No Data

GS241129P470000

- 0.01

- 0.000.00%

- 5D

- Daily

News

Goldman Sachs: Rates Hua Hong Semiconductor as a "buy", with a target price of 31.3 Hong Kong dollars.

Goldman Sachs released a research report stating that the target price for hua hong semi (01347) is 31.3 Hong Kong dollars, with a "buy" rating. The hua hong management is optimistic about the demand for all major products in 2025 and expects strong performance this year (CIS, RF, PMIC) to continue strong momentum next year, with the microcontroller unit (MCU) and power discrete devices seeing a recovery. The report mentions that hua hong's phase-two 12-inch wafer fab is scheduled to start production in the first quarter of 2025, and the company will gradually increase production and adjust the pace according to market demand. The group expects pricing for existing wafer fabs to remain stable due to

Wall Street macro traders see worst annual performance since the epidemic outbreak.

Global banks' forex and interest rate trading revenue is expected to hit the lowest level since the pandemic, influenced by narrowing profit margins and a challenging macroeconomic environment. According to data collected by Coalition Greenwich, Goldman Sachs, JPMorgan, Citigroup, Morgan Stanley, and over 250 other companies' G-10 interest rate trading is projected to collectively generate 32 billion USD in revenue, while forex trading revenue is expected to be 16.7 billion USD, representing year-on-year reductions of approximately 17% and 9%, respectively. Investor confidence in making significant macro trading views has declined this year, as unexpected economic data has undermined expectations of interest rate cuts from major global central banks.

Goldman Sachs To Go Ex-Dividend On December 2nd, 2024 With 3 USD Dividend Per Share

Behind the influx of hedge funds into japanese companies is the undervalued real estate worth 165 billion dollars.

Global hedge funds and private equity firms are flocking to Japanese companies in hopes of unlocking up to 25 trillion yen (165 billion USD) in undervalued real estate assets. The hidden value of real estate on corporate balance sheets has become a theme behind some large activist investor actions and merger and acquisition trades that have emerged in Japan this year. The latest case is the USA company Elliott Investment Management announcing that it holds 5.03% of Tokyo Gas shares, with reports last week estimating that Elliott values the latter's real estate investment portfolio at around 1.5 trillion yen — almost.

Wednesday Ends With Index Decline | Wall Street Today

Decoding Goldman Sachs Gr's Options Activity: What's the Big Picture?

Comments

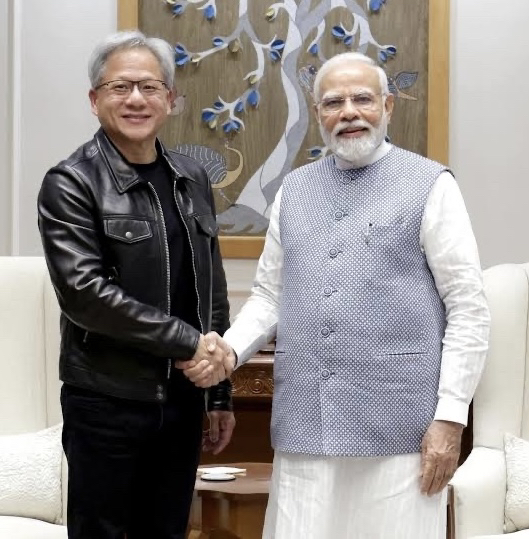

Masayoshi son meeting Modi on 27th November 🤝

.

DOCUMENTATION 📄 BEATS SPECULATION 🧐 AND CONVERSATION 🗣

Pullbacks corrections retracements are normal - Don’t let FUD, market manipulation, sell offs, propaganda, or normal ebbs and flows of the market trick you out of your position.

.

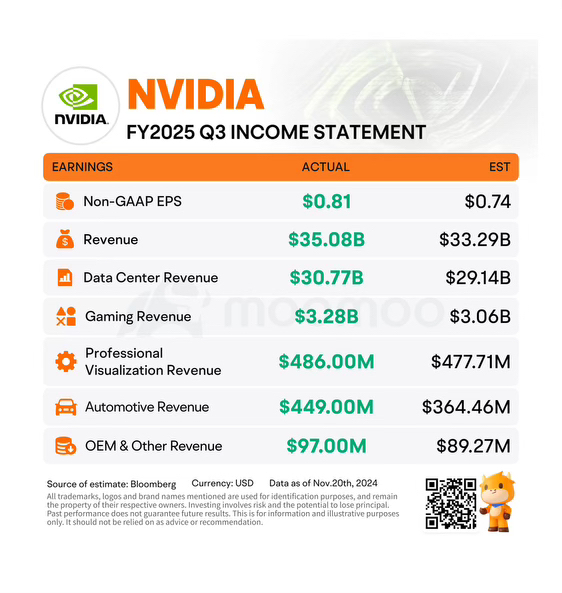

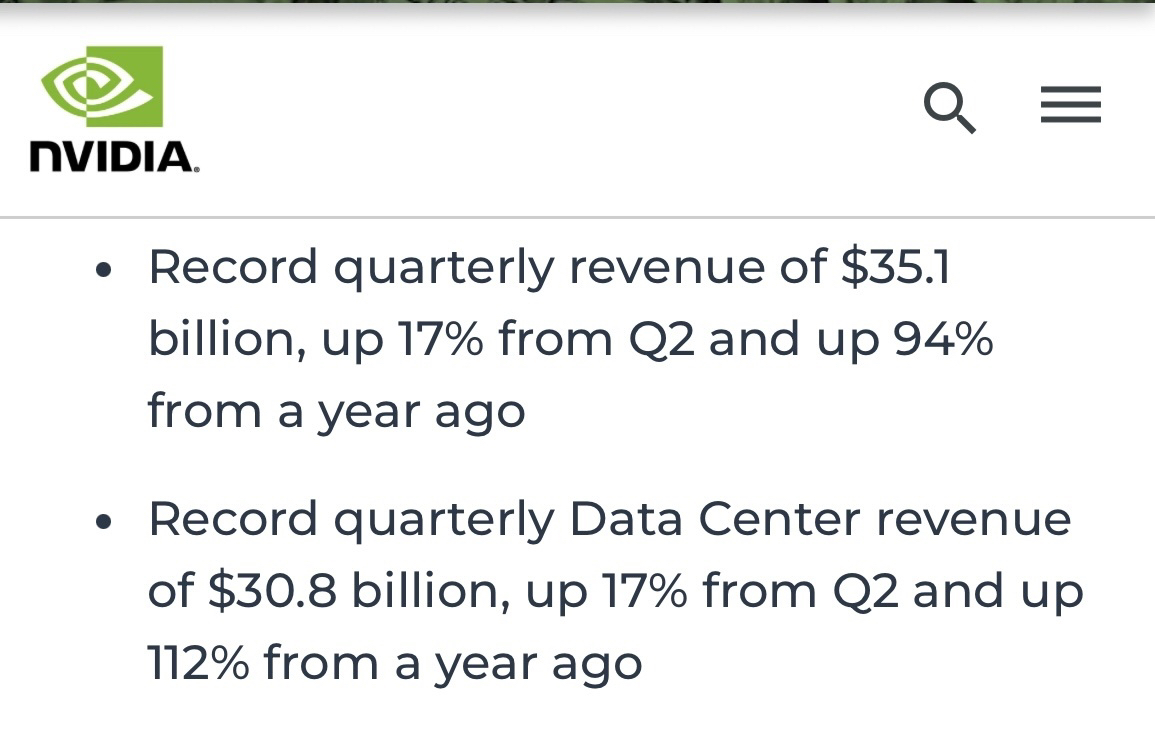

Most People Don’t Know This About $NVIDIA (NVDA.US)$

Nvidia ...

Analysts predict Trump's second-term policies could echo his first, but with a swifter pace and more assertive domestic and foreign agendas. Expectations are for a stronger application of the "A...

Geriatric old white dudes don't have any idea what tech does anymore.

If you have a 401k, make sure you're hedging against major banks failing because they're doomed. You're high if you think ppl will open a Wells Fargo account when you can spend 5 minutes and not only have a cash app account or chime account but with competitive APY, 24/7, anywhere, and no fees.

$Goldman Sachs (GS.US)$

$Block (SQ.US)$

$Dave Inc (DAVE.US)$ �...

DOCUMENTATION 📄 BEATS SPECULATION 🧐 AND CONVERSATION 🗣

Pullbacks corrections retracements are normal - Don’t let FUD, market manipulation, sell offs, propaganda, or normal ebbs and flows of the market trick you out of your position.

.

Most People Don’t Know This About $NVIDIA (NVDA.US)$

Nvidia has never been beaten by high end graphi...

However, tariff impacts could raise the rate to 2.4%. While tariff hikes and immigration policies may drag on early 2025 growth, long-term tax cuts could bolster consumption and investment.

$S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Donald Trump (LIST22962.US)$ $Trump Media & Technology (DJT.US)$

Game Over

Game Over

Coach Donnie OP : Abundant Arisings and Beautiful

and Beautiful  Blessings Freedom Fam

Blessings Freedom Fam

Improve Your MONEY MINDSET…

Improve Your MONEY MINDSET…

It’s Wisdom & Wealth Wednesday aka Wealthy Women’s Wednesday

so it’s time

MINDSET > money

Want more Money

ONLY is a powerful tool

I’m ONLY earning $5 million a month

…Seldom will I make as much as

Never will I earn more than

The amount I allow myself to think of as “a lot of money”

If you desire to earn 6 7 or 8 figures

You can’t afford to think that’s a lot of Money

Even BEFORE you start making earning or attracting a lot of money you’ve gotta minimize it

So your subconscious can realize it’s very doable

When you make it small you make YOU BIGGER than it

Then it can become YOURS

#CoachDonnie

Coach Donnie OP : $NVIDIA (NVDA.US)$ This stock, at the current price, fillowing the EPS trend and demand, will likely to get a PE ratio of 32 next year, so no reason to worry... At 170 next year, look for EPS projection again then decide whether to sell if at all. Also pay attention to macroeconomy, when GDP rate gets low and jobless/debt explode, people can exit the market.

This stock, at the current price, fillowing the EPS trend and demand, will likely to get a PE ratio of 32 next year, so no reason to worry... At 170 next year, look for EPS projection again then decide whether to sell if at all. Also pay attention to macroeconomy, when GDP rate gets low and jobless/debt explode, people can exit the market.

Kind Pumpkin : good buy

Coach Donnie OP Kind Pumpkin : You’re a WWW a Wise Woman of Wealth

Coach Donnie OP : $NVIDIA (NVDA.US)$ Stop worrying, it's Nvidia!!! collect your profit. Do you think the best company in the world is going to stay in the low to mid 100s

collect your profit. Do you think the best company in the world is going to stay in the low to mid 100s

If so you must be

If so you must be

Don't look for instant gratification.

Accumulate on the dips and when it Rockets