No Data

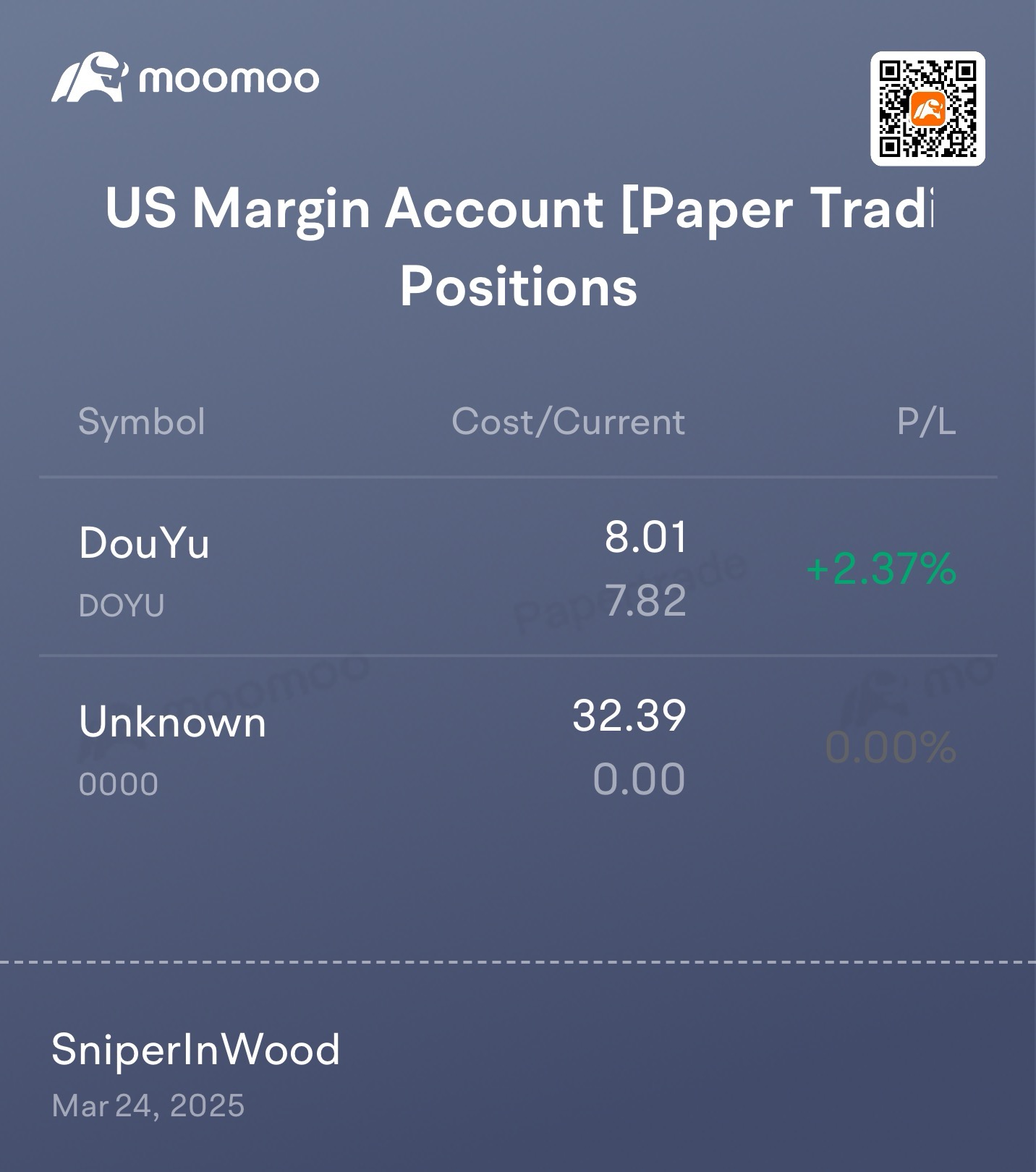

DOYU DouYu

- 7.730

- -0.090-1.15%

- 7.730

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Is M&A Coming For DouYu? Is Tencent Interested?

Citi Upgrades DouYu(DOYU.US) to Hold Rating, Raises Target Price to $10.5

As the turning point approaches, DouYu (DOYU.US) has seen its stock price surge nearly 25% with significant results from its diversified commercialization, presenting a good opportunity for layout.

The surge in stock prices is attributed to DouYu's latest Earnings Reports sending a key signal to the market, indicating that the company's fundamentals have reached a bottoming phase, and the turning point may arrive at any moment.

DouYu (DOYU.US) Earnings Reports: Optimizing Revenue Structure and Building Ecological Resilience to Construct New Growth Logic.

In today's rapidly changing business environment, companies can no longer rely on a static operation model to maintain a long-term foothold. Companies must actively embrace transformation and convert changes in the external environment into internal development momentum in order to break through and make progress in the tide of the times. How can one accurately assess the effectiveness of a company's transformation? Earnings Reports, as a good observation window, may provide us with some insights. On March 14, during Pre-Market Trading, DouYu released its Q4 and annual Earnings Reports for 2024. During the reporting period, it demonstrated its robust operational capability in a complex market environment, with DouYu achieving a revenue of 1.136 billion yuan in the fourth quarter of last year and a total annual revenue.

DouYu Intl Holdings Price Target Raised to $10.50/Share From $5.90 by Citigroup

DouYu Intl Holdings Raised to Neutral From Sell by Citigroup

Comments

DouYu Earnings Alert: Revenue Drops 12.3% but Rewards Shareholders with Massive $300M Dividend