No Data

EM Energy Monster

- 1.1400

- -0.0100-0.87%

- 1.1585

- +0.0185+1.62%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

What is the future direction of Energy Monster (EM.US) during the mid-term time of the "top trend" of shared power banks in the midst of major changes?

The "noise" in the market has not dissipated, yet Institutions still choose to privatize Energy Monster at a high premium at this time, which is intriguing...

Smart Share Global Retains Independent Advisors to Evaluate Go-Private Proposal

Alibaba, Xiaomi, and SoftBank are expected to break even! Energy Monster plans to go private and be delisted.

① The "first stock of shared charging treasures," Energy Monster announced that it has received a privatization offer from Xincheng Capital and the Board of Directors of Energy Monster, to acquire all ADS at $1.25 Cash. ② Energy Monster's revenue in the first half of 2024 is 0.86 billion yuan, a year-on-year decline of 53.74%, with a net income attributable to the parent company of 0.8829 million yuan, down 75.01% year-on-year.

The privatization offer has a premium of 74.8%. What does CITIC-Backed want from Energy Monster (EM.US) in this "grab"?

CITIC-Backed companies have jointly issued a privatization offer to the Energy Monster management at a high premium; what is the deeper meaning behind this?

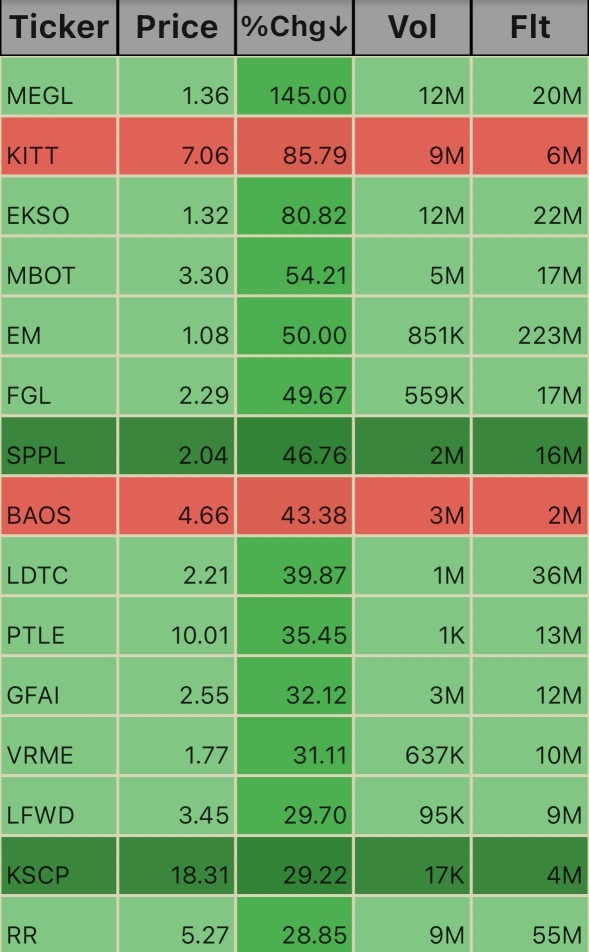

12 Consumer Discretionary Stocks Moving In Monday's Pre-Market Session

Sector Update: Consumer Stocks Higher Pre-Bell Monday

Comments

📊⚡️📊

Smart Share Global Limited Announces Receipt of a Preliminary Non-Binding Proposal to Acquire the Company

Monday, 6th January at 3:49 am

SHANGHAI, Jan. 06, 2025 (GLOBE NEWSWIRE) -- Smart Share Global Limited (NASDAQ: EM) ("Energy Monster" or the "Company"), a consumer tech company providing mobile device charging service, today announced that its board of directors (the "Board") has received a preliminary non-binding proposal letter (the "Proposal Letter"), dated Janu...

Another indicator that it was taking place were all the reverse splits that had been occurring. This is an indicator because it means theres too many shares and liquidity had reached its max potential.When this occurs, it reverts. The number one influence on liquidity is short selling. So as ...

102115941 : let the fun begin

凯神 : boss,what mean Flt?thanks ur assist ya