No Data

DIA241220P585000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Nvidia, Tesla, Apple, Palantir, AMD Top Options Volume as Holders Exit 0DTE

How Long Will the "Trump Bump" for the Stock Market Last? Here's What History Shows.

The U.S. stock market bull market cannot be stopped? Societe Generale's big short is singing a different tune: the celebration is about to end, and it's time to exit.

Albert Edwards, a bear from Industrial Bank of France, warned that the end of the yield curve inversion and high expectations for the Technology Industry may indicate that the stock market frenzy in the U.S. is about to come to an end.

The best-performing major Assets in 2024 will be: Bitcoin, Gold, US stocks, and Chinese long-term bonds.

Huatai Fixed Income states that the leading Assets in 2024 will include Bitcoin, Gold, US stocks, and China long-term bonds, while lagging Assets will include domestic Commodities, Euros, and Crude Oil Product. From the perspective of the Industry and individual stocks, the leading Assets are backed by long-term trends such as changes in the AI Technology Industry Chain, China's emotional Consumer chain, and safe-haven Assets in an uncertain environment.

After being pessimistic about the US stock market, Wall Street faces a collective "slap in the face" in 2024.

In 2024, stock prices not only did not lose momentum, but continued to soar.

12/30 [Strength and Weakness Materials]

[Bullish and Bearish Materials] Bullish materials: The Nikkei average is rising (40281.16, +713.10) • 1 dollar = 157.80-90 yen • U.S. crude oil Futures are rising (70.60, +0.98) • Active Share Buyback • Requests for corporate value enhancement by the Tokyo Stock Exchange. Bearish materials: The Dow Jones Industrial Average is falling (42992.21, -333.59) • The Nasdaq Composite Index is falling (19722.03, -298.33) • Chicago Nikkei Futures are falling (40130, -100) • The SOX Index is falling (5122.97, -

Comments

But what shook the market was the Fed's outlook for 2025, which shifted towards the hawkish direction. The Fed had revised their 2025 outlook from 3 rate cuts to 2 rate cuts, totalling 50 bps.

The Fed knows and is acknowledging that inflation is still sticky.

Meanwhile, interestingly, the latest pullback actually puts the market in a better position for a Santa rally as it helped ...

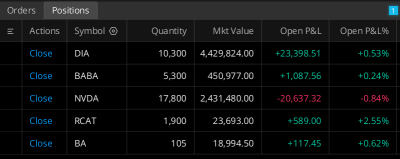

, how do you view Boeing? Thank you.

, how do you view Boeing? Thank you.