No Data

GOOGL Alphabet-A

- 195.400

- +10.230+5.52%

- 196.970

- +1.570+0.80%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Google Launches AI Technology That Generates Text, Pictures and Audio

Alphabet's Options Volume Triples as Shares Rise After Google Unveils Quantum Chip

Options Market Statistics: Alphabet Stock Hits Record High on Google's New AI Model; Options Pop

GM shuts down autonomous driving business shareholder Microsoft (MSFT.US) charges $0.8 billion

Microsoft expects to accrue about $0.8 billion in impairment charges related to GM Cruises in the second fiscal quarter.

Microsoft lost approximately $0.8 billion due to Cruise investment

Microsoft said on Wednesday that it expects to accrue impairment charges of about 0.8 billion US dollars in the second fiscal quarter, related to the company's minority investment in Cruise, an autonomous driving company owned by GM. The day before, GM said it would no longer fund this business because it was too expensive to develop this technology and set up a fleet. Microsoft announced a minority investment in Cruise in January 2021 as part of a $2 billion investment in the autonomous vehicle startup, which is mostly owned by GM. The move enabled Microsoft to take over the emerging connected car services market

The NASDAQ broke through 0.02 million points for the first time, Tesla led a group of tech giants to a new high, and Bitcoin climbed to 0.1 million dollars

The Dow and Apple fell, the Nasdaq rose nearly 2%, Tesla and Google rose nearly 6%, while Meta, Amazon, and Netflix all reached new highs. NVIDIA rose over 3%, Broadcom rose nearly 7%, Super Micro Computer once dropped over 8%, the decline of Chinese concepts narrowed, and Fangdd Network turned to rise over 11%. The U.S. November CPI confirms interest rate cut bets for next week, with a pause on rate cuts expected in January next year. The dollar and U.S. Treasury yields rebounded in a V-shape, while spot Gold reached its highest level in five weeks. The yen plunged below 152, while the offshore yuan once dropped over 300 points, falling below 7.29 yuan. After a significant interest rate cut by the Bank of Canada, the Canadian dollar and Canadian bond yields turned to rise, and oil prices increased by about 2%.

Comments

NASDAQ rose 1.77% to finish Wednesday's session at 20,035, while the S&P 500 added 0.82% to close just shy of a new high. The Russell 2000 gained 0.6% while DJIA closed 0.22% lower after giving back earlier gains.

U.S. stocks were coming off of two s...

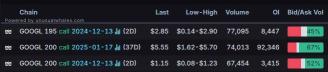

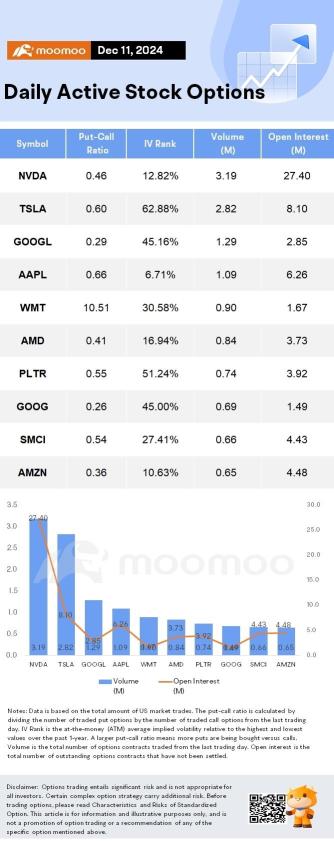

1. $Alphabet-A (GOOGL.US)$ shares closed at its highest level on record Wednesday, with the most traded calls are contracts of $195 strike price that expire on Dec. 13. The total volume reaches 77,095 with the open interest of 8,447.

The Google parent announced its Gemini 2.0 model and some of the projects that will come with it. Alphabet said that developers will be the first to have a...

Congrats to investors who have held on to their good quality stocks for the last few years. Most of them should be giving you decent paper profits now.

Big tech stocks such as Google and Tesla rose more than 5%, pushing Nasdaq to yet another all time high.

What a time to be invested in the stock market!

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $Tesla (TSLA.US)$ $Alphabet-A (GOOGL.US)$ $NVIDIA (NVDA.US)$ $Apple (AAPL.US)$ $Amazon (AMZN.US)$ $Netflix (NFLX.US)$ $Microsoft (MSFT.US)$ $Meta Platforms (META.US)$ $Palantir (PLTR.US)$ $Super Micro Computer (SMCI.US)$ $MicroStrategy (MSTR.US)$

it is a good sign and momentum will continue , just hold tide ur ticket and enjoy the ride