No Data

EURUSD EUR/USD

- 1.04276

- +0.00652+0.63%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

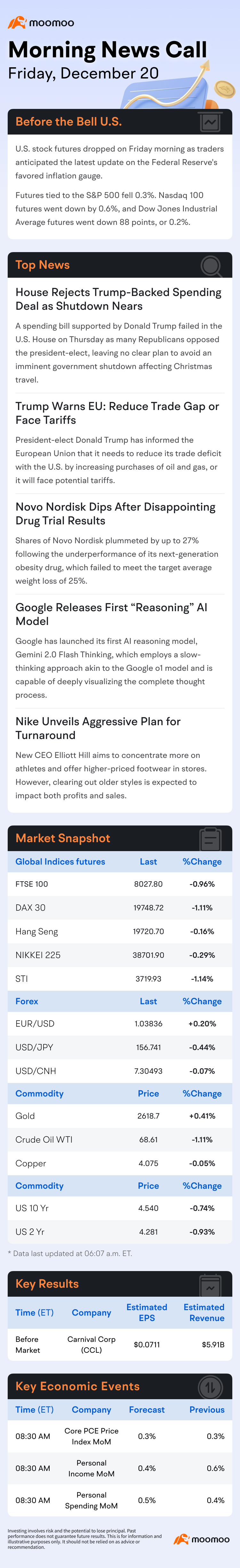

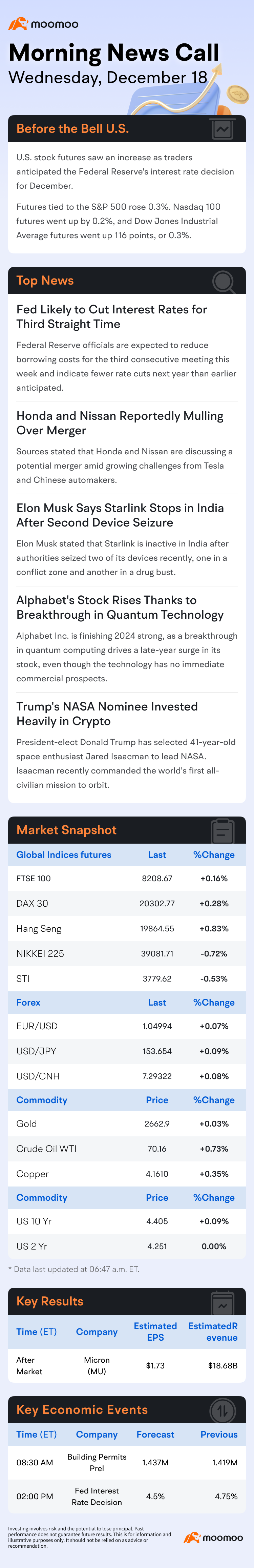

Oil prices have dropped by 2.5%! With the Federal Reserve's interest rate hike expectations conflicting with demand, what will the future trend be?

This week, the international crude oil market closed stable, with Brent crude oil Futures rising by 0.08% to $72.94 per barrel, while WTI Crude Oil Futures increased by 0.12% to $69.46 per barrel. For the week, the two major Indicators of crude oil Futures cumulatively dropped by about 2.5%. The market is weighing the expectations of interest rate cuts in the USA and the demand outlook, while the dollar's pullback has provided some support for the crude oil market. The cooling of inflation in the USA has led to a softening of the dollar, which theoretically is Bullish for crude oil prices. However, the hawkish signals released by the Federal Reserve after the year-end meeting have weakened market expectations for significant rate cuts in 2025. Although the dollar has retreated from two-year highs,

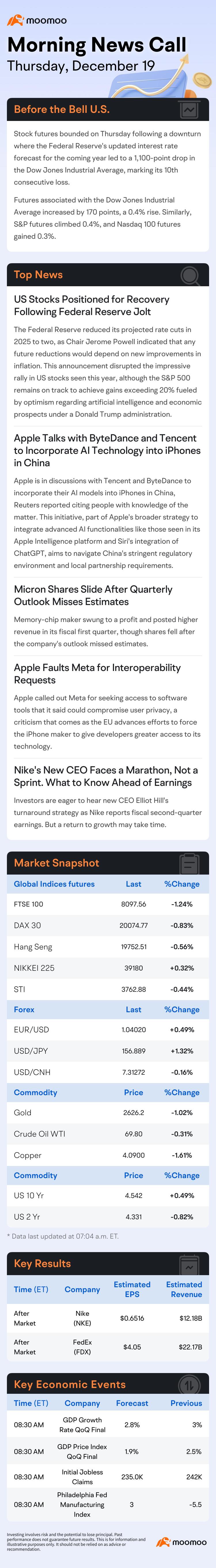

The only official who voted against at the Federal Reserve's December meeting explains: Why is there no support for lowering interest rates? (Full text attached)

Federal Reserve Chair Hammack indicated that based on her determination that monetary policy is currently close to a neutral stance, she tends to keep policy stable until more evidence shows that inflation is returning to the target path of 2%. The momentum of the USA economy and the recent high inflation data prompted her to raise the inflation forecast for next year. She believes her decision is a tough choice.

Overview of opinions: After the Federal Reserve cut interest rates by 25 basis points, the Fed chairman made several statements.

After the Federal Reserve made its latest interest rate decision this week, several officials voiced their insights on outlook and inflation issues intensively on Friday. San Francisco Fed President expects fewer rate cuts next year than anticipated. Daly feels "very comfortable" with the median estimate of two rate cuts next year. Mary Daly, President of the San Francisco Federal Reserve Bank, stated that she is "very comfortable" with the median estimate of the decision-makers for two rate cuts next year, emphasizing that the Federal Reserve can shift to a slower pace. Chicago Fed President raises rate outlook but still expects lower borrowing costs. Austan Goolsbee, President of the Chicago Fed, mentioned that he slightly raised his rate outlook for 2025, but...

External headlines: OpenAI releases the simulation reasoning model o3. Trump plans to continue providing military aid to Ukraine. Germany's Volkswagen reaches an agreement between labor and management.

The main headlines that the Global financial media paid attention to last night and this morning include: According to reports, Trump plans to continue providing military assistance to Ukraine. The team of President-elect Trump has told European officials that Trump will push NATO member countries to increase their defense spending from the current 2% of GDP to 5%, but plans to continue providing military assistance to Ukraine. A source familiar with the discussions told the newspaper that Trump would be satisfied with countries spending 3.5%. Currently, only 23 of the 32 NATO member countries have met the military spending benchmark of 2%. By 2024, the defense spending of the USA will account for.

Express News | EUR/USD Is Higher Following November PCE Data

The Federal Reserve's "third-in-command": It is expected that interest rate cuts will continue in the future and considerations have begun regarding the impact of Trump's policies.

①Williams stated that he expects the Federal Reserve to implement more interest rate cuts, but the decision on rate cuts will depend on subsequent data, as monetary policy still suppresses economic growth momentum; ②Williams acknowledged that the impact of Trump's policy agenda has begun to influence his economic outlook.

103635526 : Dow Initial tumble amid Bitcoin collapse 10%,HSI follow suit ?

Margalie. J Destine : What gonna be happening Don’t buyout