SBUX.US)$ $Coca-Cola (KO.US)$ $PepsiCo (PEP.US)$ $Nike (NKE.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $Financial Select Sector SPDR Fund (XLF.US)$ $Crude Oil Futures(JAN5) (CLmain.US)$ $SPDR Gold ETF (GLD.US)$ $Adobe (ADBE.US)$ ��������...

5 out of the Mag 7 are reporting this week - Meta, Amazon, Apple, Google and Microsoft.

On the economic calendar front, 2 huge data this week - Fed’s preferred inflation gauge - the PCE price index (Thurs)

Finally, on Friday, the October jobs report will come out.

$ProShares UltraPro QQQ ETF (TQQQ.US)$ $Enphase Energy (ENPH.US)$ $McDonald's (MCD.US)$ $Starbucks (SBUX.US)$ $Coca-Cola (KO.US)$ $PepsiCo (PEP.US)$ $Nike (NKE.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $Financial Select Sector SPDR Fund (XLF.US)$ $Crude Oil Futures(JAN5) (CLmain.US)$ $SPDR Gold ETF (GLD.US)$ $Adobe (ADBE.US)$ ��������...

From YouTube

10

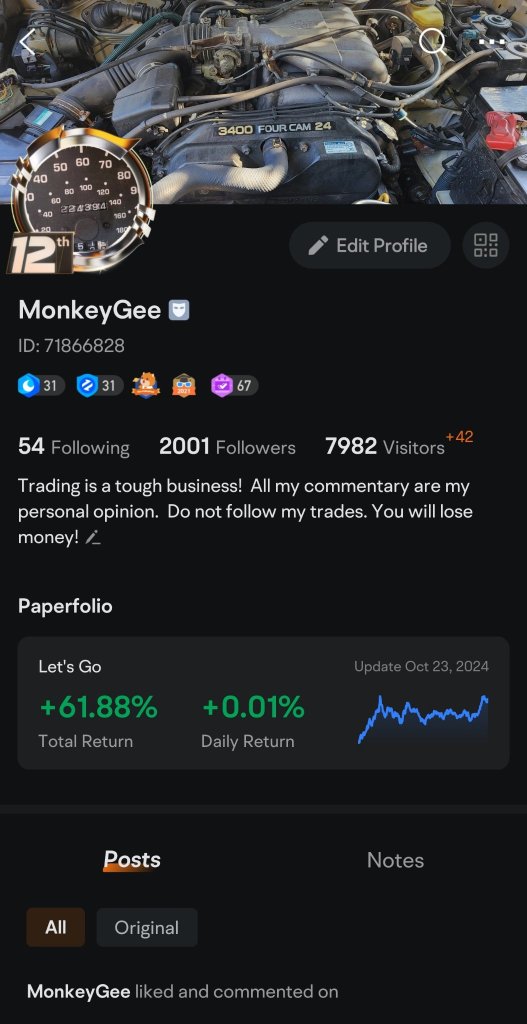

First lets get the daily quiz thing out of the way - the answers were usually quite logical and simple to answer, but most of the time if I failed at a guess, it's related to the stock direction prediction. All in all as of 23 Oct 2024, I've gotten 210 out of 270 max points, I also missed the first day of the daily quiz.

Now, time for the main topic. I basically failed the weekly challenge.

Why?

Because I made bad picks for the stoc...

Now, time for the main topic. I basically failed the weekly challenge.

Why?

Because I made bad picks for the stoc...

18

$Let's Go$

Thank you for everyone's support and positive feedback. Will continue to work hard to provide high-quality stock market commentary. Looking forward to 3K!

$SPDR S&P 500 ETF (SPY.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$

Thank you for everyone's support and positive feedback. Will continue to work hard to provide high-quality stock market commentary. Looking forward to 3K!

$SPDR S&P 500 ETF (SPY.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$

4

It has been quite a solid run for S&P500 as it surged to yet another all time high last week, capping off a six consecutive weeks of gains. This is the longest weekly winning streak of 2024.

After decent earnings from Netflix and major financial institutions, will these powerful earnings continue as the earnings season go full force?

$Vanguard S&P 500 ETF (VOO.US)$ $Salesforce (CRM.US)$ $Super Micro Computer (SMCI.US)$ $Advanced Micro Devices (AMD.US)$ $Arm Holdings (ARM.US)$ $Bank of America (BAC.US)$ $Disney (DIS.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $Crude Oil Futures(JAN5) (CLmain.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$ $USD (USDindex.FX)$ $CBOE Volatility S&P 500 Index (.VIX.US)$ $BABA-W (09988.HK)$

After decent earnings from Netflix and major financial institutions, will these powerful earnings continue as the earnings season go full force?

$Vanguard S&P 500 ETF (VOO.US)$ $Salesforce (CRM.US)$ $Super Micro Computer (SMCI.US)$ $Advanced Micro Devices (AMD.US)$ $Arm Holdings (ARM.US)$ $Bank of America (BAC.US)$ $Disney (DIS.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $Crude Oil Futures(JAN5) (CLmain.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$ $USD (USDindex.FX)$ $CBOE Volatility S&P 500 Index (.VIX.US)$ $BABA-W (09988.HK)$

From YouTube

8

1

WHAT'S HAPPENING

Markets mostly moved higher overnight, digesting a goodie bag of pleasant surprises. The Dow Jones $SPDR Dow Jones Industrial Average Trust (DIA.US)$ rose to another record high, while Europe’s pan-index, the Stoxx 600, gained 0.8%, ending near a record. Why? Well, markets are forward-looking and believe the bull run can continue thanks to the ...

Markets mostly moved higher overnight, digesting a goodie bag of pleasant surprises. The Dow Jones $SPDR Dow Jones Industrial Average Trust (DIA.US)$ rose to another record high, while Europe’s pan-index, the Stoxx 600, gained 0.8%, ending near a record. Why? Well, markets are forward-looking and believe the bull run can continue thanks to the ...

From YouTube

8

1

No comment yet

Chad Dunbar : Stability is better for investments.

EZ_money : Bitcoin bubble gonna burst...my stomach hurts

Cow Moo-ney OP EZ_money :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Wowser : It has a lot to do with his cabinet picks. The question being are they qualified. With Trump's loyalty over competency guidelines some are questioning his choices . Even Murdoch mentioned some doubt.

71732910 Wowser : We all have that question in the back of minds.