US ETFDetailed Quotes

ETHW Bitwise Ethereum ETF

- 13.765

- +0.645+4.92%

Trading Apr 1 12:09 ET

13.825High13.235Low

13.825High13.235Low169.48KVolume13.410Open13.120Pre Close2.29MTurnover1.28%Turnover Ratio--P/E (Static)13.26MShares29.52052wk High--P/B182.52MFloat Cap12.89052wk Low--Dividend TTM13.26MShs Float29.520Historical High--Div YieldTTM4.50%Amplitude12.890Historical Low13.538Avg Price1Lot Size

$Ethereum (ETH.CC)$

March 18, 2025

1️⃣ Part 1 - Complete Technical Analysis of Ethereum

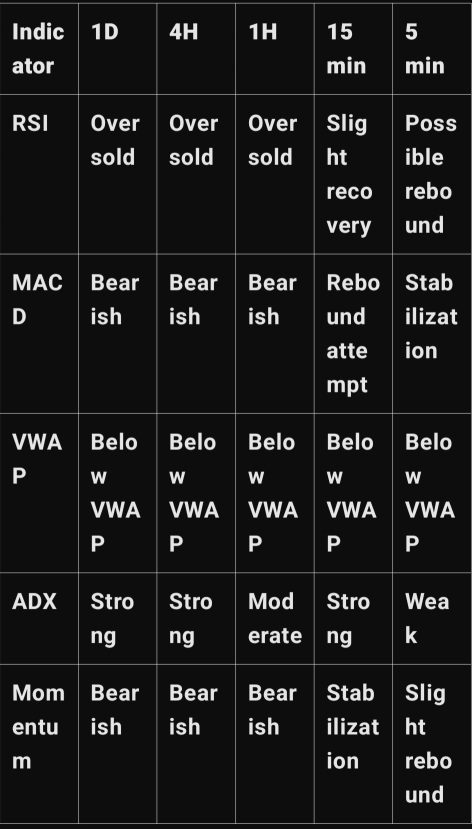

📊1. Multi-Timeframe Analysis (15min, 1h, 4h, Daily)

General Trend & Market Structure

15min: Strong bullish trend with potential exhaustion.

1h: Confirmation of a strong rally with indicators in the overbought zone.

4h: Ongoing bullish recovery, with signs of momentum excess.

Daily: Returning to a bullish phase, key resistance around $1950.

---

2. Volume & Liquidi...

March 18, 2025

1️⃣ Part 1 - Complete Technical Analysis of Ethereum

📊1. Multi-Timeframe Analysis (15min, 1h, 4h, Daily)

General Trend & Market Structure

15min: Strong bullish trend with potential exhaustion.

1h: Confirmation of a strong rally with indicators in the overbought zone.

4h: Ongoing bullish recovery, with signs of momentum excess.

Daily: Returning to a bullish phase, key resistance around $1950.

---

2. Volume & Liquidi...

+9

16

18

2

$Ethereum (ETH.CC)$

March 5, 2025:

🔹️Part 1: Context, Trends, and Market Structure

---

1. Multi-Timeframe Analysis and Market Structure

Multi-timeframe analysis is essential to identify underlying trends and avoid false signals. We will analyze ETH across multiple timeframes to detect key levels and the current market dynamics.

a) Monthly Chart (Long-Term)

General Trend: ETH is in a bullish recovery phase after a strong recent correction. Monthl...

March 5, 2025:

🔹️Part 1: Context, Trends, and Market Structure

---

1. Multi-Timeframe Analysis and Market Structure

Multi-timeframe analysis is essential to identify underlying trends and avoid false signals. We will analyze ETH across multiple timeframes to detect key levels and the current market dynamics.

a) Monthly Chart (Long-Term)

General Trend: ETH is in a bullish recovery phase after a strong recent correction. Monthl...

+1

20

12

1

$Ethereum (ETH.CC)$

March 4, 2025

1️⃣ Phase 1: Trend Analysis and Multi-Timeframe Chart Structures

---

1. Weekly Chart Analysis

General Trend:

Main trend: Bearish within a long-term descending channel.

Key Support: $2002 (last tested low).

Key Resistance: $2837 (BBI) and $3152 (VWAP).

Technical Indicators:

RSI: 19.31 (extremely oversold), indicating a potential technical rebound.

MACD: -299.61 (strong negative divergence, but the bearish ...

March 4, 2025

1️⃣ Phase 1: Trend Analysis and Multi-Timeframe Chart Structures

---

1. Weekly Chart Analysis

General Trend:

Main trend: Bearish within a long-term descending channel.

Key Support: $2002 (last tested low).

Key Resistance: $2837 (BBI) and $3152 (VWAP).

Technical Indicators:

RSI: 19.31 (extremely oversold), indicating a potential technical rebound.

MACD: -299.61 (strong negative divergence, but the bearish ...

32

2

1

$Ethereum (ETH.CC)$

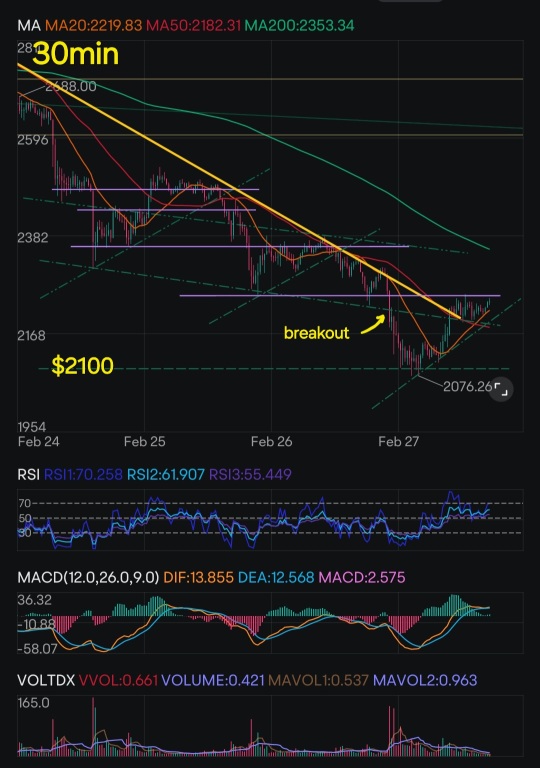

Phase 1: Trend Analysis and Chart Structure Review

---

1. Trend Analysis and Chart Patterns

✅ Weekly Chart

Overall Trend: Bearish within a long-term descending channel.

Key Support: $2076, repeatedly tested with a potential rebound.

Key Resistance: $2947, aligned with the BBI and the 50MA.

RSI: 21.61 (extremely oversold), signaling a potential rebound.

MACD: -248.879 (very bearish), but losing momentum.

SLOWKD: K:...

Phase 1: Trend Analysis and Chart Structure Review

---

1. Trend Analysis and Chart Patterns

✅ Weekly Chart

Overall Trend: Bearish within a long-term descending channel.

Key Support: $2076, repeatedly tested with a potential rebound.

Key Resistance: $2947, aligned with the BBI and the 50MA.

RSI: 21.61 (extremely oversold), signaling a potential rebound.

MACD: -248.879 (very bearish), but losing momentum.

SLOWKD: K:...

13

11

3

$Ethereum (ETH.CC)$

Phase 1: Trend Analysis and Chart Structure Review

---

1. General Trend and Chart Structure Analysis

📌 Weekly Timeframe

Main trend: Still bearish, ETH is moving within a broad descending channel.

Key support: $2090 - $2200, a historically strong base tested multiple times.

Key resistance: $2930 - $3100, aligned with the 50MA and a previous support-turned-resistance.

Volume: VOLDTX spiked to 491.7, indicating massive ...

Phase 1: Trend Analysis and Chart Structure Review

---

1. General Trend and Chart Structure Analysis

📌 Weekly Timeframe

Main trend: Still bearish, ETH is moving within a broad descending channel.

Key support: $2090 - $2200, a historically strong base tested multiple times.

Key resistance: $2930 - $3100, aligned with the 50MA and a previous support-turned-resistance.

Volume: VOLDTX spiked to 491.7, indicating massive ...

17

15

2

$Ethereum (ETH.CC)$

Phase 1: Trend Analysis and Chart Structures

---

1. General Trend and Market Evolution

📌 Monthly Timeframe

Primary trend: Bearish but potentially forming support.

Trendlines:

The long-term uptrend line has been retested, a rebound is possible.

A major resistance around $4100 - $4800 is blocking further upside movement.

Channel:

The price is still evolving in a broad bearish channel, with a possible stabilization.

Bollin...

Phase 1: Trend Analysis and Chart Structures

---

1. General Trend and Market Evolution

📌 Monthly Timeframe

Primary trend: Bearish but potentially forming support.

Trendlines:

The long-term uptrend line has been retested, a rebound is possible.

A major resistance around $4100 - $4800 is blocking further upside movement.

Channel:

The price is still evolving in a broad bearish channel, with a possible stabilization.

Bollin...

23

$Ethereum (ETH.CC)$ Here's my 3 parts analysis:

Multi-Timeframe Technical Analysis of Ethereum (ETH)

Part 1: Long-Term Analysis (Daily - 1D)

1. Overall Trends and Patterns:

Bearish channel: ETH continues to move within a well-defined descending channel. The price remains below the dynamic resistance of the channel, confirming persistent selling pressure.

Key Levels:

Major support at $2120 (tested several times without a clear break).

Resist...

Multi-Timeframe Technical Analysis of Ethereum (ETH)

Part 1: Long-Term Analysis (Daily - 1D)

1. Overall Trends and Patterns:

Bearish channel: ETH continues to move within a well-defined descending channel. The price remains below the dynamic resistance of the channel, confirming persistent selling pressure.

Key Levels:

Major support at $2120 (tested several times without a clear break).

Resist...

3

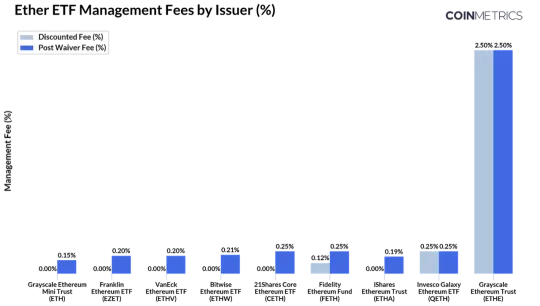

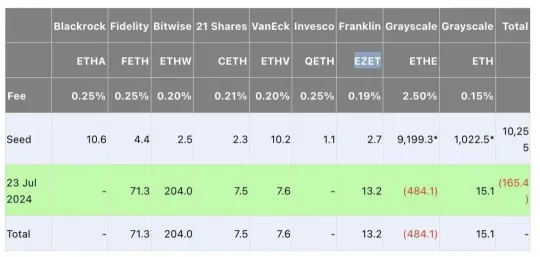

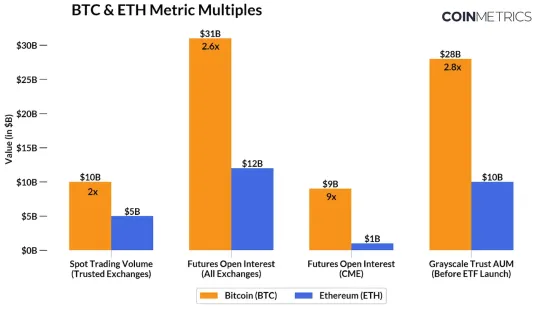

Impressive Debut on Launch Day

On July 23, nine Ethereum spot ETFs made their debut, issued by traditional asset management giants such as BlackRock, Fidelity, and emerging crypto funds like Grayscale and Bitwise. These ETFs track the spot price of Ethereum.

By listing on exchanges such as the Chicago Board Options Exchange (CBOE), the New York Stock Exchange (NYSE), and NASDAQ, investors can now hold this emerging top-t...

On July 23, nine Ethereum spot ETFs made their debut, issued by traditional asset management giants such as BlackRock, Fidelity, and emerging crypto funds like Grayscale and Bitwise. These ETFs track the spot price of Ethereum.

By listing on exchanges such as the Chicago Board Options Exchange (CBOE), the New York Stock Exchange (NYSE), and NASDAQ, investors can now hold this emerging top-t...

6

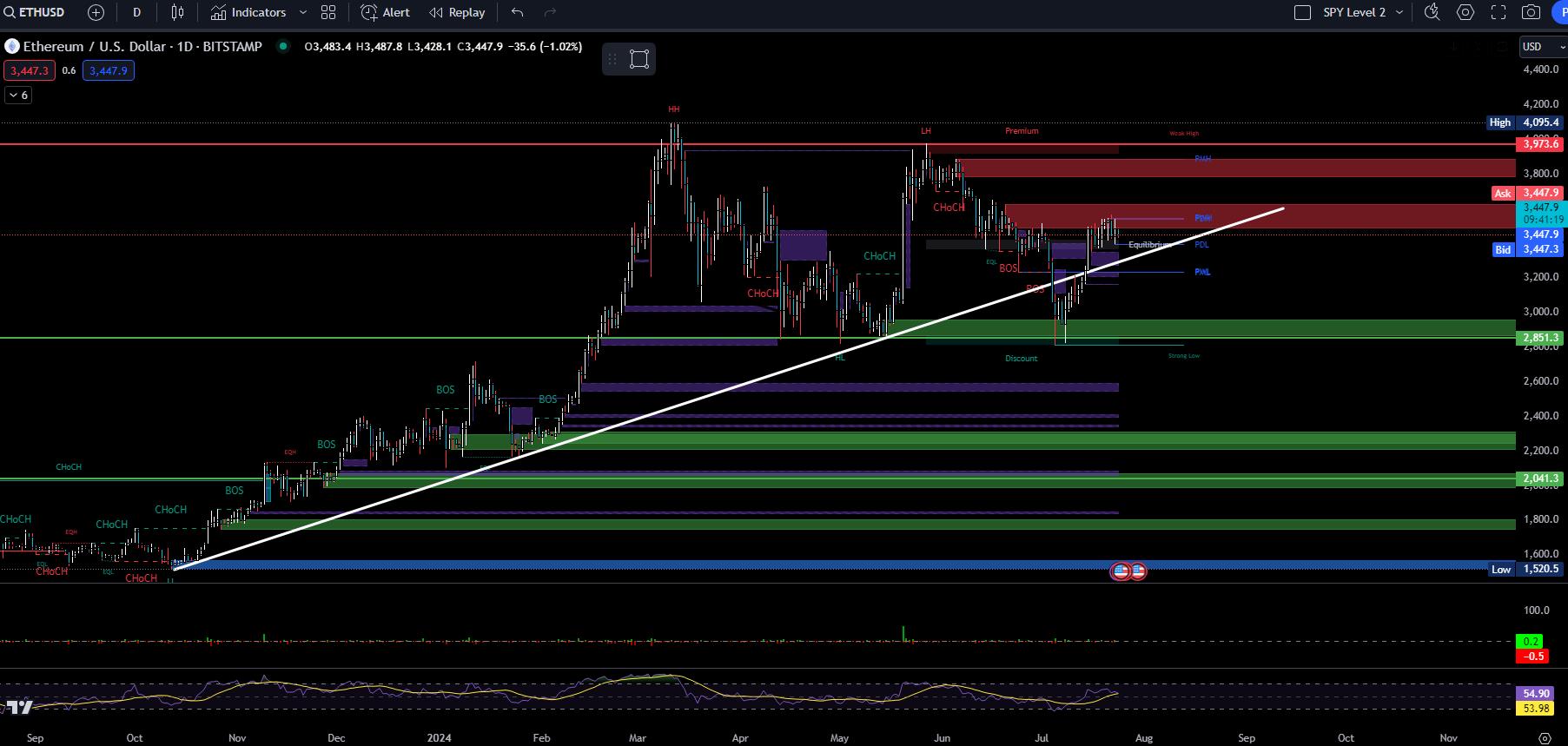

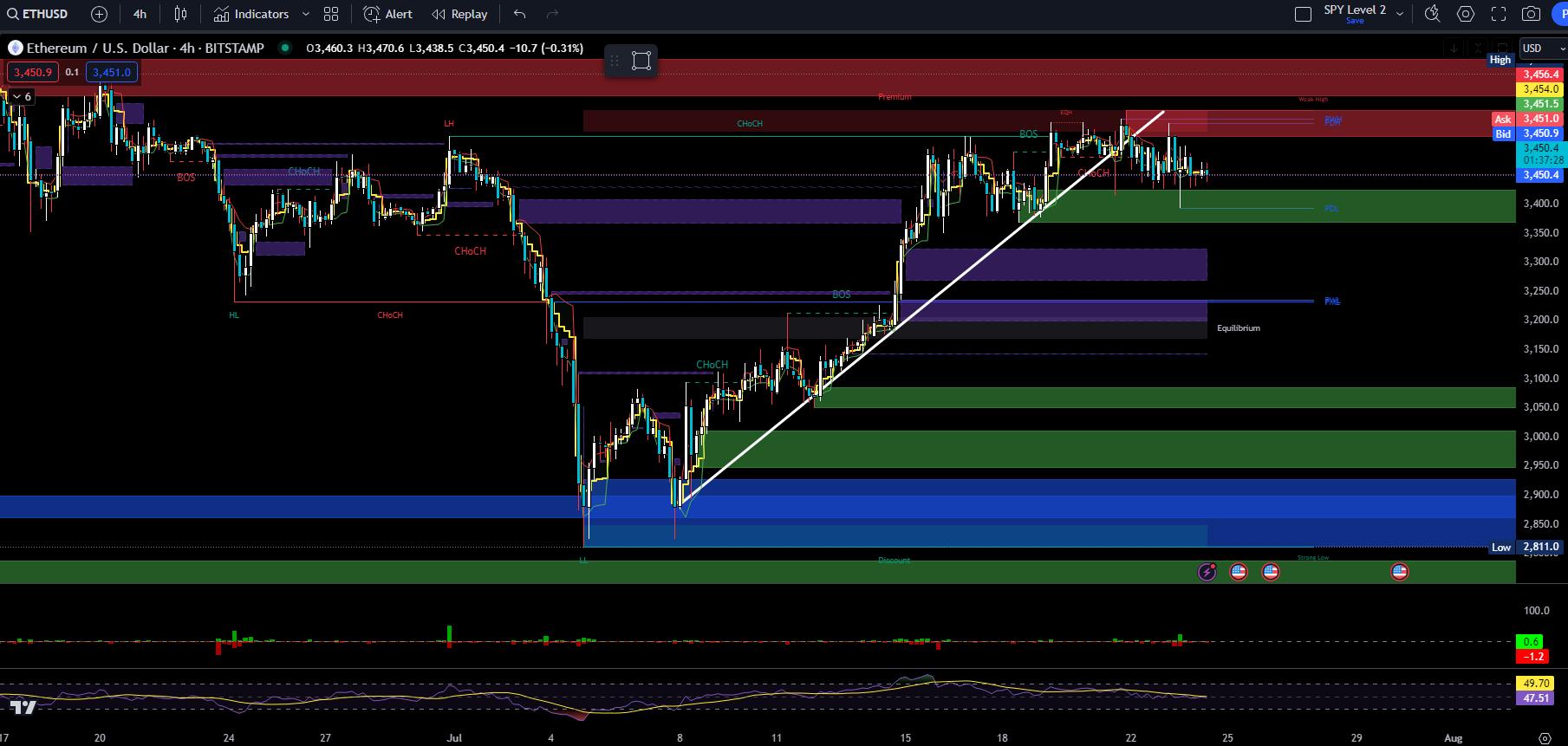

Good morning, good morning, gooooood morning everyone! My name is Alkaline, and welcome back to The Market!

First and foremost, I have to apologize once again for the lack of articles this week and the previous week. Between the IT outage, personal events, and work related assignments; I have not had the time to write an article the way that I want to. However, I have some free time this morning and so lets go over the charts and Market news!

Before we begi...

First and foremost, I have to apologize once again for the lack of articles this week and the previous week. Between the IT outage, personal events, and work related assignments; I have not had the time to write an article the way that I want to. However, I have some free time this morning and so lets go over the charts and Market news!

Before we begi...

+12

19

1

6

No comment yet

Bitcoin is slow and expensive to use (10 minutes per transaction on average, high fees).

Bitcoin is slow and expensive to use (10 minutes per transaction on average, high fees).

104540272 : You mean you guys still believe in chart analysis and indicators? In the crypto sphere these mean nothing. Unseen hands are manipulating those graphs. Wake up or lose all your money. Trade like a whale's thinking.

104540272 : AI tools also failed time and again to predict price movt. Never be so naive to think that AI is perfect. Far from it.

Ghost 1 : man bro this is analysis paralysis right here

Kevin Matte OP 104540272 : I don’t buy Ethereum directly; I trade leveraged Ethereum ETFs. For these products, technical analysis is crucial as they amplify market movements. Understanding trends, key levels, and indicators helps optimize entry and exit points. Even if the crypto market is manipulated, "whales" also use these tools to structure their trades. Ignoring charts means trading blindly.

Kevin Matte OP 104540272 : My friend, I've been training my AI for months to help me with technical analysis. Only. I don't use a "bot" or "algos" or anything else for my trades. I created it myself and no one else, and I train it, in my own way. You shouldn't rely on it, it's an aid, a suggestion. It's already better than believing "analysts". If you want, my friend, I can explain to you how I do it, it's very easy to get results like these! I also use it as a screener and for financial analysis.

View more comments...