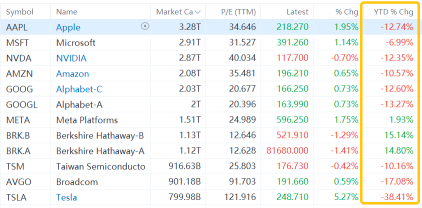

US Stock MarketDetailed Quotes

DOCS Doximity

- 58.030

- -0.480-0.82%

Close Mar 31 16:00 ET

- 58.750

- +0.720+1.24%

Post 18:08 ET

10.89BMarket Cap58.03P/E (TTM)

58.730High56.320Low2.27MVolume56.590Open58.510Pre Close130.93MTurnover1.74%Turnover Ratio80.60P/E (Static)187.64MShares85.21052wk High10.56P/B7.56BFloat Cap22.96052wk Low--Dividend TTM130.32MShs Float107.790Historical High--Div YieldTTM4.12%Amplitude19.710Historical Low57.657Avg Price1Lot Size

Doximity Stock Forum

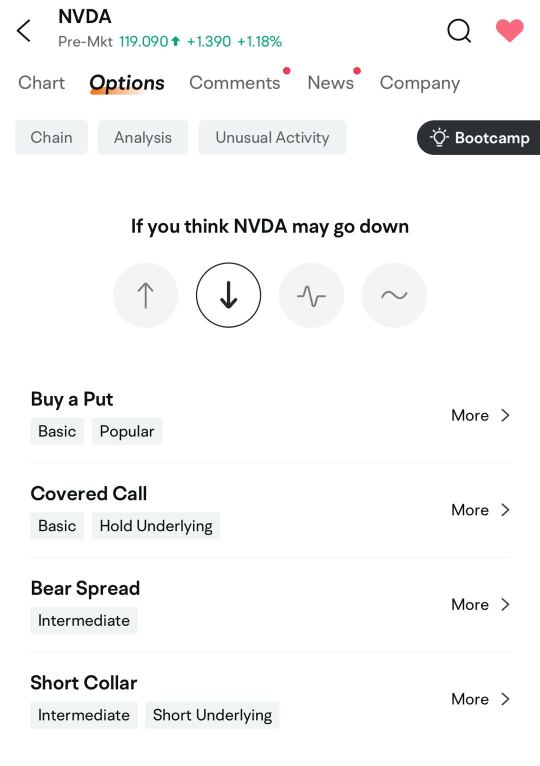

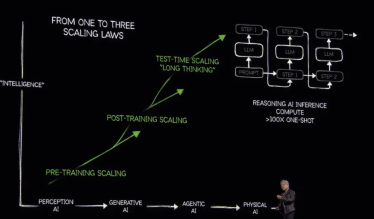

Last Friday, major U.S. stock indexes staged a late rally, with the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ posting weekly gains of 0.51% and 0.17%, respectively, snapping a four-week losing streak. Nvidia’s GTC conference concluded, yet the stock slipped over 3% for the week.

In recent weeks, two unexpected narratives have reshaped global asset valuations. First, DeepSeek’s breakthrough has spo...

In recent weeks, two unexpected narratives have reshaped global asset valuations. First, DeepSeek’s breakthrough has spo...

+3

19

1

24

$Doximity (DOCS.US)$ Institutions are buying....

1

$Doximity (DOCS.US)$ 100%

if you had an Olympic runner that came in first by a big margin in the last four races would you bet on that person?

if you had a horse that came in first for four races in a row would you bet on that horse?

if you had a company that GAPPED UP significantly higher four out of four quarters in a row would you invest in that company?

Doximity (DOCS) IS YOUR OLYMPIC RUNNER IS YOUR HORSE AND IS THE COMPANY THAT HAS EXCEEDED REVENUE EARNINGS AND GUIDANCE FOUR OUT OF FOUR...

if you had an Olympic runner that came in first by a big margin in the last four races would you bet on that person?

if you had a horse that came in first for four races in a row would you bet on that horse?

if you had a company that GAPPED UP significantly higher four out of four quarters in a row would you invest in that company?

Doximity (DOCS) IS YOUR OLYMPIC RUNNER IS YOUR HORSE AND IS THE COMPANY THAT HAS EXCEEDED REVENUE EARNINGS AND GUIDANCE FOUR OUT OF FOUR...

6

4

$Hims & Hers Health (HIMS.US)$ , an online health and wellness platform, has seen its stock soar over 78% since February, with a year-to-date surge exceeding 174%. This outpaces the projected full-year gain of 171% for 2024.

What's Fueling HIMS' Rally?

HIMS surged 17.5% on Wednesday following the announcement of an acquisition, reaching an intraday high of nearly 25% and hitting a record $72.

Hims & Hers disclosed it acquired Sigmund NJ LLC, also known as Trybe La...

What's Fueling HIMS' Rally?

HIMS surged 17.5% on Wednesday following the announcement of an acquisition, reaching an intraday high of nearly 25% and hitting a record $72.

Hims & Hers disclosed it acquired Sigmund NJ LLC, also known as Trybe La...

30

2

43

$Doximity (DOCS.US)$ why u drop

1

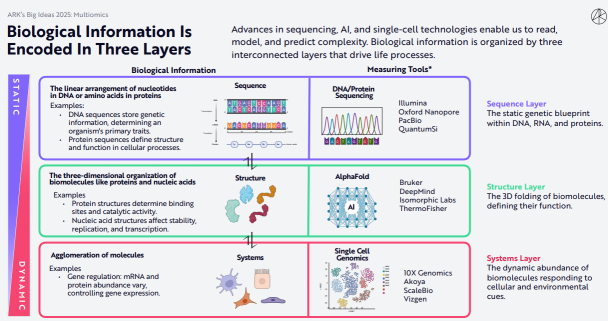

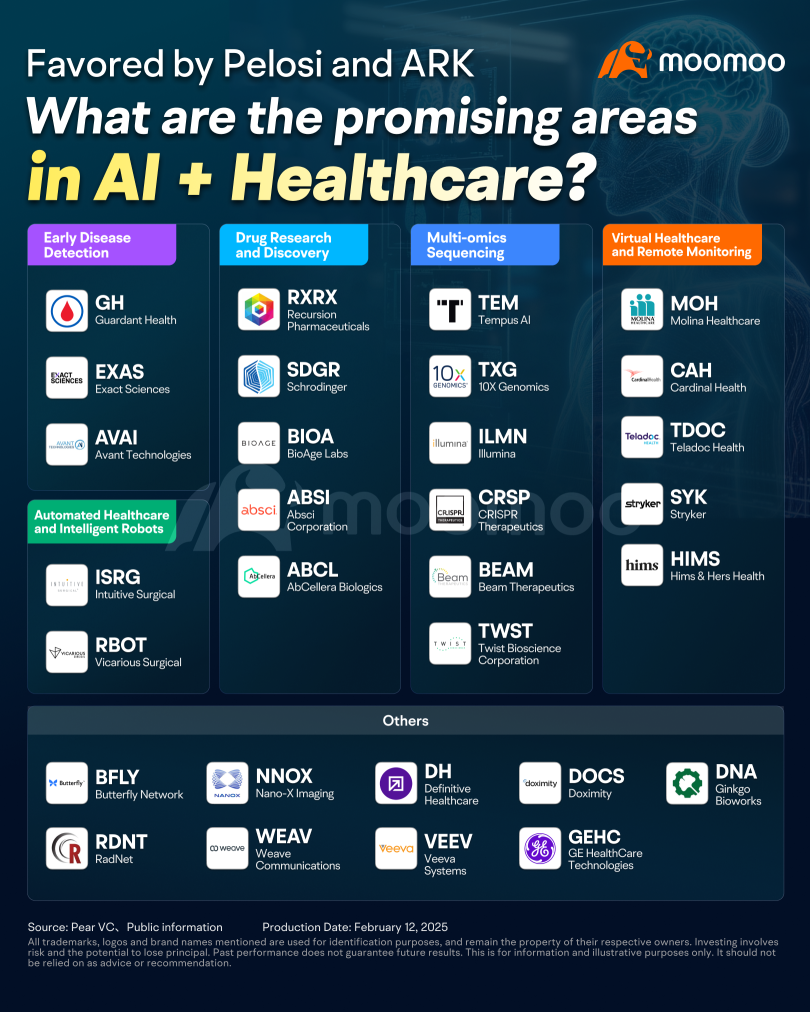

The attention of AI Medteck stocks are rapidly increasing.

Pelosi's new holdings have doubled $Tempus AI (TEM.US)$ value in just a few weeks, and $Firefly Neuroscience (AIFF.US)$'s inclusion in NVIDIA's Connect program has also caused its stock price to soar.

In addition, DeepSeek's rapid rise has boosted the AI application sector, particularly in medicine/healthcare. Cathie Wood believes medical AI is undervalued, with untapped pot...

Pelosi's new holdings have doubled $Tempus AI (TEM.US)$ value in just a few weeks, and $Firefly Neuroscience (AIFF.US)$'s inclusion in NVIDIA's Connect program has also caused its stock price to soar.

In addition, DeepSeek's rapid rise has boosted the AI application sector, particularly in medicine/healthcare. Cathie Wood believes medical AI is undervalued, with untapped pot...

116

14

285

$Doximity (DOCS.US)$ why drop

No comment yet

Deborah Rodgers : wow