No Data

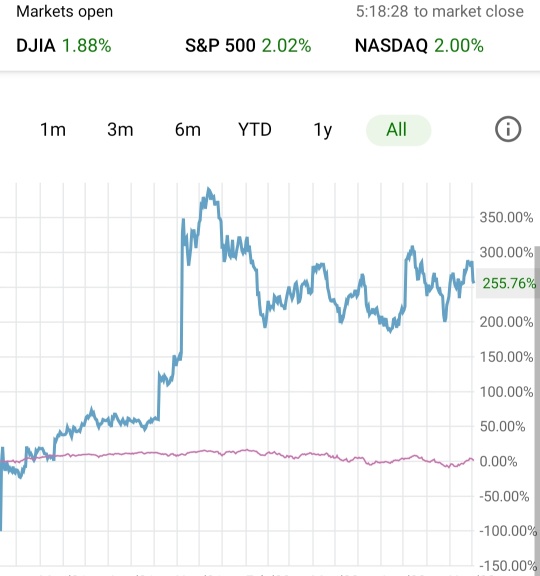

FCG First Trust Natural Gas ETF

- 25.030

- +0.400+1.62%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Commodity Roundup: Oil Rises to Start New Year, Russian Gas Exports to EU via Ukraine Halted

U.S. Natural Gas Pulls Back but Still Posts 44% Full-year Gain

Wall Street's Most Accurate Analysts Weigh In On 3 Energy Stocks With Over 4% Dividend Yields

Global LNG export growth hit a nine-year low. Exports are expected to expand next year, but LNG prices are likely to continue rising.

The delays in the USA LNG projects and sanctions against Russia have restrained the supply scale; looking ahead to 2025, export scale is expected to increase due to the new exports from the USA and Canada entering the market.

The most bullish oil prices in four months! Traders focus on "Trump VS Iran".

Although oversupply puts pressure on the oil market in 2025, investors are still preparing for upside risks, primarily influenced by Trump's stance on Iran after returning to the White House, as well as the ongoing geopolitical risks.

Crude Oil Edges Higher, Helped by Rally in Diesel and Natural Gas Futures

Comments

Prepare while I take you Through my lo...

$Occidental Petroleum (OXY.US)$ $NOV Inc (NOV.US)$ $Cleveland-Cliffs (CLF.US)$ $Baker Hughes (BKR.US)$ $Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares (GUSH.US)$ $VanEck Oil Services ETF (OIH.US)$ $SPDR S&P Oil & Gas Exploration & Production ETF (XOP.US)$ $SPDR S&P Metals & Mining ETF (XME.US)$ $Chord Energy (CHRD.US)$ $Invesco Dynamic Energy Exploration &Production Etf (PXE.US)$ $First Trust Natural Gas ETF (FCG.US)$ $Intrepid Potash (IPI.US)$ $The Mosaic (MOS.US)$ $Energy Fuels (UUUU.US)$ $United States Steel (X.US)$ $MicroSectors Gold Miners 3X Leveraged ETN (GDXU.US)$

$ChemoCentryx (CCXI.US)$ Is it just an oversold bounce, or recovery? Bouncing off of the lower bollinger band, have we found support? If we rebound the upper bollinger band us just below the gap to fill around 27. Look how far CCXI was sold down on ...

Well it was a crazy week, after all the chart indecision we ended bearish🐻. But what does the shortened trading week have in store? (markets closed for good friday)🌴🍷🥈⚰🐑

Let's see what the charts say:

°when looking at at my charts understand that rarely does anything move in a straight line, just because I drew one does not mean I believe it will follow it. Also I cannot predict the future, I only follow the chart ...

My teacher!!

My teacher!!

iamiam OP : Blackrock finally reported it now has almost an 11% ownership of CLF, get ready to fly.

icezzz : Thanks bro iam for your update

icezzz : What’s your target price to exit tsla?

iamiam OP icezzz : when the momentum turns, anywhere from 150-220

Thelord : Where do you see QQQ pulling back to?

View more comments...