US Stock MarketDetailed Quotes

DOCS Doximity

- 61.310

- -1.120-1.79%

Close Mar 18 16:00 ET

- 61.890

- +0.580+0.95%

Pre 04:12 ET

11.50BMarket Cap61.31P/E (TTM)

63.086High60.770Low1.80MVolume62.210Open62.430Pre Close110.36MTurnover1.38%Turnover Ratio85.15P/E (Static)187.64MShares85.21052wk High11.16P/B7.99BFloat Cap22.96052wk Low--Dividend TTM130.32MShs Float107.790Historical High--Div YieldTTM3.71%Amplitude19.710Historical Low61.320Avg Price1Lot Size

Doximity Stock Forum

$Doximity (DOCS.US)$ 100%

if you had an Olympic runner that came in first by a big margin in the last four races would you bet on that person?

if you had a horse that came in first for four races in a row would you bet on that horse?

if you had a company that GAPPED UP significantly higher four out of four quarters in a row would you invest in that company?

Doximity (DOCS) IS YOUR OLYMPIC RUNNER IS YOUR HORSE AND IS THE COMPANY THAT HAS EXCEEDED REVENUE EARNINGS AND GUIDANCE FOUR OUT OF FOUR...

if you had an Olympic runner that came in first by a big margin in the last four races would you bet on that person?

if you had a horse that came in first for four races in a row would you bet on that horse?

if you had a company that GAPPED UP significantly higher four out of four quarters in a row would you invest in that company?

Doximity (DOCS) IS YOUR OLYMPIC RUNNER IS YOUR HORSE AND IS THE COMPANY THAT HAS EXCEEDED REVENUE EARNINGS AND GUIDANCE FOUR OUT OF FOUR...

6

4

$Hims & Hers Health (HIMS.US)$ , an online health and wellness platform, has seen its stock soar over 78% since February, with a year-to-date surge exceeding 174%. This outpaces the projected full-year gain of 171% for 2024.

What's Fueling HIMS' Rally?

HIMS surged 17.5% on Wednesday following the announcement of an acquisition, reaching an intraday high of nearly 25% and hitting a record $72.

Hims & Hers disclosed it acquired Sigmund NJ LLC, also known as Trybe La...

What's Fueling HIMS' Rally?

HIMS surged 17.5% on Wednesday following the announcement of an acquisition, reaching an intraday high of nearly 25% and hitting a record $72.

Hims & Hers disclosed it acquired Sigmund NJ LLC, also known as Trybe La...

30

2

43

$Doximity (DOCS.US)$ why u drop

1

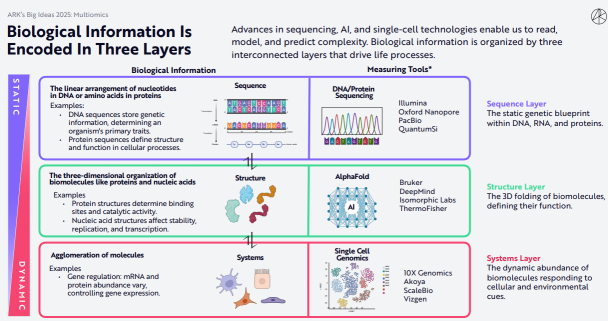

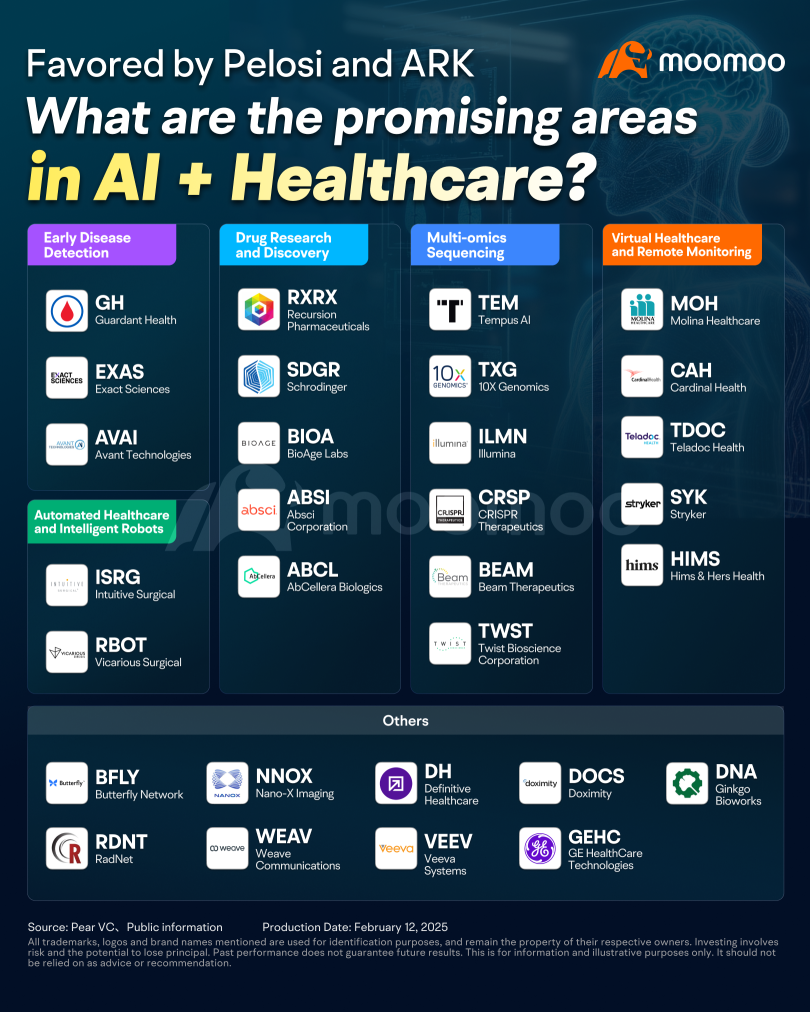

The attention of AI Medteck stocks are rapidly increasing.

Pelosi's new holdings have doubled $Tempus AI (TEM.US)$ value in just a few weeks, and $Firefly Neuroscience (AIFF.US)$'s inclusion in NVIDIA's Connect program has also caused its stock price to soar.

In addition, DeepSeek's rapid rise has boosted the AI application sector, particularly in medicine/healthcare. Cathie Wood believes medical AI is undervalued, with untapped pot...

Pelosi's new holdings have doubled $Tempus AI (TEM.US)$ value in just a few weeks, and $Firefly Neuroscience (AIFF.US)$'s inclusion in NVIDIA's Connect program has also caused its stock price to soar.

In addition, DeepSeek's rapid rise has boosted the AI application sector, particularly in medicine/healthcare. Cathie Wood believes medical AI is undervalued, with untapped pot...

115

13

284

$Doximity (DOCS.US)$ why drop

Morning Movers

Gapping up

$Pinterest (PINS.US)$ shares jumped 22% in premarket trading after the company forecasted 13%-15% Q1 revenue growth, aligning with analysts' $846.8 million estimate. The surge followed strong Q4 sales, boosting optimism amid rising digital ad demand.

$Doximity (DOCS.US)$ shares surged after reporting strong Q3 results and issuing Q4 and FY25 guidance that exceeded expectations.

$Affirm Holdings (AFRM.US)$ shares ju...

Gapping up

$Pinterest (PINS.US)$ shares jumped 22% in premarket trading after the company forecasted 13%-15% Q1 revenue growth, aligning with analysts' $846.8 million estimate. The surge followed strong Q4 sales, boosting optimism amid rising digital ad demand.

$Doximity (DOCS.US)$ shares surged after reporting strong Q3 results and issuing Q4 and FY25 guidance that exceeded expectations.

$Affirm Holdings (AFRM.US)$ shares ju...

21

2

13

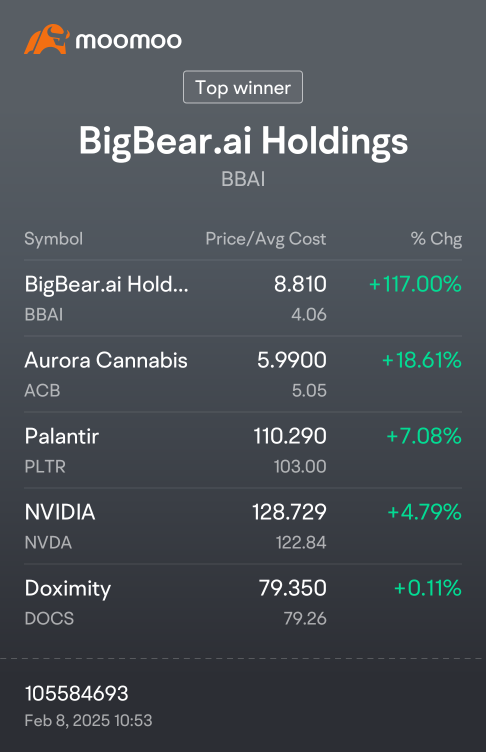

$Doximity (DOCS.US)$ soared nearly 25% after hours Thursday after the medical-records platform's fiscal Q3 earnings and revenues were just what the doctor ordered.

DOCS gained 24.4% to $73.50 shortly before 4:30 p.m. ET after the firm reported $0.45 in adjusted earnings per share on $168.6 million in the three months ended Dec. 31.

That beat the $0.34 in non-GAAP EPS on $152.8 million that analysts' consensus estimate ...

DOCS gained 24.4% to $73.50 shortly before 4:30 p.m. ET after the firm reported $0.45 in adjusted earnings per share on $168.6 million in the three months ended Dec. 31.

That beat the $0.34 in non-GAAP EPS on $152.8 million that analysts' consensus estimate ...

2

$Doximity (DOCS.US)$ guys be very cafeful jumping on top of this move. This is just a pressure cooker from short squeeze. This will go back down Next week. I would not touch DOCS if I where you. Be patient and wait for better entry.

8

1

No comment yet

Nchiwla : il loving this man! thanks

Ginvest : sort of remember that kathy woods loves this and left wounded?

10baggerbamm OP Ginvest : you need to be in it at the right time..

you also need to be able to buy it in the right amount at the right time.

I'm saying you have to take a position I'm only buying a third of what I ordinarily would buy so take that into consideration. you have $10,000 that you want to buy in a stock and you typically buy $10,000 at a time you would buy $3,300 worth using the same one third purchase. if there is a 10 to 15% discounting because of Market volatility you would add your next 3rd.. and so on. you're talking mid-may before quarter like May 13th somewhere in there I don't know if the exact date has been announced but it's the second week in May at this point that's why it's too early to buy a call option because you're going to spend too much in time value and that's going to decay unless we get 2 weeks of rallying in the market which this stock will go up 10 points from here if that's the case I don't necessarily think that's going to happen Friday's rally we don't have a follow-through today we just had some economic numbers that are lifting the market which is consumer purchases it's kind of a non-event for a technology company this has more to do with consumer sentiment which is been shit month over month.

I don't really care what Cathy Woods is doing.. I do follow her purchases just to have an idea what she buys and typically her track record is if a stock crashes she buys it if a company misses earnings and gaps down 20% 30% she buys it because she likes these dead cat bounces she likes a reversion to the mean.. I'm not in that camp I don't like buying earning shortfalls and quite frankly I posted a dynamic comparison I think I did it over the weekend or maybe it was Thursday or Friday last week... it was a dynamic comparison of how well she has done relative to Berkshire Hathaway in a live tick and she's lagged dramatically.

so her buying is not an influence one way or another.

I'm looking at the ability for management to execute which they have done I'm looking at the percent of increases on that earnings day which are enormous..

I'm looking at the overall trend of the stock it gaps up and then it gradually consolidates and loses about half of its rally it trade sideways going into earnings and then there's another monster Gap up so the pattern has repeated itself four out of four quarters this one a little bit more because the market has been terrible.

this is not a company that is front and center on President Trump agenda where it's going to be subjected to tariffs and a potentially could hurt revenue or margins it's not a company that is front and center for restrictions of sales to other countries like Nvidia. and I think that's what you need the key in on you need to be in companies that are not the ones that everybody knows about number one number two they can't be the pawn on the chessboard.

use this example now for 6 weeks you don't want to own a stock that is going to be killed by the other countries night rook Bishop when they attack and counter on a tariff. if you listened last Howard lutnik who's the Secretary of commerce. he came out and he said if you own a company that's selling off because of what president Trump is doing too bad.

I will say that pissed me off because you know it's easy when you're a billionaire to overlook a 10 or 20% stock drop or 30% or 40 but if you're a regular person it's real money to you and you might have lost 6 months worth of your work in the past 1 month because the stock traded down that you own.

and that's why I'm advocating that you need to look at companies that are not on that chessboard that are not the ones that at any moment another country is going to impose a tariff on or trade restriction.

this company doesn't have those problems

and that's why I believe it needs to be bought but you have to do it strategically you can't go all in and buy your full position.

Ginvest : THANK YOU for sharing your wisdom. i wrote down to my little yellow book and moomoo alert fot this stock ( along with VKTX, RXRX, RVPH waiting for a right entry point)