No Data

ERX241220C62000

- 0.40

- -0.55-57.89%

- 5D

- Daily

News

Oil Headed for Weekly Gains as Sanctions Outlook Raises Supply Worries -- Market Talk

Oil Prices Steady As Market Balances IEA Surplus Forecast With Rate Cut Optimism

Update: WTI Oil Edges Down as the IEA Sees the Market Over Supplied in 2025

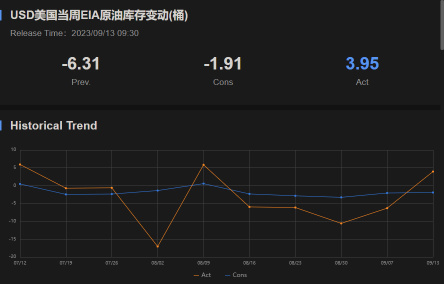

Crude Oil Jumps Back Above $70 as US Inventories Fall to Lowest Level

IEA Monthly Report: Even if OPEC+ delays production increases, there will still be an oversupply of oil next year!

The IEA stated that if OPEC+ implements the production recovery plan starting in April, the Global market will face a surplus of 1.4 million barrels per day. The IEA has raised the forecast for global oil demand growth in 2025 by 90,000 barrels to 1.1 million barrels, mainly due to the economic stimulus measures recently announced by China.

WTI Edges Higher to Near $70.00 on China Stimulus, New EU Sanctions Against Russia

Comments

Context: Moomoo’s Papertrading ends 3 Oct, which meant I had to maintain 1st place for 4 more days (at start of Fri).

Logic: I observed the leaderboard & fluctuation patterns, noting the table toppers were mostly long China.

However on Tue, we had a sizeable correction (5-8%) post-Mon rush (which in fact, caused much grief in our competitors’ Whatsapp chat 😂)

Action: With my slim 2% lead, I unloaded all positions & my i...

Natural Gas is Starting to Look More Bullish

Nat gas has had a rough go since November this year. It has lost over 20% of its value since. The unseasonably warmer than usual weather in the norther hemisphere and the slow global economic growth has held down the commodity.

More recently nat gas was consolidating near its lows with a bear flag type of wedge pattern. It seemed as if the commodity was forming a...

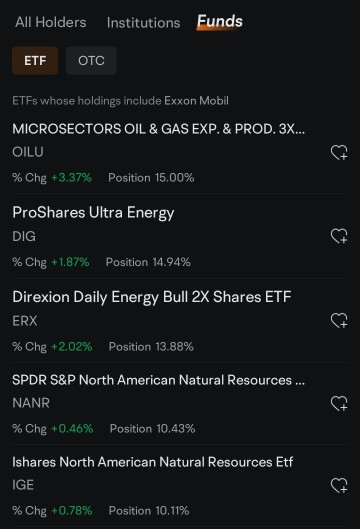

Wondering what everyone’s thoughts are on holding some energy ETF’s for the mid/long term. $SPDR S&P Oil & Gas Exploration & Production ETF (XOP.US)$ $Occidental Petroleum (OXY.US)$ $Direxion Daily Energy Bull 2X Shares ETF (ERX.US)$

In a previous post about crude prices, I mentioned the areas where we might see some selling. Currently, the price of crude is just below the first area of resistance that I discussed. Check out the post in the link directly below.

Dovish Macro Picture

Oil prices have been on a very sharp rally for the past few months. Policy from Opec has been the main driver of this price spike. The macroeconomic situation is still very dovish fo...

Here are 3 reasons why Exxon Mobil ( $Exxon Mobil (XOM.US)$ ) remains attractive.

103255820 : Wah v diversified portfolio there

leoneday : Yang's purchase is a bit aggressive.

103798718 : Should have YOLO and all in on $Futu Holdings Ltd (FUTU.US)$, yesterday top gainer at 11%, went on a run from $57 to above $100 in a short time