AU Stock MarketDetailed Quotes

GMG Goodman Group

- 35.490

- -0.120-0.34%

20min DelayTrading Feb 17 15:00 AET

67.84BMarket Cap-682.50P/E (Static)

35.900High35.060Low1.60MVolume35.100Open35.610Pre Close56.76MTurnover39.28052wk High0.09%Turnover Ratio1.91BShares28.08752wk Low-0.052EPS TTM61.03BFloat Cap39.280Historical HighLossP/E (Static)1.72BShs Float0.082Historical Low-0.052EPS LYR2.36%Amplitude0.30Dividend TTM3.87P/B1Lot Size0.85%Div YieldTTM

Goodman Group Stock Forum

The RBA is set to release its February monetary policy decision on February 18. The market now sees a 90% chance of a 25 basis point rate cut, which would bring the cash rate down from 4.35% to 4.10%.

If the RBA cuts rates in February, it would mark the first rate cut since the cash rate was raised to 4.35% in November 2023, and the first in over four years, signaling Australia's official entry into a rate-cutting cycle.

RBA rate cu...

If the RBA cuts rates in February, it would mark the first rate cut since the cash rate was raised to 4.35% in November 2023, and the first in over four years, signaling Australia's official entry into a rate-cutting cycle.

RBA rate cu...

+1

16

3

16

Earnings season has a tendency for some volatility. It's a good opportunity to get in lower, then sell higher, or just buy low and sit on it while it grows (hopefully!)

An old mantra is buy on the rumour, sell on the news. This is very true when applied to ASX listed stocks, especially in energy and mining.

I've said it before and will say it again..... one has to keep a close eye on Joint Ventures (JV's) and Mergers and ...

An old mantra is buy on the rumour, sell on the news. This is very true when applied to ASX listed stocks, especially in energy and mining.

I've said it before and will say it again..... one has to keep a close eye on Joint Ventures (JV's) and Mergers and ...

3

1

Top gainers: $Insignia Financial Ltd (IFL.AU)$, $Boss Energy Ltd (BOE.AU)$ and $Paladin Energy Ltd (PDN.AU)$

Top losers: $Bellevue Gold Ltd (BGL.AU)$, $Cettire Ltd (CTT.AU)$ and $Johns Lyng Group Ltd (JLG.AU)$

Australian shares edged higher on Monday, with the $S&P/ASX 200 (.XJO.AU)$ gaining 0.08% to close at 8,257.40. Investors remained cautious, mirroring Asian markets, as they await Friday's US jobs report. The...

Top losers: $Bellevue Gold Ltd (BGL.AU)$, $Cettire Ltd (CTT.AU)$ and $Johns Lyng Group Ltd (JLG.AU)$

Australian shares edged higher on Monday, with the $S&P/ASX 200 (.XJO.AU)$ gaining 0.08% to close at 8,257.40. Investors remained cautious, mirroring Asian markets, as they await Friday's US jobs report. The...

2

1

Top gainers: $Web Travel Group Ltd (WEB.AU)$, $Telix Pharmaceuticals Ltd (TLX.AU)$ and $Meridian Energy Ltd (MEZ.AU)$

Top losers: $BSP Financial Group Ltd (BFL.AU)$, $Auckland International Airport Ltd (AIA.AU)$ and $Tabcorp Holdings Ltd (TAH.AU)$

The Australian share market declined slightly on Friday, reversing the gains made earlier in this week that had led to two record highs. The $S&P/ASX 200 (.XJO.AU)$ dropped by 0...

Top losers: $BSP Financial Group Ltd (BFL.AU)$, $Auckland International Airport Ltd (AIA.AU)$ and $Tabcorp Holdings Ltd (TAH.AU)$

The Australian share market declined slightly on Friday, reversing the gains made earlier in this week that had led to two record highs. The $S&P/ASX 200 (.XJO.AU)$ dropped by 0...

4

2

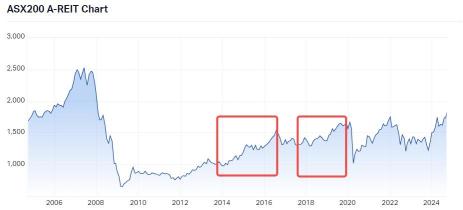

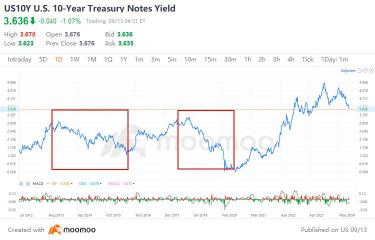

Australian Real Estate Investment Trusts (A-REITs) offer investors a way to engage in the commercial real estate market without directly holding physical property. These A-REITs own, operate, or finance a range of real estate sectors, generating income as a result.

Is it the right time to invest in A-REITs amidst US Federal Reserve rate cuts? To answer this, we need to look at three questions:

1.How is the US Fede...

Is it the right time to invest in A-REITs amidst US Federal Reserve rate cuts? To answer this, we need to look at three questions:

1.How is the US Fede...

+2

11

1

5

What's happening? Well, three things: Volatility is calming. It's as calm as a cucumber compared to last week (see below). Markets are going back to ‘business as usual.’Markets are holding their breath for Jerome Powell's signal of a Fed rate cut in September at his Jackson Hole address next week, with this week's CPI release not expected to rock the boat. For the most part,

it looks like markets...

it looks like markets...

3

2

In Australia, it's the most important week for earnings releases, with proxies and some of our biggest companies reporting this week. So, it could be hugely pivotal for markets and respective sectors, so if we get an earnings beat in Australia's biggest bank, for example, you might expect the entire banking sector and perhaps the market to move higher. The inverse is also possible, wh...

7

2

Looking back at the first half of this year, the Australian stock market performed well, with the ASX index repeatedly reaching historic highs, as investors cheered better-than-expected half-year corporate results and held high hopes for interest rate cuts later this year. As of the close on June 27th, the $S&P/ASX 200 (.XJO.AU)$, which mirrors the trend of...

13

3

G'day, mooers! Check out the latest news on today's stock market!

• Apple, Microsoft push S&P 500, Nasdaq to new highs

• ASX rises ahead of RBA decision; Fortescue falls over 4%

• Stocks to watch: Tamboran Resources, Fortescue

Wall Street Summary

The S&P 500 and Nasdaq resumed their rally to fresh all-time highs, buoyed by gains in tech giants $Apple (AAPL.US)$ and $Microsoft (MSFT.US)$.

The $S&P 500 Index (.SPX.US)$ rose to a...

• Apple, Microsoft push S&P 500, Nasdaq to new highs

• ASX rises ahead of RBA decision; Fortescue falls over 4%

• Stocks to watch: Tamboran Resources, Fortescue

Wall Street Summary

The S&P 500 and Nasdaq resumed their rally to fresh all-time highs, buoyed by gains in tech giants $Apple (AAPL.US)$ and $Microsoft (MSFT.US)$.

The $S&P 500 Index (.SPX.US)$ rose to a...

15

1

No comment yet

PAUL BIN ANTHONY : tq sir god bless your and family Amen

151878395 : Anyone know of an ETF for the 1. telecomms in Aus, 2. Materials in Aus 3. consumer staples in Aus?

151878395 : and the other sectors mentions 4,5,6?