No Data

DIG250117C60000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

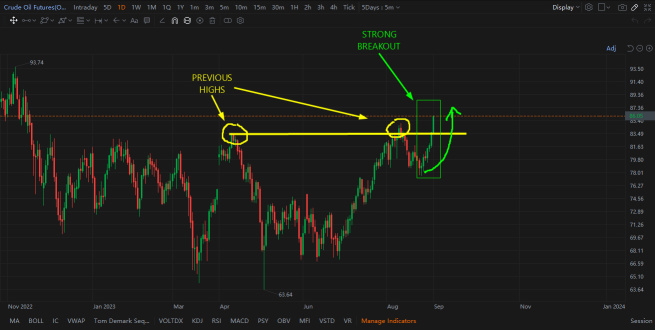

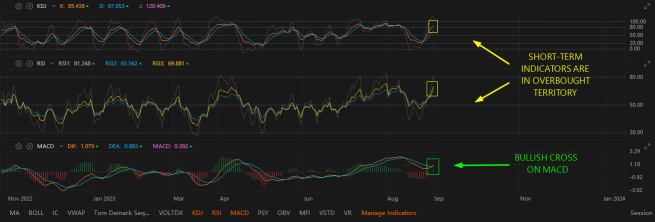

WTI Crude Breaks Resistance, Eyes US$80 Next

Oil Prices Inch Higher on China Stimulus Hopes; Set for 2nd Straight Weekly Gain

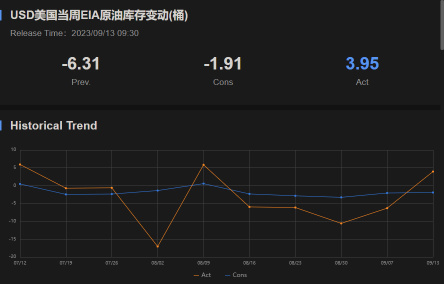

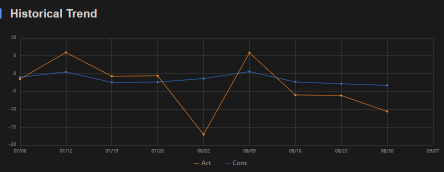

Weekly Crude Inventories Fall Less Than Expected

German Power Slips Below Zero as Negative-Price Phenomenon Grows

The most bullish oil prices in four months! Traders focus on "Trump VS Iran".

Although oversupply puts pressure on the oil market in 2025, investors are still preparing for upside risks, primarily influenced by Trump's stance on Iran after returning to the White House, as well as the ongoing geopolitical risks.

Trump's return to the White House may bring new variables, as bets on Crude Oil Product Call have risen to a four-month high.

In the second-to-last week of 2024, as investors prepare for Trump's return to the White House in the new year, bets are being placed on Call Crude Oil Product, reaching their highest point in four months.

Comments

Natural Gas is Starting to Look More Bullish

Nat gas has had a rough go since November this year. It has lost over 20% of its value since. The unseasonably warmer than usual weather in the norther hemisphere and the slow global economic growth has held down the commodity.

More recently nat gas was consolidating near its lows with a bear flag type of wedge pattern. It seemed as if the commodity was forming a...

In a previous post about crude prices, I mentioned the areas where we might see some selling. Currently, the price of crude is just below the first area of resistance that I discussed. Check out the post in the link directly below.

Dovish Macro Picture

Oil prices have been on a very sharp rally for the past few months. Policy from Opec has been the main driver of this price spike. The macroeconomic situation is still very dovish fo...

Here are 3 reasons why Exxon Mobil ( $Exxon Mobil (XOM.US)$ ) remains attractive.

Energy investors have had a very profitable few months. Oil prices have been on a sharp incline recently. How high can the price of oil go? Nobody knows for sure, but there are a few factors you can watch out for.

Laws of Demand

What causes oil prices to move? The laws of supply and demand dictate oil prices. It sounds simple, but with all of the geopolitical issues around the world, oil prices can be quite volatile and hard to ...

SpyderCall OP : @ThirtyOne $United States Gasoline Fund Lp (UGA.US)$Check it out. I know you were asking about

ThirtyOne SpyderCall OP : I appreciate it! Yea I have been watching this with UNG

TinkerB3ll SpyderCall OP : Agree personally now look to go long but again NG is so highly manipulated![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

SpyderCall OP TinkerB3ll : That is exactly why I am skeptical. I feel like the manipulation could be at its highest ever since the Russian war/Nat gas supply issues.

Ultratech TinkerB3ll : ng is heavily shorted that's why kold when ung is high

View more comments...