No Data

FDN241220C175000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Fed's Bowman Says Regulators Shouldn't Rush to Contain AI

Salesforce Tool Aims To Simplify AI Agent Testing, Deployment

Amazon Shares Rise After-Hours as Earnings, Revenue Beat

Salesforce Launches Agentforce, Redefining AI In Business With Autonomous Solutions

Financial Morning Post: The first batch of active equity funds' third-quarter reports are released, leveraged funds continue to enter the market, and margin trading balance has increased for seven consecutive trading days.

【Highlights】A-shares are expected to welcome hundreds of billions of incremental funds. After the accelerated implementation of two major innovative mmf policy tools, all parties in the market are speeding up their participation and advancing related matters. On the 18th, the People's Bank of China announced the official launch of SFISF, with an initial operation scale of 500 billion yuan. The central bank will conduct operations in batches according to the needs of participating institutions. The first batch of 20 securities and fund companies have been approved to participate, with the initial application quota exceeding 200 billion yuan. Subsequently, institutions responded quickly and actively promoted the landing of SFISF business. Starting this Monday (21st), China International Capital Corporation and GTJA.

Salesforce Cuts Wait Times In Healthcare, New Collaboration Transforms Prior Authorizations

Comments

Any analysis provided is merely an opinion and not a fact. Please use it for reference only.

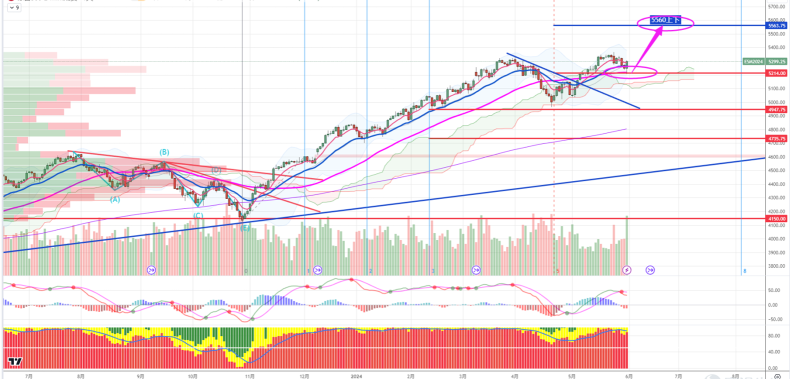

Major Indices Futures Daily Charts

S&P 500 Heatmap: Performance of S&P 500 constituents last week.

$S&P 500 Index (.SPX.US)$ $E-mini S&P 500 Futures(DEC4) (ESmain.US)$

$CBOE Volatility S&P 500 Index (.VIX.US)$ Daily Chart

Nasdaq 100 Heatmap: Performance of Nasdaq 100 constituents this week.

$NASDAQ 100 Index (.NDX.US)$ $Nasdaq Composite Index (.IXIC.US)$

���������...

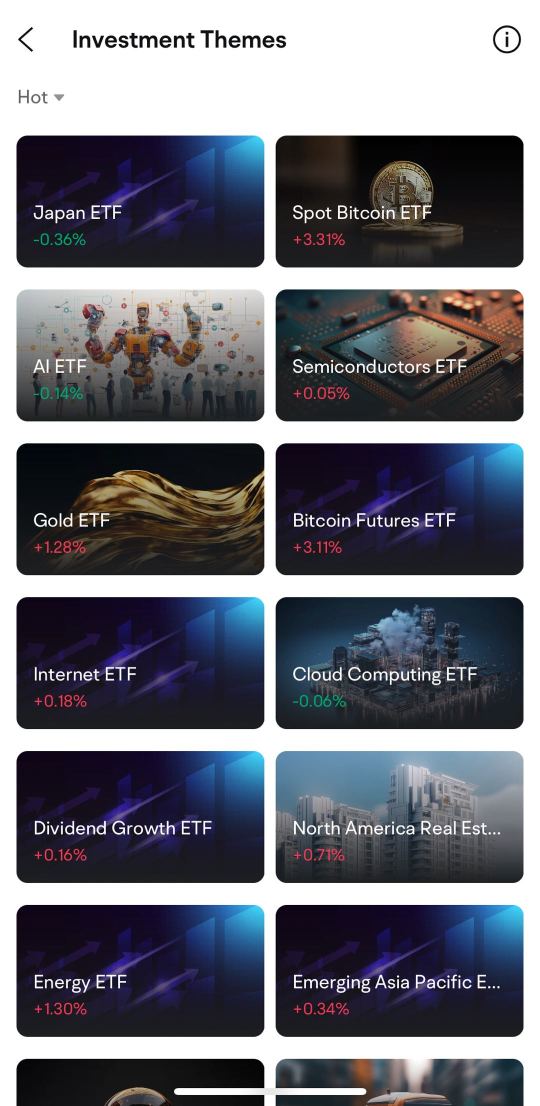

Tip: Currently, moomoo has updated the ETF con...