No Data

GFI Gold Fields

- 20.600

- -0.050-0.24%

- 20.560

- -0.040-0.19%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Gold prices are rising too quickly! Goldman Sachs is already looking at $3,300 by the end of the year before even finishing the report.

①Goldman Sachs Analysts Lina Thomas and Daan Struyven just raised the target price for gold by the end of 2025 to $3,100 per ounce last month; ②this month, the gold price has already surpassed the $3,000 mark for the first time in history, forcing Goldman Sachs to hurriedly "tear up the report" and revise their forecast.

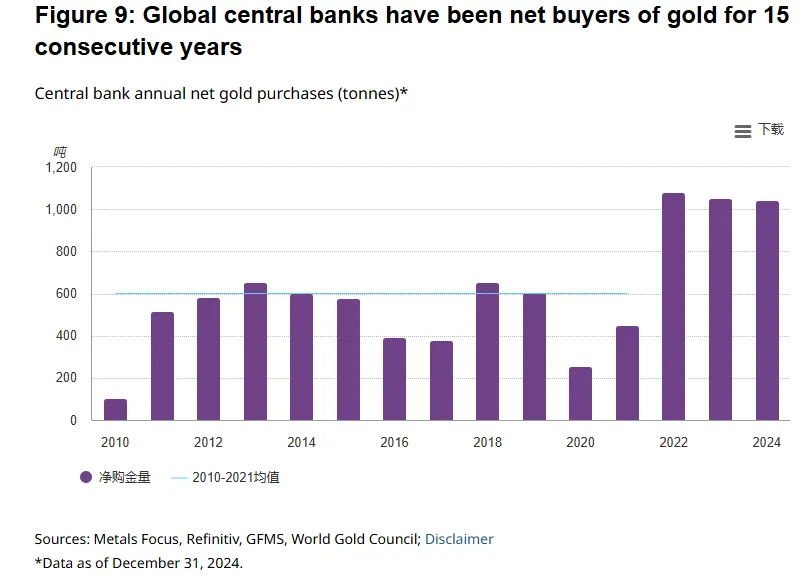

Goldman Sachs has raised its year-end gold price target to $3,300, citing that "demand from central banks and ETFs has exceeded expectations."

Goldman Sachs stated that recent ETF inflows have been unexpectedly strong, reflecting an increase in investors' demand for safe-haven assets. In addition, Goldman Sachs expects that major central banks in Asia may continue to rapidly purchase Gold over the next 3-6 years, with countries like China potentially raising their target Gold reserve ratio from the current 8% to 20-30%.

Update: Gold Edges Off a Record High as Safe-Haven Demand Remains Strong

Where Is Gold Headed After A Record Climb?

BofA Upgrades New Gold, Lifts Target by 50% on Growth Potential

Gold Trades at Another Record High as Safe-Haven Demand Remains Strong

Comments

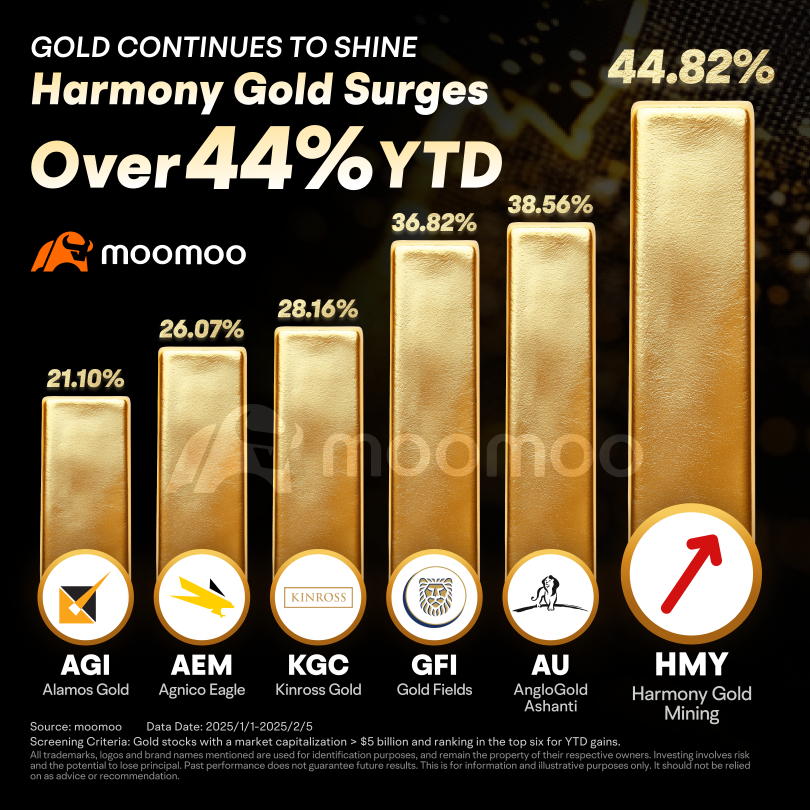

The robust performance of gold also boosts...

The increase in gold prices this year has been primarily driven by the policies implemented since Trump took office. These policies have intensified economic and geopolitical uncertainties, which in turn ha...