No Data

US OptionsDetailed Quotes

FBL250117P41000

- 0.00

- 0.000.00%

15min DelayClose Jan 6 09:30 ET

0.00High0.00Low

0.00Open0.00Pre Close0 Volume0 Open Interest41.00Strike Price0.00Turnover90.22%IV-7.67%PremiumJan 17, 2025Expiry Date2.92Intrinsic Value100Multiplier10DDays to Expiry0.00Extrinsic Value100Contract SizeAmericanOptions Type-0.6567Delta0.0637Gamma9.29Leverage Ratio-0.1015Theta-0.0074Rho-6.10Eff Leverage0.0236Vega

Intraday

- 5D

- Daily

No Data

News

The Best-performing Actively Managed ETFs

A Deep Dive into Investing in a Single Stock ETF: Using NVIDIA as an Example

A new chapter in the US stock market? The financial reports of the 'Seven Sisters' are coming out in succession, with a focus on AI capital expenditures.

Last week, the financial reports of Tesla and Alphabet caused a round of tech stock decline. This week, the US stock market welcomes the financial reports of Mag 7, including Amazon, Apple, Meta, and Microsoft, and the market has already begun to tremble.

Best Inverse/Leveraged ETFs of Last Week

JNUG, AGQ and TSLL Among Weekly ETF Movers

GraniteShares 2x Long META Daily ETF To Carry Out 5-for-1 Stock Split On March 13th, 2024

Comments

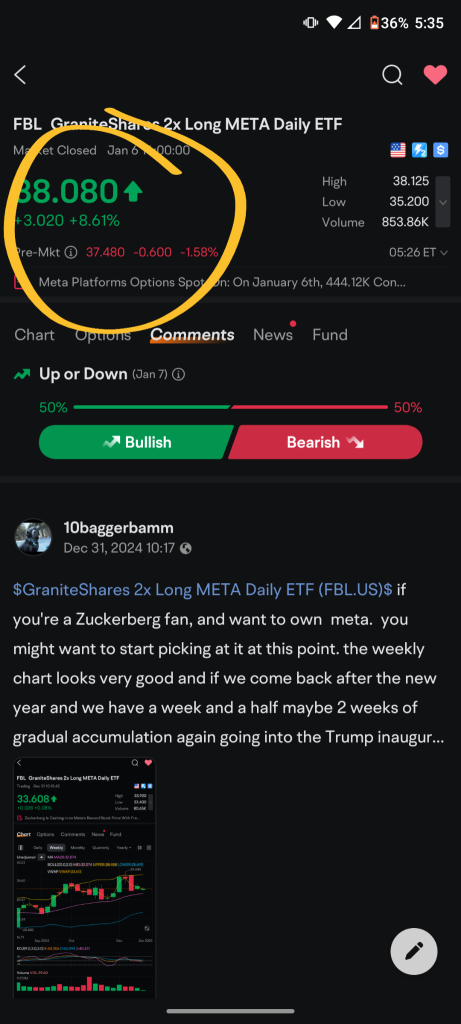

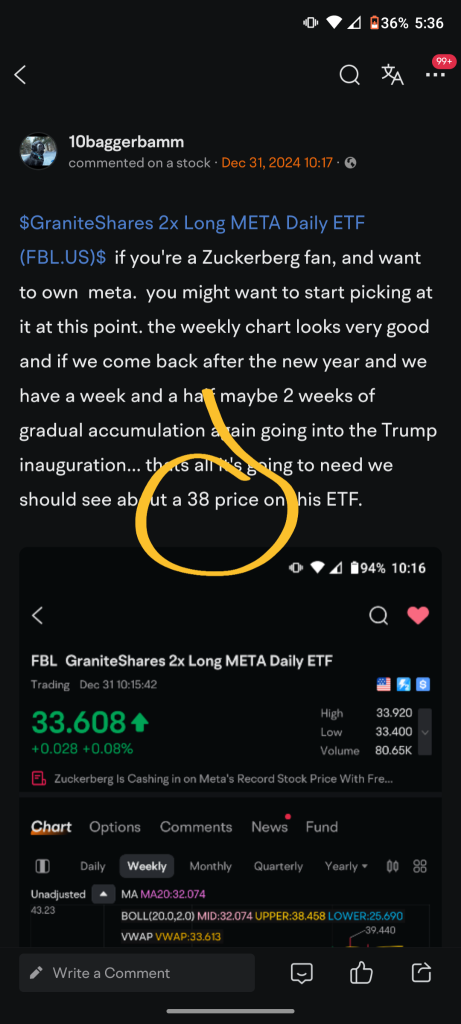

$GraniteShares 2x Long META Daily ETF (FBL.US)$ if you're a Zuckerberg fan, and want to own meta. you might want to start picking at it at this point. the weekly chart looks very good and if we come back after the new year and we have a week and a half maybe 2 weeks of gradual accumulation again going into the Trump inauguration... thats all it's going to need we should see about a 38 price on this ETF.

$GraniteShares 2x Long META Daily ETF (FBL.US)$ look at Facebook down I wonder what Mark Zuckerberg is thinking today.. 🤣

maybe it has something to do where Trump said he's going to hold all of those people accountable

maybe it has something to do where Trump said he's going to hold all of those people accountable

1

1

I posted my experiments on investing with the leverage ETF mid of Sept. You can read about the post in the link below.

https://www.moomoo.com/community/feed/113135188377606?share_code=01vzMj My losing Leveraged ETFs

At that time, 2 of the 3 ETFs ( $GraniteShares 2x Long NVDA Daily ETF (NVDL.US)$ and $Direxion Daily GOOGL Bull 2X Shares (GGLL.US)$ ) I invested were in red. The one that was making money ( $GraniteShares 2x Long META Daily ETF (FBL.US)$ ) was only gaining 1.7%.

F...

https://www.moomoo.com/community/feed/113135188377606?share_code=01vzMj My losing Leveraged ETFs

At that time, 2 of the 3 ETFs ( $GraniteShares 2x Long NVDA Daily ETF (NVDL.US)$ and $Direxion Daily GOOGL Bull 2X Shares (GGLL.US)$ ) I invested were in red. The one that was making money ( $GraniteShares 2x Long META Daily ETF (FBL.US)$ ) was only gaining 1.7%.

F...

8

1

Read more

BelleWeather : Hey, congrats! But, why trade the LETF vs shares or options with which one can choose fees, risk, timing, leverage, etc? Or even trade options ON the LETF (lower cost of entry, easy to front run and at a disadvantage with daily rebalancing that one can exploit?)

10baggerbamm OP BelleWeather : I think I know what you're asking I've never heard it put that way but let me try to answer it.

very seldomly do I buy calls or buy puts

the reason is statistically 90% of the time they expire worthless so when I'm involved with options the vast majority of time I sell puts at lower strike prices in the current market to collect the premiums on companies that I'd like to own typically they're just above the support line and if I get put the stock or the ETF I'm fine with it or I sell covered calls so I become the casino and I let other people become the degenerate gamblers by buying the puts and calls I just sell the puts and sell the covered calls.

that answers that question and the reason why I didn't buy calls here is because most of the time you can be right about the movement of an underlying stock but you're wrong about the time and the time value decays and your option expires worthless

as far as buying the individual stock I want the leverage and that's why I use 2X and 3X ETFs the vast majority of time. whether it is on an index or an individual company it's the easiest way to obtain leverage at the lowest cost solution.

if I were to buy a thousand shares of meta as an example and I wanted 2x leverage in theory I'd have to buy 2,000 shares or I'd have to go on to margin and buy a thousand shares on margin in order to obtain that same 2x leverage that this ETF offers.

cost of borrowing meta on margin is going to far out way buying it through a leveraged ETF and let the management use underlying options and derivatives to create what works out to be about a 2X leverage most of the time understanding that leverage ETFs can trade at a premium or discount than that asset value throughout the day.

so that's why I typically don't buy call options even if I'm very bullish believing something's going to go up and throughout the year I have but call options on certain ETFs I bought nail last year and I made 18x and a couple of days on a call option. and same with micron last year when it had a huge gap up on earnings I did very well in options on that.

so if I do call options typically it's very short period of time to expiration a couple of days at the most so maybe it's a Monday Tuesday purchase for Thursday Friday event that I think might happen and by Friday at 4:00 p.m. they're worthless anyways so I'm not really buying a lot in time value I'm just looking for a big gap and I know my loss going in and I figure they're going to go to zero if I'm wrong.

so hopefully that answers your question

BelleWeather 10baggerbamm OP : Um, honestly a jumble of contradictions! Don’t wish to argue, but hiring degenerate gamblers to manage the risk and leverage is not inexpensive, though certainly is easier, I suppose…but confusing as clearly one wouldn’t wish to employ anyone to lose 90% of the time. Anyway, you don’t prefer it and that’s fine. Have a great day and congratulations again on your success!

10baggerbamm OP BelleWeather : you obviously have no idea what you're talking about because the cost from the management fees of a leveraged ETF is far less than what the cost would be if you try to do it yourself that's just a fact I've been in leverage ETFs and I've hold some for a year and a half right now so when people talk about decay I know more about it first hand than anybody that regurgitates with somebody else told them because they listen to what somebody else said or what somebody else read online.

as far as call options and put options buying them 90% of the time they expire worthless that's a fact if you choose to ignore it good luck to you you're going to go broke in the process of trying to be the Las Vegas Gambler that's going to win at the roulette table because the odds are stacked against you nine to one and that's a fact of life.

if you want to buy the common stock buy the common stock you don't get leverage so I made it a simple to understand obviously this is just way above your pay grade to comprehend