No Data

GS250103P580000

- 0.93

- -6.33-87.19%

- 5D

- Daily

News

Goldman Sachs: It is expected that Iran's oil supply will decline before Q2, with Brent crude oil projected to reach $78 in June.

Goldman Sachs predicted on Friday that Iran's crude oil production will decrease slightly. The investment bank's base forecast is that by the second quarter of 2025, Iran's crude oil supply will drop by 0.3 million barrels per day to 3.25 million barrels per day. Analysts also predict that the benchmark Brent crude oil will reach a peak of $78 per barrel in June. Goldman Sachs stated in a research report: "Although we believe there is a risk of a decline in Iranian production compared to current levels and our forecast, we still maintain our basic expectation that Iranian crude oil production will drop to 3.25 million barrels per day in the second quarter of 2025." Goldman Sachs expects Iran's oil exports to continue to decline. Goldman Sachs stated.

Santa Clause Came and Went Without Bringing Gifts | Weekly Buzz

Goldman Sachs's Alex Golten Appointed to Chief Risk Officer

Friday? More Like Grinch Day | Wall Street Today

Investing in Goldman Sachs Group (NYSE:GS) Five Years Ago Would Have Delivered You a 168% Gain

Gold's Rally Continues Following Biggest Yearly Gain Since 2010

Comments

Tax-Loss Harvesting: Investors often sell off underperf...

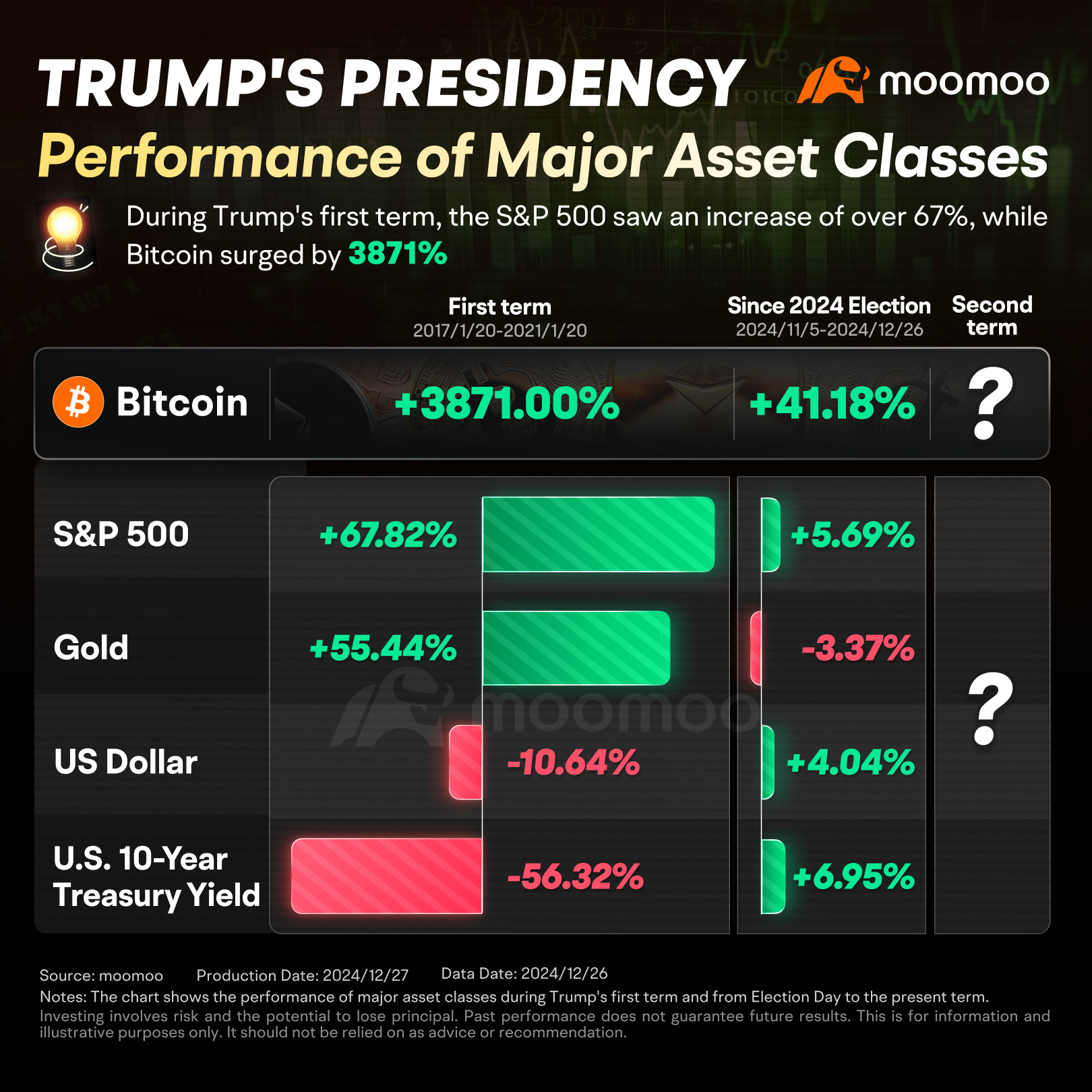

Since Election Day on November 5, 2024, up to December 26, 2024, the S&P 5...

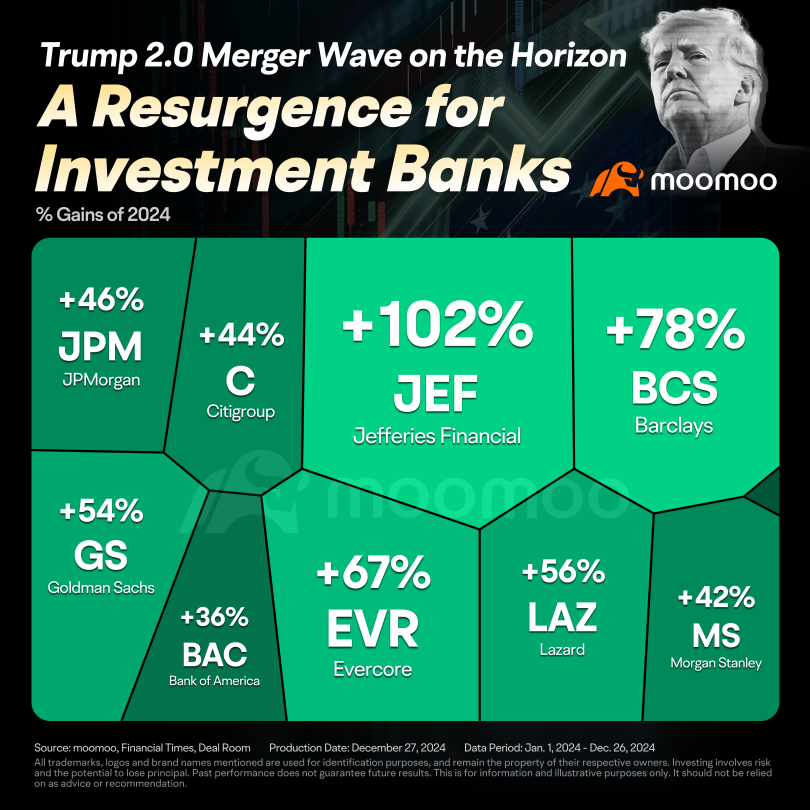

M&A activity is already showing signs of recovery. According to Dealogic, announced M&A deals in 2024 surpassed $1.4 trillion, up from $1.32 trillion in 2023, though slightly bel...

🎯 Here's my strategic blueprint:

Tap into AI & Energy Opportunities: Focus on stocks like $Tesla (TSLA.US)$, $NVIDIA (NVDA.US)$ for AI leadership and $Exxon Mobil (XOM.US)$ for energy resilience. 🛠️⚡

Embrace Trump 2.0: Expect regulatory ease & tax cuts to boost finances. 🏛️💰 $Goldman Sachs (GS.US)$ $JPMorgan (JPM.US)$

Small-Caps Strategy:

Buy $AST SpaceMobile (ASTS.US)$ , $Jumia Technologies (JMIA.US)$ , $indie Semiconductor (INDI.US)$ , ...

Buy n Die Together❤ :

103575541 :

104088143 : What happened?