No Data

GLL241220C17000

- 0.45

- -0.50-52.63%

- 5D

- Daily

News

The gold price has returned to $2700, and China Construction Bank continues to raise the entry threshold for individual gold rsp, conservative and cautious customers will no longer be able to invest in this product.

On the evening of November 22, China Construction Bank Corporation announced that starting from tomorrow, it will adjust the risk rating of the Easy Gold (physical gold rsp) product to 'medium risk.' Conservative and cautious customers will not be able to carry out the aforementioned 'Easy Gold' corresponding trades.

Spot gold briefly rose above the $2,700 mark as the escalating conflict between Russia and Ukraine highlighted the appeal of safe-haven assets.

① The spot gold price is expected to achieve the largest weekly increase in over a year this week, reaching a daily high of $2700.21 per ounce; ② The situation between Russia and Ukraine has become complicated, with Russia testing a "new type of medium-range hypersonic missile"; ③ Global central bank bids have driven gold prices to rise more than 30% since the beginning of the year.

Gold Prices Rise, Set for Strong Weekly Gains on Russia-Ukraine Jitters

Gold Continues Bullish Trend, Eyes US$2,700 Mark

Risk aversion demand has "ignited" the gold bulls, causing gold prices to rise for four consecutive days!

The price of gold at $3,000 will 'look very cheap' in 3 to 4 years.

Gold will continue to shine! Commodity experts: Gold prices will hit new highs repeatedly in the first year of "Trump 2.0"!

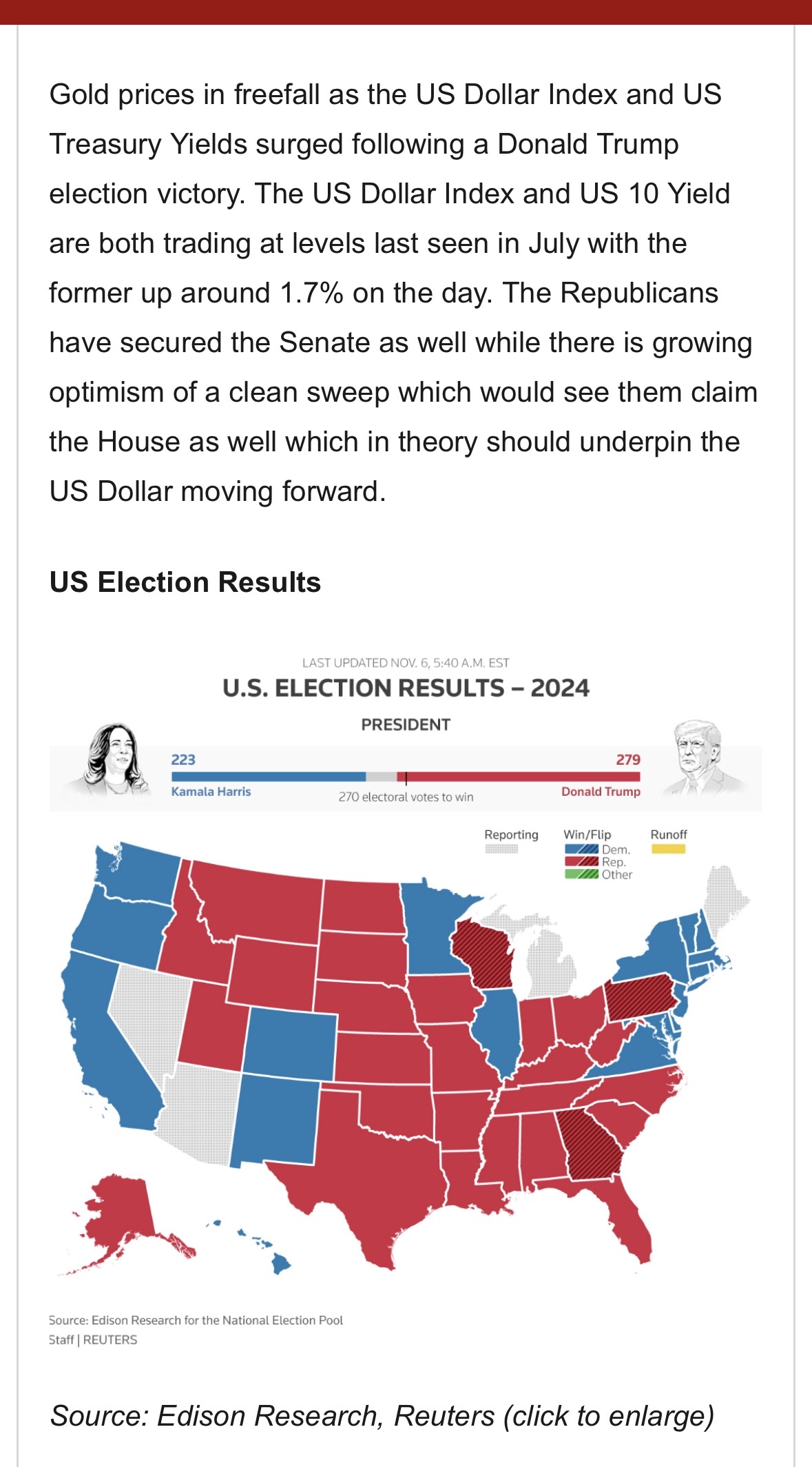

①csi commodity equity index expert Jeffrey Christian expects the price of gold to reach a new historical high by the end of January next year, as significant uncertainty in the "Trump 2.0" policy will lead investors to flock to gold and other defensive assets for safety. ②He believes that the recent decline in gold prices may be due to some investors taking profits.

Comments

$XAU/USD (XAUUSD.CFD)$

$Kamala Harris (LIST22990.US)$ $Donald Trump (LIST22962.US)$ $Trump Media & Technology (DJT.US)$ $DB GOLD DOUBLE LONG EXCH TRADED NOTES (DGP.US)$ $ProShares UltraShort Gold (GLL.US)$

sell when others are buying, buy when others are selling

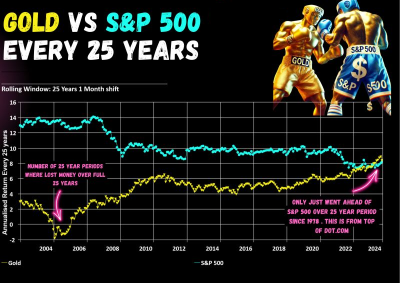

is a chance to dive into the rolling 25-year performance of Gold vs. the S&P 500 since 1978.

But here’s the kicker: no single asset class, especially not Gold, is your golden ticket to investment success. Since 1978, over any rolling 25-year period, gold has only just edged out the S&P 500 when you cherry-pick starting at the Dotcom crash and includes the GFC an...

淡定的惠特莫爾 : Will it continue to fall? Should I sell now? Hi!

172727077 : Don't be afraid, buy again at a low stock price.

淡定的惠特莫爾 172727077 : Thank you Good night

Good night

TANDOT : sell sell sell don't buy