No Data

FXI250110C30000

- 0.01

- 0.000.00%

- 5D

- Daily

News

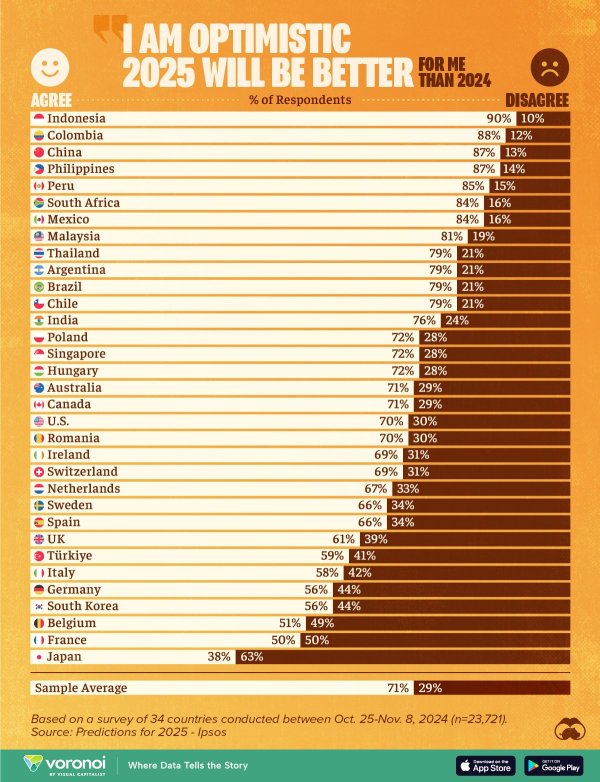

Trillions of incremental funds are on the way, is a long-term bull market for A-shares just around the corner? Wall Street anticipates 13 trillion entering the market within three years.

JPMorgan stated that the inflow of funds could reach 13 trillion yuan within three years; the Chinese government is guiding Funds and Insurance companies to increase their investments in the A-share market.

Asia Markets Rise Tracking Wall Street Gains on Trump Remarks; BOJ Hikes Rates Amid Higher Wages, Inflation

Trump Says He Would Rather Not Have to Use Tariffs on China

Express News | Trump: Would Rather Not Have to Use Tariffs Over China

Asia Markets Mixed After China Urges More Stock Purchases, Traders Assess Trump Policies

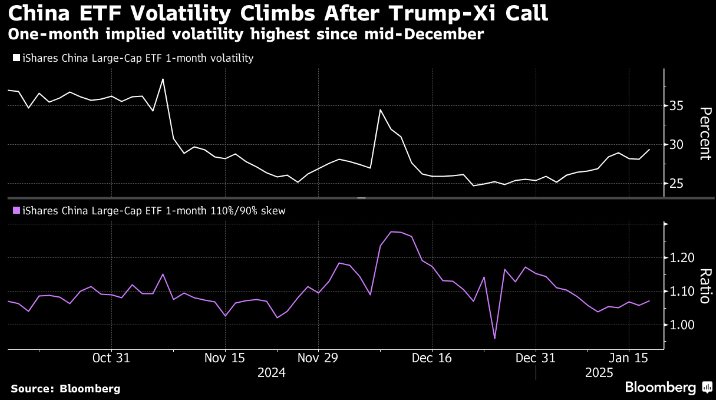

Overseas funds are buying Call Options on China Stocks ETF.

On Friday, there was another wave of overseas capital significantly buying Call Options for China Stocks ETF. According to media reports, last Friday (January 17), Wall Street traders significantly purchased Call Options linked to the Exchange Traded Fund (ETF) associated with Chinese stock indices. Chris Murphy, co-head of derivatives strategy at Susquehanna International Group, revealed that investors bought Call Options giving them the right to purchase about 4 million shares of iShares Core MSCI China Index ETF (FXI) at a price of $31-32 before the end of next week, and also purchased some 2.

Comments

China is fast catching up on AI, but today china's market look pathetic. 🔮🔮🔮 show me china's AI future 🤔🤔🤔

Is this the start of paradigm shift?

👇🏻🔭🔮🔮🔮

Chinese start-up DeepSeek’s new AI model outperforms Meta, OpenAI products

Banks are likely experiencing intense margin pressure.

If RE demand recovery doesn’t sustain this month and going into the Lunar New Year, confidence is going away without a big fiscal stimulus.

$Kraneshares Tr Bosera Msci China A Sh Etf (KBA.US)$ $iShares MSCI China ETF (MCHI.US)$ $iShares China Large-Cap ETF (FXI.US)$ $CHINA O/SEAS LAND (CAOVY.US)$

$iShares China Large-Cap ETF (FXI.US)$ $CSI 300 Index (000300.SH)$ $Hang Seng TECH Index (800700.HK)$ $Hang Seng Index (800000.HK)$ $KraneShares CSI China Internet ETF (KWEB.US)$

Buy n Die Together❤ :

Cui Nyonya Kueh : Just wait and watch.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

7-Heavens : I believe Xi and Trump will have positive chemistry and the Tariffs will be reasonably moderated

105742796 Learner : Interesting news

72056517 : xi and trump are power couple

View more comments...