US OptionsDetailed Quotes

EL241122C84000

- 0.08

- 0.000.00%

15min DelayClose Nov 22 16:00 ET

0.00High0.00Low

0.00Open0.08Pre Close0 Volume3 Open Interest84.00Strike Price0.00Turnover0.00%IV16.58%PremiumNov 22, 2024Expiry Date0.00Intrinsic Value100Multiplier-7DDays to Expiry0.08Extrinsic Value100Contract SizeAmericanOptions Type--Delta--Gamma901.50Leverage Ratio--Theta--Rho--Eff Leverage--Vega

Estee Lauder Stock Discussion

$Estee Lauder (EL.US)$

A voting opportunity to test your prediction accuracy, which will expire before Monday to avoid contamination. Please Vote ☑️

------------------------------------------------

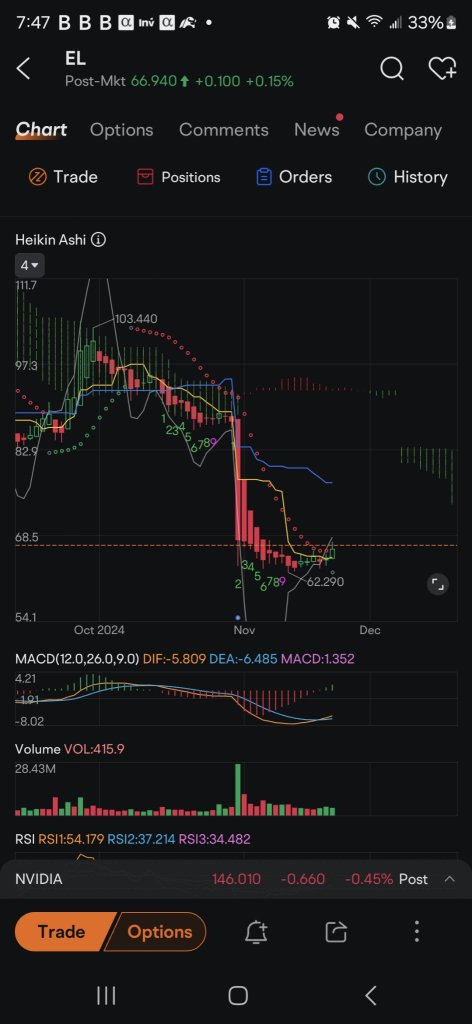

TA of Estee Lauder

$Estee Lauder (EL.US)$

I'm sorry, but all I can see is the downtrend this week. I guess you guys had a really good week. However, it did hit the daily top Bollinger band, and it will likely retrace back to around the middle Bollinger band.

Maybe ret...

A voting opportunity to test your prediction accuracy, which will expire before Monday to avoid contamination. Please Vote ☑️

------------------------------------------------

TA of Estee Lauder

$Estee Lauder (EL.US)$

I'm sorry, but all I can see is the downtrend this week. I guess you guys had a really good week. However, it did hit the daily top Bollinger band, and it will likely retrace back to around the middle Bollinger band.

Maybe ret...

![Estee Lauder - TA [W1: 2-6 December]](https://sgsnsimg.moomoo.com/sns_client_feed/152375282/20241130/98bde1396ec1aaa62240640d94f7acea.jpg?area=102&is_public=true)

6

5

$Estee Lauder (EL.US)$ is this the real breakout?

1

1

$Estee Lauder (EL.US)$ looking good

$Estee Lauder (EL.US)$ Kevin Walsh is husband of Jane Lauder.

1

1

$Estee Lauder (EL.US)$

Trend reversal! it's time to rise

Trend reversal! it's time to rise

3

$Estee Lauder (EL.US)$

huge inside buy here, over 20 million

grey dot on daily. 3rd chart low on monthly

huge inside buy here, over 20 million

grey dot on daily. 3rd chart low on monthly

5

No comment yet

ひな☆彡 SOXL(Bull) OP : Please go vote, there aren’t much voting. This is a good interactive poll

晴瓦林 : This is a very undervalued stock to me. EL crashed on its earnings report. The P/S is extremely low historically, they probably use their revenue to increase EPS in the next earning report, so that P/E will be more appealing than it is now. Debt to equity is pretty low too, more people will buy it up if they find out about that.

The Heikin-ashi chart shows it has barely any momentum to drop. And, I can see the institutions (XL) and large retailers are buying up at the end of the trading day.

There are many campers at 72, this stock probably hardly go below 72.

I will consider getting EL in my portfolio.

耐心等待一记好球 : Thank you for doing the analysis.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

晴瓦林 耐心等待一记好球 : You're welcome

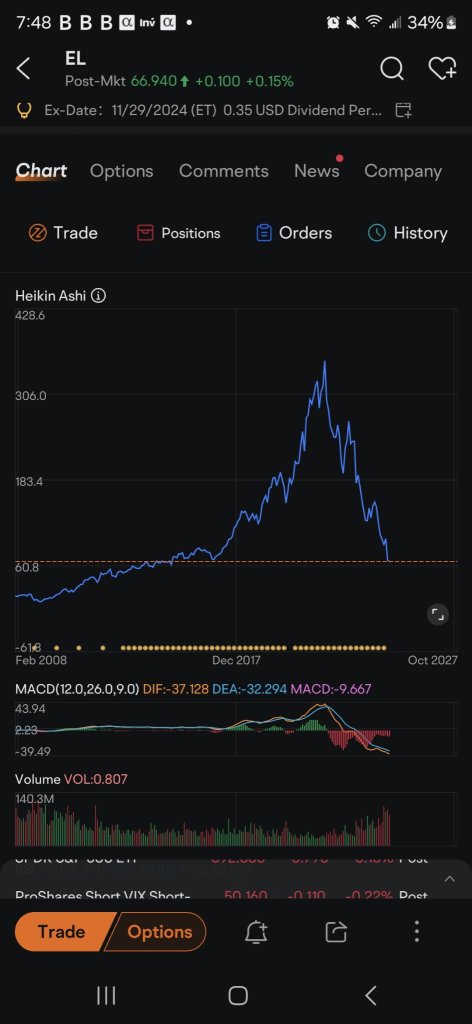

晴瓦林 : Also, The vanguard and Blackrock are buying EL up too. So, this is likely to stop dropping maybe. But I just noticed the 5Y chart now, and I'm not very confident that EL will rise in 1 year. I'm gonna buy in the dollar-cost averaging method instead. The revenue doesn't look that terrible to me. And the price is in the 2017 range, there might be potential to grow for EL to grow, but I'd sell before its earning report being published.

After doing all of these evaluations, I want to look somewhere else that is less risky than this.