No Data

GLNCY GLENCORE PLC

- 9.290

- +0.070+0.76%

- 8.912

- -0.378-4.07%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

European autos and mining stocks rose, boosted by Trump's comments on tariffs.

European automotive, beverage, and mining stocks rose. The Stoxx 600 basic resources Sector was one of the best-performing sectors of the day, increasing by 2.2%; at 13:39 Central European Time, the Large Cap rose by 0.4%. Rio Tinto rose by 1.7%, Anglo American rose by 0.7%, and Glencore rose by 2.2%. A softer tariff stance pressured the dollar and boosted the prices of CSI Commodity Equity Index priced in dollars. Among Auto Manufacturers, Mercedes rose by 2%, Stellantis rose by 1.7%, BMW rose by 1.9%, Volkswagen rose by 1.7%, and the parts supplier Forvia rose by 5.6%. Chemical stocks.

London Listed Miners Boosted by Rising Base Metal Prices -- Market Talk

Goldman Sachs released a tariff forecast: the possibility of the USA imposing a 10% tariff on Copper in Q1 is about 50%.

① Wall Street traders are preparing to analyze Trump's inauguration speech word by word, to determine the impact of his policies on the market; ② Goldman Sachs stated the likelihood of a 10% tariff on Copper by the USA in Q1 is 50%, which is basically consistent with Goldman Sachs' own forecast; ③ The oil market believes the likelihood of Trump imposing tariffs on oil is close to 40%, higher than Goldman Sachs' expected 15%; additionally, Goldman Sachs said the likelihood of tariffs on Gold is only 10%.

Potential Rio Tinto-Glencore Combination Considered Poor Fit, Unlikely to Happen

European stock markets have risen for the fourth consecutive week, with the FTSE 100 Index outperforming.

European stock markets have risen for four consecutive weeks, with mining stocks increasing, following reports that Rio Tinto and Glencore are discussing a merger of businesses. The United Kingdom stock market has reached a record high. The Stoxx Europe 600 Index closed up 0.7%, led by mining stocks. The FTSE 100 Index rose by 1.4%, achieving its best three-day increase since 2022, with the largest exporters benefiting from the weakness of the British Pound. Medical Care is the only sector in the European stock indices that declined, as Novo-Nordisk A/S fell following reports that the Ozempic and Wegovy weight loss drugs are targets for Insurance price negotiations. The decline in the pharmaceutical company's stock price caused its Market Cap to fall below that of the Luxury Goods leader.

UK Stocks Jump; Rio Tinto-Glencore Merger Talks Surprise

Comments

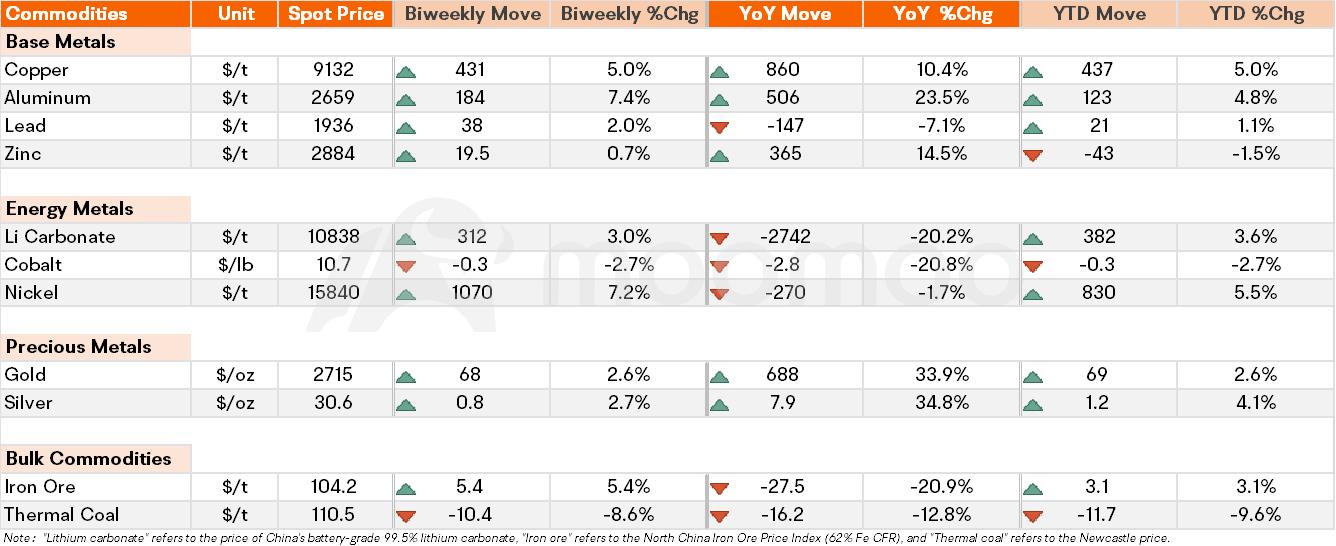

• Base metals: Aluminum prices rose to $2659 per tonne

• Energy metals: Li carbonate prices rose 3.0% in the past two weeks

• Precious metals: Gold prices rose 2.6% to $2715 per oz

• Bulk commodities: Iron ore prices rose 5.4% in the past two weeks

Spot Pri...

Raw Materials for Current Mature Technol...

1. Electric Motors: EVs use electric motors instead of engines, which require more copper for windings.

2. Batteries: The battery packs in EVs, especially lithium-ion batteries, have copper components fo...

- Production at Codelco, the world's top supplier of the red metal, fell 10.1% to 107,300 metric tons in March.

- There was another strike at MMG's large Las Bambas copper mine, one of the largest copper mines in South America.

- Glencore's copper production fell another 2% last quarter and has been declining for more than 4 years.

- Copper production at Antofagasta, a major copper mine...

Buy n Die Together❤ :