US Stock MarketDetailed Quotes

GM General Motors

- 47.030

- +0.350+0.75%

Close Mar 31 16:00 ET

- 46.760

- -0.270-0.57%

Post 20:01 ET

46.79BMarket Cap7.38P/E (TTM)

47.270High45.610Low15.88MVolume45.660Open46.680Pre Close743.97MTurnover1.60%Turnover Ratio7.38P/E (Static)995.00MShares60.94652wk High0.74P/B46.63BFloat Cap38.67652wk Low0.48Dividend TTM991.47MShs Float65.202Historical High1.02%Div YieldTTM3.56%Amplitude13.897Historical Low46.853Avg Price1Lot Size

General Motors Stock Forum

EV maker $Tesla (TSLA.US)$ is perhaps the most controversial stock in U.S financial markets right now. Sales appear to be slowing, while CEO Elon Musk's position as a Trump administration adviser has led political opponents to attack Tesla vehicles, dealerships and even some vehicle owners.

TSLA popped 11.9% on Monday (March 24), but has generally been sinking for months. What does technical and fundamental analysis say might happen next...

TSLA popped 11.9% on Monday (March 24), but has generally been sinking for months. What does technical and fundamental analysis say might happen next...

6

2

$General Motors (GM.US)$ I'm listening to the morning commentary right now. the big news this week is the 25% Auto tariffs that are taking effect April 2nd.. I didn't hear president Trump say this however in the morning commentary notes he evidently warned us automakers not to increase car prices to customers.

WTF!

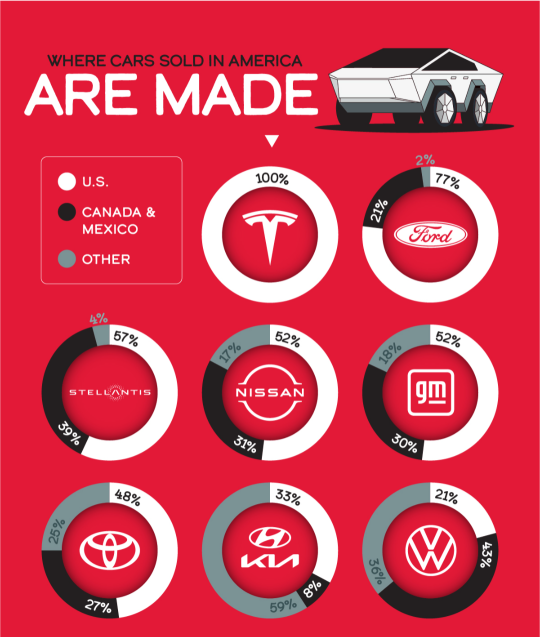

below is a chart you can see the automakers and what percentage of their business comes from overseas.

Do you actually think general motors Ford are going to eat these increases and...

WTF!

below is a chart you can see the automakers and what percentage of their business comes from overseas.

Do you actually think general motors Ford are going to eat these increases and...

4

1

$General Motors (GM.US)$ make America great again

21

• US markets: General Motors dives 7% into bear market, Ford sinks 3.9%. While Ferrari jumps 3.2% as its not expected to fare as bad amid new 25% auto tariffs.

• Aussie markets: Gold, silver hit brand new record all time highs ahead of Australian inflation data next week. Australian election date set of May 3, bringing key stocks into focus.

• Stocks to watch: GM, Ford, Ferrari, De Grey, Ramelius Resources,, ...

• Aussie markets: Gold, silver hit brand new record all time highs ahead of Australian inflation data next week. Australian election date set of May 3, bringing key stocks into focus.

• Stocks to watch: GM, Ford, Ferrari, De Grey, Ramelius Resources,, ...

From YouTube

33

2

3

The Nasdaq Composite Index, Dow Jones Industrial Average and S&P 500 all inched lower Thursday, weighed down by President Donald Trump's announcement of planned 25% tariffs on all cars made outside of the United States.

The $Nasdaq Composite Index (.IXIC.US)$ led the way lower, falling 94.98 ticks (0.5%) to 17.804.03, while the $Dow Jones Industrial Average (.DJI.US)$ shed 155.09 points (0.4%) to 42,299.70. ...

The $Nasdaq Composite Index (.IXIC.US)$ led the way lower, falling 94.98 ticks (0.5%) to 17.804.03, while the $Dow Jones Industrial Average (.DJI.US)$ shed 155.09 points (0.4%) to 42,299.70. ...

19

1

$General Motors (GM.US)$ back to $43 the $34 soon. GM is dead, can’t make profit on EV and ICE sell is down in China and around the world.

$General Motors (GM.US)$ fuk happen here

1

Gold futures hit an all-time high Thursday as President Donald Trump's new planned 25% tariffs on all foreign-built automobiles boosted uncertainty in global markets.

$Gold Futures(JUN5) (GCmain.US)$ rose as much as 1.4% Thursday morning to a $3,065.50 intraday record high for April delivery. Spot $Gold (LIST2110.US)$ also rallied.

Gold historically rises in a "flight-to-quality" move any time instability arises in world affair...

$Gold Futures(JUN5) (GCmain.US)$ rose as much as 1.4% Thursday morning to a $3,065.50 intraday record high for April delivery. Spot $Gold (LIST2110.US)$ also rallied.

Gold historically rises in a "flight-to-quality" move any time instability arises in world affair...

31

2

22

Morning Movers

Gapping Up

Shares of $Soleno Therapeutics (SLNO.US)$ surged 36.6% following the U.S. FDA's approval of VYKATTM XR for the treatment of hyperphagia in Prader-Willi Syndrome, as announced by Soleno Therapeutics.

$KE Holdings (BEKE.US)$ shares rose 3.8% following the news that its subsidiary, Beihaojia, has expanded into Changsha for the first time.

$Liberty Energy (LBRT.US)$'s shares increased by 2.9% after Morgan Stanley...

Gapping Up

Shares of $Soleno Therapeutics (SLNO.US)$ surged 36.6% following the U.S. FDA's approval of VYKATTM XR for the treatment of hyperphagia in Prader-Willi Syndrome, as announced by Soleno Therapeutics.

$KE Holdings (BEKE.US)$ shares rose 3.8% following the news that its subsidiary, Beihaojia, has expanded into Changsha for the first time.

$Liberty Energy (LBRT.US)$'s shares increased by 2.9% after Morgan Stanley...

Expand

Expand 26

4

8

No comment yet

71781791 : Here let me save you some time. T/A doesn't work on TSLA

ZnWC : This article analysed Tesla based on a car making company - focusing on EV sales. It is never complete if you ignore the other aspects such as energy storage, autonomous (FSD), robotaxi (Cybercab), robotics (Optimus) and artificial intelligence (DOJO) - Tesla is a tech company. What is the fair value of the stock will depend on what you want to believe. Read more here:

What's a Fair Valuation for Tesla (TSLA) Today?

The article also didn't mention the main reason for the delivery shortfall recently. Piper Sandler emphasized that supply constraints, rather than demand issues, are the primary factor behind the anticipated Q1 delivery shortfall. Read more here:

Piper Sandler maintains Tesla stock Overweight with $450 target - Investing