No Data

EDU New Oriental

- 46.820

- +0.690+1.50%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

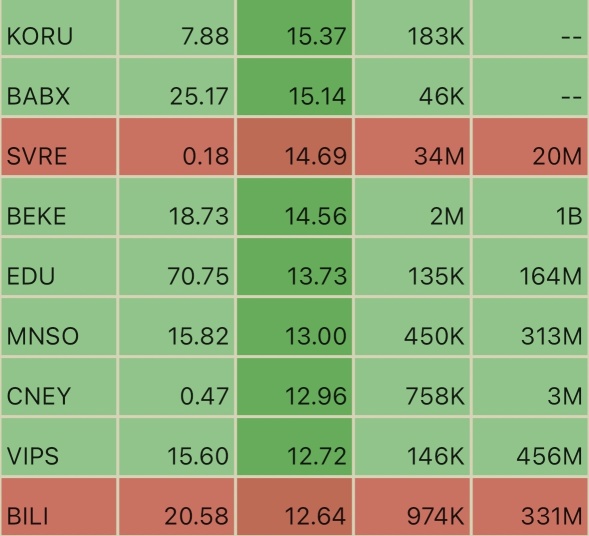

Hong Kong stocks move | NEW ORIENTAL-S (09901) rebounds over 3% as EAST BUY affects company performance. Morgan Stanley states that management's guidance is reasonable but difficult to boost confidence.

NEW ORIENTAL-S (09901) rebounded over 3%. As of the time of writing, it is up 2.26%, priced at 36.2 Hong Kong dollars, with a transaction volume of 0.485 billion Hong Kong dollars.

【Brokerage Focus】China Merchants International maintains a "Shareholding" rating for New Oriental (09901), indicating that the decline in stock price is due to weak growth guidance for the second half of 2025.

Jingu Financial News | China Merchants International published a research report indicating that New Oriental (09901) reported a year-on-year revenue growth of 19% for the second quarter of the fiscal year 2025 (ending last November), with core business revenue increasing by 31% year-on-year. The non-GAAP operating margin improved by 12 basis points year-on-year to 3.1%, surpassing expectations. The report noted that the company's stock price fell by 23%, primarily due to weak growth guidance for the second half of 2025, influenced by challenges in overseas business. However, the outlook for steady growth in the K-12 business remains Bullish. The bank has lowered its non-GAAP net profit forecast for the group from 2025 to 2027.

CITIC Securities: Maintains EAST BUY "Outperform Industry" rating, Target Price raised to 20 Hong Kong dollars.

CITIC released a research report stating that they are Bullish on EAST BUY (01797) self-operated products and multi-channel Global Strategy development prospects, maintaining the "outperform Industry" rating; due to more optimistic growth expectations and the repair of market risk preferences, the Target Price is raised by 74% to HKD 20. Considering the more moderate increase rate of self-operated products accounted for under the total amount method compared to the bank's expectations, FY25/26 revenues are revised down by 32.9%/28.8% to 3.83 billion yuan/4.51 billion yuan; adjusted net income attributable to shareholders is reduced by 28.4%/39.8% to 0.151 billion yuan/0.227 billion yuan. EAST BUY announced 1HFY2.

New Oriental Stock Down on Q2 Earnings Lag, Revenue Beat

This STMicroelectronics Analyst Turns Bearish; Here Are Top 5 Downgrades For Wednesday

New Oriental Education Price Target Cut to $44.00/Share From $79.00 by Macquarie

Comments

$New Oriental (EDU.US)$ $EAST BUY (01797.HK)$ $NEW ORIENTAL-S (09901.HK)$ $TAL Education (TAL.US)$ $Gaotu Techedu (GOTU.US)$

📊⚡️📊

For y/y price changes

Food, tobacco & liquor -0.1%

Clothing +1.4%

Accomodation +0.0%

Necessities & services +0.2%

T...

Buy n Die Together❤ :

Cui Nyonya Kueh : Just wait and watch.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

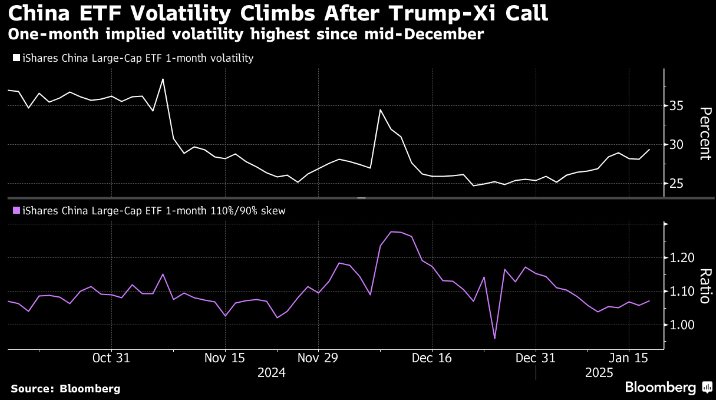

7-Heavens : I believe Xi and Trump will have positive chemistry and the Tariffs will be reasonably moderated

105742796 Learner : Interesting news

72056517 : xi and trump are power couple

View more comments...