No Data

EDU250117P16920

- 0.05

- 0.000.00%

- 5D

- Daily

News

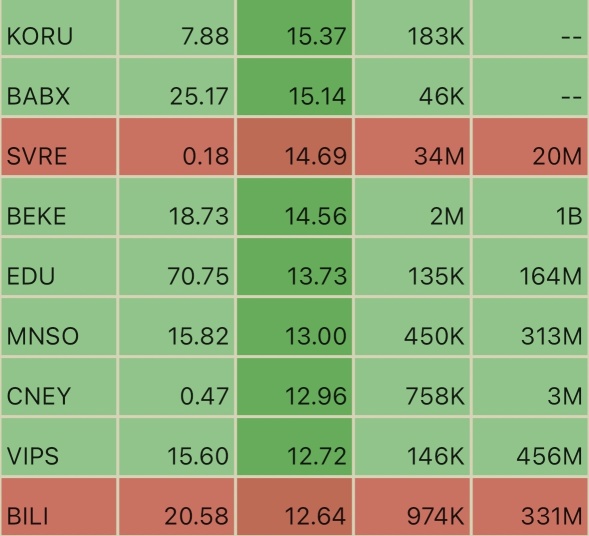

Overview of the Hong Kong Index on the 22nd: The Hang Seng fell by 1.6%, marking a decline after seven days, while New Oriental Education dropped by 24%.

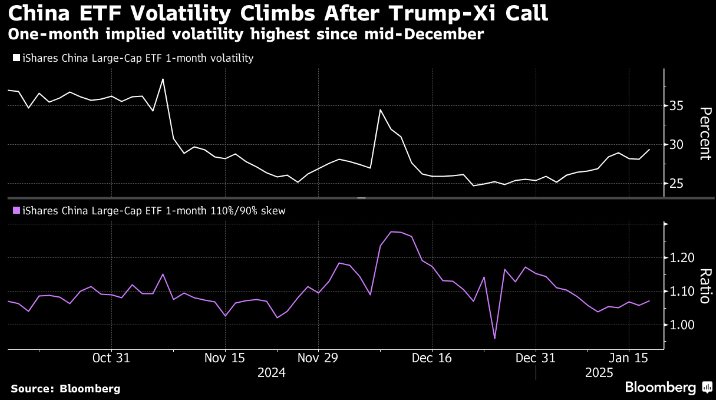

On the 22nd, the Hong Kong market saw the Hang Seng Index, composed of 83 major stocks, decline by 327.78 points (1.63%) to 19,778.77 points. The China mainland stocks index (formerly known as the H-share index), composed of mainland enterprise stocks, fell by 143.74 points (1.96%) to 7,177.14 points, marking a drop for the first time in seven days. The trading volume amounted to 135.3 billion 17.2 million Hong Kong dollars (compared to 147.9 billion 84.7 million Hong Kong dollars on the 21st). There's a trend of increased caution among investors regarding the USA's trade policy.

Express News | New Oriental Education & Technology Group Inc : JP Morgan Cuts to Neutral From Overweight; Cuts Target Price to $50 From $85

A dramatic drop of 30%! New Oriental has faced a "performance slaughter," with EAST BUY losing nearly 100 million in the past six months after the departure of Dong Yuhui.

EAST BUY's stock price has already experienced a "knee cut."

Major bank rating | Morgan Stanley: Downgraded New Oriental's Target Price to 52 USD, rating lowered to 'In line with the market.'

Morgan Stanley issued a report stating that New Oriental's guidance for the third quarter of the 2025 fiscal year is weak, believing that uncertainty has increased for the third quarter and beyond. The bank believes that New Oriental's visibility for the 2026 fiscal year is limited, predicting that its core revenue will further slow to a year-on-year growth of 20%, with non-GAAP operating profit of 0.577 billion USD and non-GAAP net profit of 0.528 billion USD. The bank has lowered its earnings forecast for New Oriental's 2025 fiscal year by 18% and by 17% for the 2026 fiscal year, reflecting a downward adjustment in the core operating margin, which has been eroded by overseas and tourism business.

Behind the 30% drop: New Oriental's Earnings Reports triggered stock price fluctuations. Can it turn around in the future?

① In the first half of the fiscal year 2025, New Oriental saw significant overall performance growth, but why did profits decline in the second fiscal quarter? ② How do institutions view the future performance of New Oriental and EAST BUY?

BofA Securities Maintains New Oriental(EDU.US) With Buy Rating, Cuts Target Price to $68.6

Comments

$New Oriental (EDU.US)$ $EAST BUY (01797.HK)$ $NEW ORIENTAL-S (09901.HK)$ $TAL Education (TAL.US)$ $Gaotu Techedu (GOTU.US)$

📊⚡️📊

For y/y price changes

Food, tobacco & liquor -0.1%

Clothing +1.4%

Accomodation +0.0%

Necessities & services +0.2%

T...

Buy n Die Together❤ :

Cui Nyonya Kueh : Just wait and watch.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

7-Heavens : I believe Xi and Trump will have positive chemistry and the Tariffs will be reasonably moderated

105742796 Learner : Interesting news

72056517 : xi and trump are power couple

View more comments...