No Data

ERO Ero Copper

- 13.870

- +0.470+3.51%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Is the USA's rush for Copper going to cause a Global "Copper shortage"? An unprecedented scene is unfolding in the Metal market.

① A well-known Copper Trade dealer, Kostas Bintas, stated that the massive influx of Copper into the USA will cause serious supply shortages in other parts of the world, especially in the main Consumer nations. ② Last week, Financial Associated Press reported that there are signs indicating that USA ports are about to be flooded with a large import of Copper, as traders are rushing to transport goods ahead of the tariffs that President Trump may implement.

The "well-known bulls" in the copper market support: inventory transfer + supply not meeting demand, copper prices can rise another 1/3 at most!

A highly regarded bullish figure in the Copper market once again predicts that copper prices will reach an all-time high.

Base Metal Prices Mixed After Copper Briefly Hits $10,000 -- Market Talk

Commodity Roundup: Copper Prices Top $10,000 Ahead of Trump's Potential Tariffs

After breaking 0.01 million dollars, how much longer can the price of Copper continue to rise.

Morgan Stanley believes that although the current supply fundamentals of Copper are solid, the rise in speculative positions and tightening term spreads may exacerbate market volatility. Additionally, any changes in tariff policies could lead to market reversals.

Is there a crazy rush before Trump's tariffs? A large amount of Copper is about to "flood" the USA ports...

According to four insiders familiar with the shipping situation, it is expected that 0.1 million to -0.15 million tons of refined Copper will arrive in the USA in the coming weeks; if they all arrive in the same month, it is expected to exceed the historical maximum import record of 136,951 tons set in January 2022.

Comments

It's important to acknowledge that the stock market is not the economy, and the economy is not the s...

$Apple (AAPL.US)$ initiated at buy by DA Citigroup, announced targe price at $60.00.

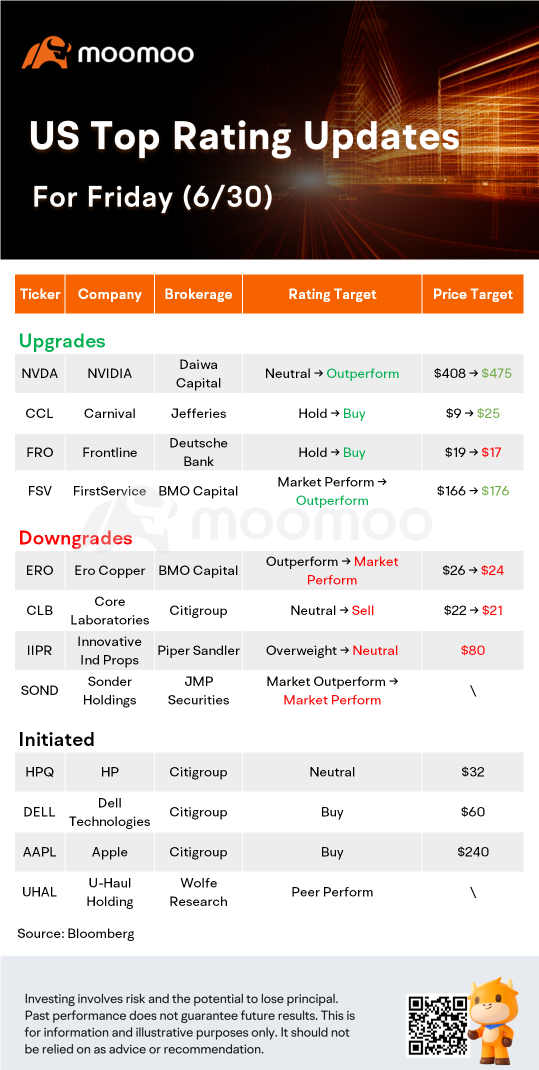

$NVIDIA (NVDA.US)$ was upgraded by Daiwa Capital from neutral to outperform, increased target price from $408.00 to $475.00.

$Carnival (CCL.US)$ was upgraded by Jefferies from hold to buy, increased target price from $9.00 to $25.00.

$Ero Copper (ERO.US)$ was d...

TWIMO (151403908) : BHP has disappointed since I sold in October last year…. Wondering what’s going on…

Michael McCarthy CEO OP TWIMO (151403908) : Yes - your timing looks good! The boost from the PBoC's policy announcements was significant, but pressure on iron ore prices since isn't helping. Where would you buy back in?

TWIMO (151403908) Michael McCarthy CEO OP : I was lucky to exit. Bought it because I wanted to enjoy the dividend. Excited because BAT was more attractive, another lucky one. Might reconsider BHP if it rise above the 150 moving average.

Didn't realised iron ore price was directly impacting stock price until I bought Fortescue. Not so lucky and under water

Michael McCarthy CEO OP TWIMO (151403908) : What a ride!

151825295 : yea missing a factor. instostain manipulation. this stock is being hammered by it. short distort, layering, spoofing, pump and dump. some thief instostain has been suppressing the price. the asic does nothing as corrupt. stock should be humming but aint. take a guess at which instothief it is.

View more comments...