No Data

GS241213P455000

- 3.10

- 0.000.00%

- 5D

- Daily

News

Ormat Technologies' Secondary Share Offering Priced

Express News | Goldman Sachs : RBC Raises Target Price to $610 From $558

Goldman Sachs: Maintains TUHU-W "Buy" rating, with the Target Price raised to HKD 24.5.

Goldman Sachs released a research report stating that it maintains a "Buy" rating for TUHU-W (09690), with the Target Price raised by 8.8% from HKD 22.5 to HKD 24.5. The bank expects that TUHU, as China's largest integrated online and offline Car Service platform, will enjoy sustained operational leverage and efficiency improvements, thereby reducing operating expense ratios. Coupled with an improvement in gross margin, this is expected to lead to years of operational profit expansion, with a projected compound annual growth rate of net profit of 35% from 2023 to 2026. Goldman Sachs believes that TUHU is the largest independent Automotive Aftermarket (IAM) supplier in China, leveraging its lower and more transparent pricing and revenue-generating capabilities.

Regulations on Cryptos in the USA are expected to loosen, but major Wall Street banks remain cautious.

Despite the expectation of regulatory loosening, Bank of America bankers remain cautious about Cryptos.

Trump is reportedly set to ring the bell at the NYSE today. What does it signify?

① According to media reports, the USA's incoming president Trump will go to the NYSE on Thursday to ring the opening bell and deliver a speech; ② There are reports that Trump will be named Time Magazine's Person of the Year for 2024, but this has not yet been confirmed by Time; ③ Since Trump's announcement of victory, the three major US stock indices have risen repeatedly, with the market encouraged by promises of tax cuts and deregulation.

The central parity rate of the RMB against the US dollar is reported at 7.1854, down by 11 points.

On December 12, the middle exchange rate of the RMB against the USD was reported at 7.1854, down 11 points. The CPI in the USA for November recorded the largest increase in seven months, but it is unlikely to prevent the Federal Reserve from lowering interest rates next week. The consumer price index in the USA for November recorded the largest increase in seven months, but against the backdrop of a cooling job market, this is unlikely to prevent the Federal Reserve from lowering rates for the third time next week. Data shows that last month the CPI increased by 0.3% month-on-month, the largest increase since April, following a continuous increase of 0.2% over the previous four months. The year-on-year CPI growth rate increased to 2.7% after rising to 2.6% in October.

Comments

Masayoshi son meeting Modi on 27th November 🤝

.

DOCUMENTATION 📄 BEATS SPECULATION 🧐 AND CONVERSATION 🗣

Pullbacks corrections retracements are normal - Don’t let FUD, market manipulation, sell offs, propaganda, or normal ebbs and flows of the market trick you out of your position.

.

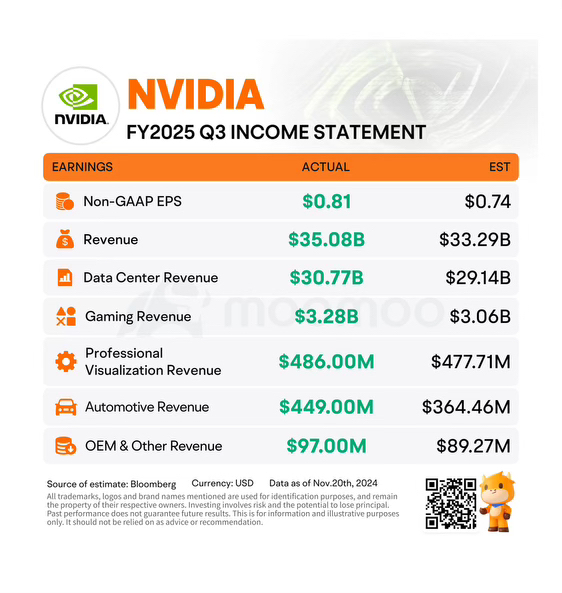

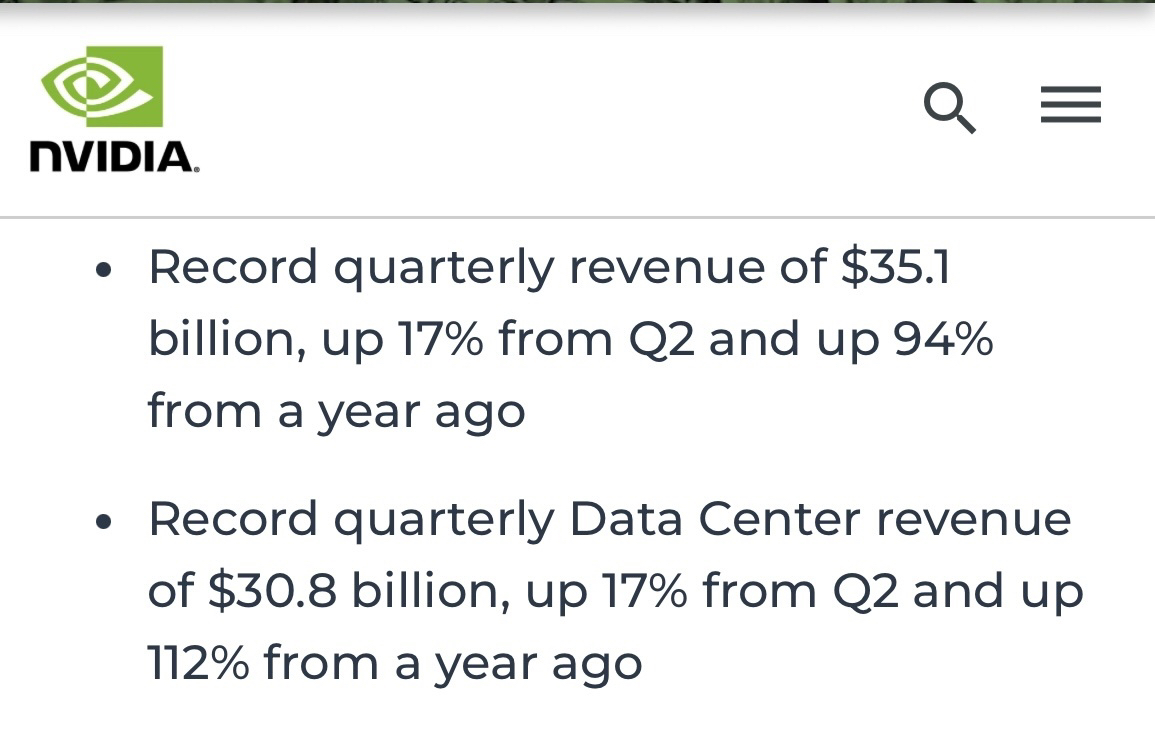

Most People Don’t Know This About $NVIDIA (NVDA.US)$

Nvidia ...

Analysts predict Trump's second-term policies could echo his first, but with a swifter pace and more assertive domestic and foreign agendas. Expectations are for a stronger application of the "A...

Geriatric old white dudes don't have any idea what tech does anymore.

If you have a 401k, make sure you're hedging against major banks failing because they're doomed. You're high if you think ppl will open a Wells Fargo account when you can spend 5 minutes and not only have a cash app account or chime account but with competitive APY, 24/7, anywhere, and no fees.

$Goldman Sachs (GS.US)$

$Block (SQ.US)$

$Dave Inc (DAVE.US)$ �...

DOCUMENTATION 📄 BEATS SPECULATION 🧐 AND CONVERSATION 🗣

Pullbacks corrections retracements are normal - Don’t let FUD, market manipulation, sell offs, propaganda, or normal ebbs and flows of the market trick you out of your position.

.

Most People Don’t Know This About $NVIDIA (NVDA.US)$

Nvidia has never been beaten by high end graphi...

However, tariff impacts could raise the rate to 2.4%. While tariff hikes and immigration policies may drag on early 2025 growth, long-term tax cuts could bolster consumption and investment.

$S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Donald Trump (LIST22962.US)$ $Trump Media & Technology (DJT.US)$

Game Over

Game Over

Coach Donnie OP : Abundant Arisings and Beautiful

and Beautiful  Blessings Freedom Fam

Blessings Freedom Fam

Improve Your MONEY MINDSET…

Improve Your MONEY MINDSET…

It’s Wisdom & Wealth Wednesday aka Wealthy Women’s Wednesday

so it’s time

MINDSET > money

Want more Money

ONLY is a powerful tool

I’m ONLY earning $5 million a month

…Seldom will I make as much as

Never will I earn more than

The amount I allow myself to think of as “a lot of money”

If you desire to earn 6 7 or 8 figures

You can’t afford to think that’s a lot of Money

Even BEFORE you start making earning or attracting a lot of money you’ve gotta minimize it

So your subconscious can realize it’s very doable

When you make it small you make YOU BIGGER than it

Then it can become YOURS

#CoachDonnie

Coach Donnie OP : $NVIDIA (NVDA.US)$ This stock, at the current price, fillowing the EPS trend and demand, will likely to get a PE ratio of 32 next year, so no reason to worry... At 170 next year, look for EPS projection again then decide whether to sell if at all. Also pay attention to macroeconomy, when GDP rate gets low and jobless/debt explode, people can exit the market.

This stock, at the current price, fillowing the EPS trend and demand, will likely to get a PE ratio of 32 next year, so no reason to worry... At 170 next year, look for EPS projection again then decide whether to sell if at all. Also pay attention to macroeconomy, when GDP rate gets low and jobless/debt explode, people can exit the market.

Kind Pumpkin : good buy

Coach Donnie OP Kind Pumpkin : You’re a WWW a Wise Woman of Wealth

Coach Donnie OP : $NVIDIA (NVDA.US)$ Stop worrying, it's Nvidia!!! collect your profit. Do you think the best company in the world is going to stay in the low to mid 100s

collect your profit. Do you think the best company in the world is going to stay in the low to mid 100s

If so you must be

If so you must be

Don't look for instant gratification.

Accumulate on the dips and when it Rockets

View more comments...