US Stock MarketDetailed Quotes

HBM Hudbay Minerals

- 7.754

- -0.246-3.08%

Trading Mar 28 12:03 ET

3.06BMarket Cap38.77P/E (TTM)

8.000High7.670Low2.34MVolume7.980Open8.000Pre Close18.28MTurnover0.65%Turnover Ratio38.77P/E (Static)394.94MShares10.47052wk High1.20P/B2.80BFloat Cap6.41552wk Low0.02Dividend TTM360.52MShs Float26.647Historical High0.19%Div YieldTTM4.12%Amplitude0.677Historical Low7.812Avg Price1Lot Size

Hudbay Minerals Stock Forum

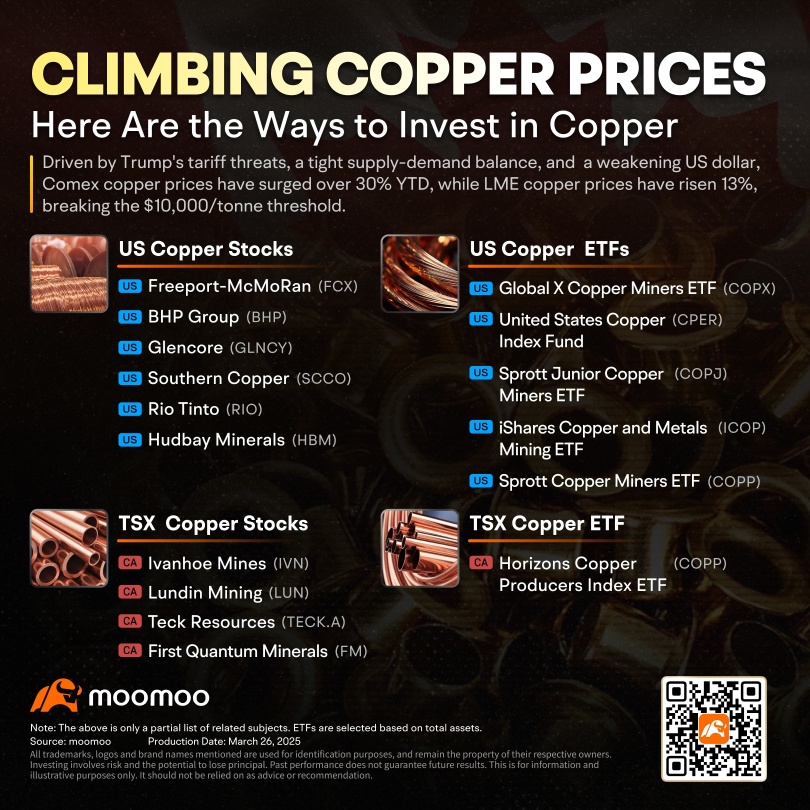

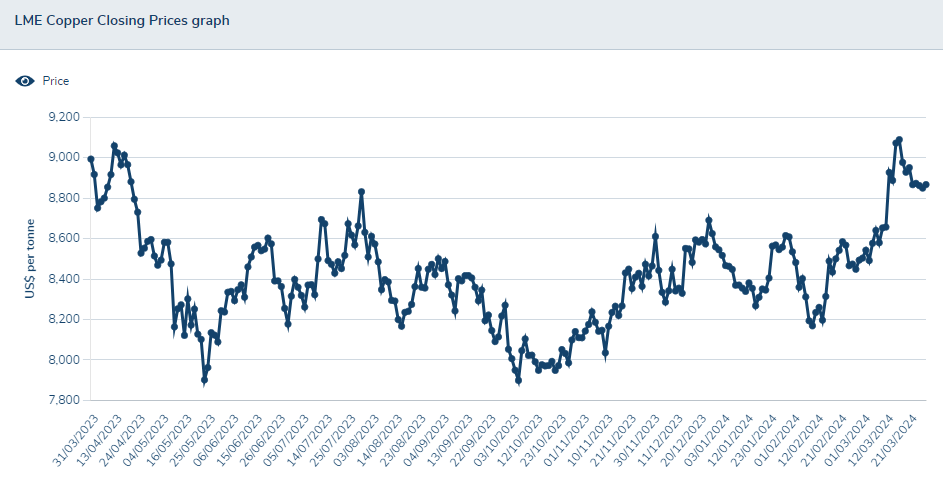

$Copper Futures(MAY5) (HGmain.US)$ on New York's Comex exchange soared to unprecedented levels, driven by market anticipation of significant import tariffs on this vital industrial metal.

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. Copper minin...

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. Copper minin...

6

1

3

$Copper Futures(MAY5) (HGmain.US)$ on New York's Comex exchange soared to unprecedented levels, driven by market anticipation of significant import tariffs on this vital industrial metal.

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. ...

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. ...

9

1

$Copper Futures(MAY5) (HGmain.US)$ on New York's Comex exchange soared to unprecedented levels, driven by market anticipation of significant import tariffs on this vital industrial metal.

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. Copper minin...

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. Copper minin...

18

1

22

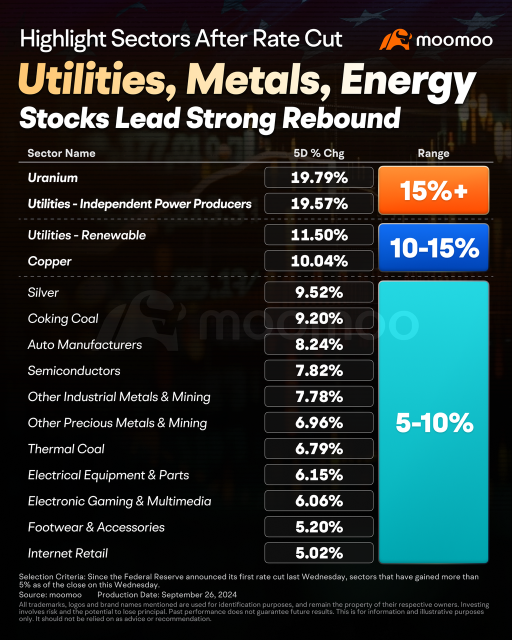

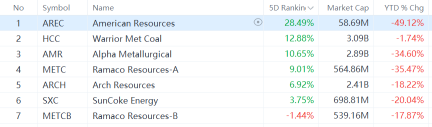

US stocks surged last week, driven by easing policies. The Federal Reserve cut interest rates by 50 basis points last Wednesday, its first reduction in four years. On Tuesday, China's central bank announced significant rate cuts and several financial support measures.

In the week following the Fed’s rate cut, utilities, metals, and energy stocks led gains in the US market. $Utilities - Independent Power Producers (LIST2462.US)$ and �����...

In the week following the Fed’s rate cut, utilities, metals, and energy stocks led gains in the US market. $Utilities - Independent Power Producers (LIST2462.US)$ and �����...

+5

30

2

18

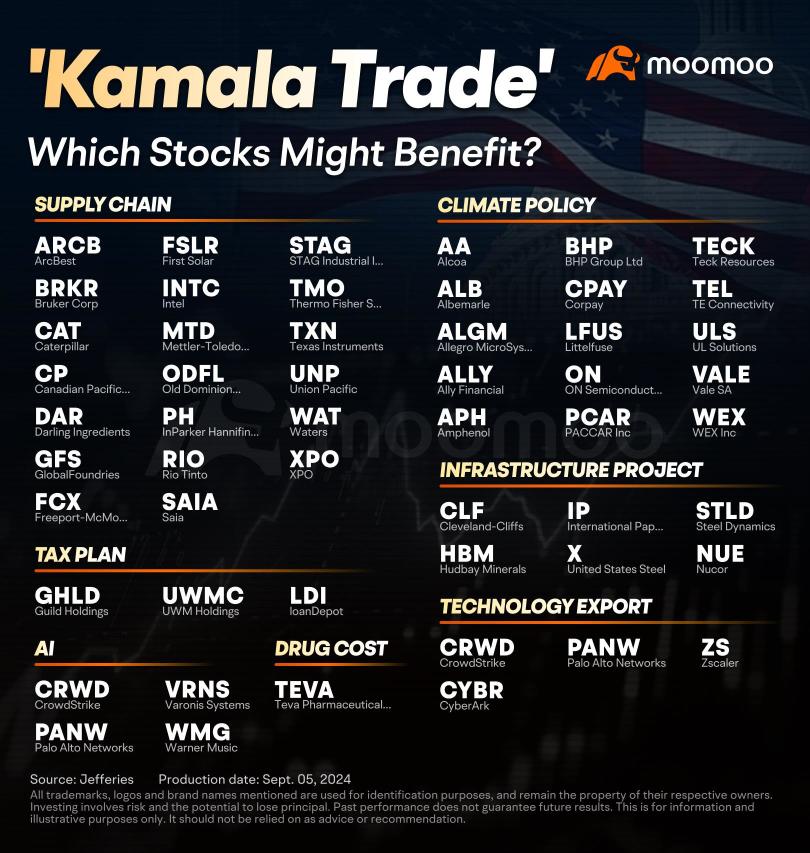

The 2024 U.S. presidential race between former President Donald Trump and current Vice President Kamala Harris is still "incredibly close," according to the latest New York Times survey. As investors await the outcome of the November election, equity analysts are busy parsing through the candidates' pronouncements for clues on which stocks could benefit from their policies.

Jefferies analysts cited 10 possible policies that Tr...

Jefferies analysts cited 10 possible policies that Tr...

31

8

43

In a report released on May 29, from RBC Capital maintained a Buy rating on $Hudbay Minerals (HBM.US)$ , with a price target of C$18.00. The company’s shares closed yesterday at $9.77.

Crittenden covers the Basic Materials sector, focusing on stocks such as $FIRST QUANTUM MINERALS (FQVLF.US)$ & $Hudbay Minerals (HBM.US)$ . According to Crittenden has an average return of 24.7% and a 63.04% success rate on recommended stocks.

The word on The Street in general, suggests a Strong Buy anal...

Crittenden covers the Basic Materials sector, focusing on stocks such as $FIRST QUANTUM MINERALS (FQVLF.US)$ & $Hudbay Minerals (HBM.US)$ . According to Crittenden has an average return of 24.7% and a 63.04% success rate on recommended stocks.

The word on The Street in general, suggests a Strong Buy anal...

3

1

2

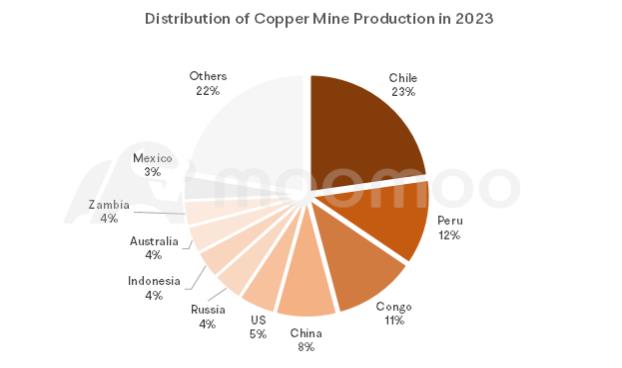

Bank of America's commodities team forecasts a strong copper market due to high demand from energy transitions and limited supply. They have also grown significantly optimistic about gold, expecting its price to be propelled by central banks, Chinese investors, Western macroeconomic influences, and the anticipated conclusion of interest rate increases. They predict gold could reach $3,000 per ounce by the end of 2025, ...

38

4

41

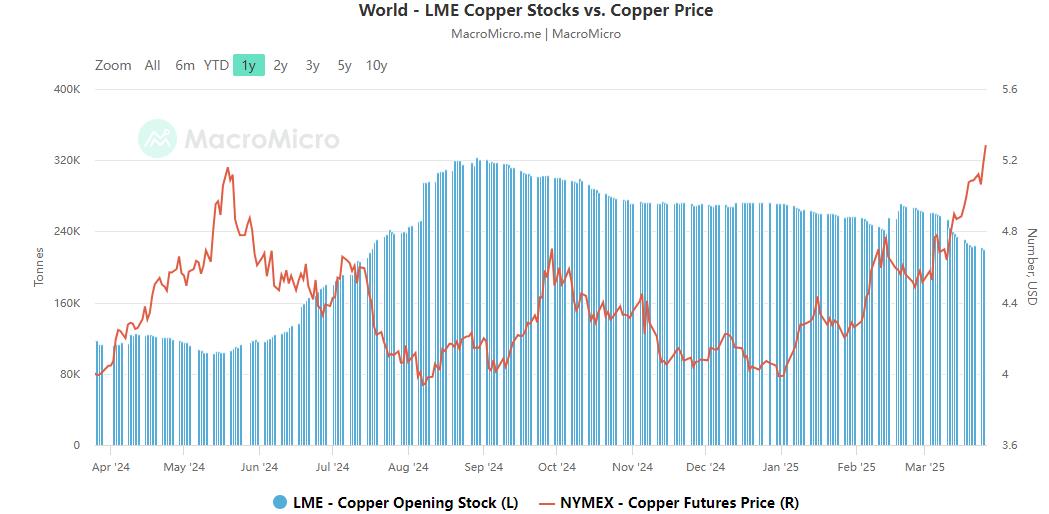

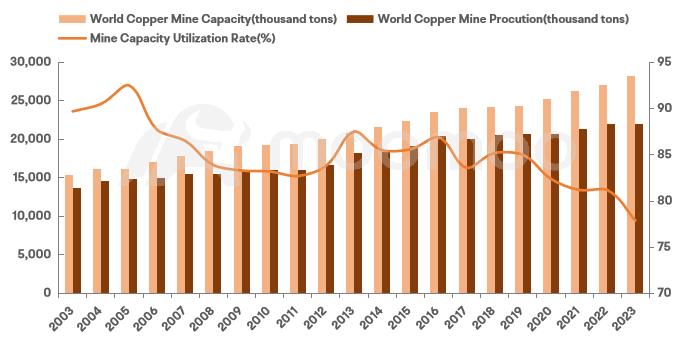

Since the fourth quarter of 2023, the global copper mining industry has experienced multiple supply disruptions, with recent news of planned production cuts by Chinese smelters intensifying market unease. Supported by expectations of a tight supply, $Copper Futures(MAY5) (HGmain.US)$ prices have been fluctuating with an upward trend since the end of October last year, and have recently seen an accelerated increase. Since March, g...

+4

13

2

8

Micron Technology has begun mass production of high-bandwidth memory (HBM) for NVIDIA's latest artificial intelligence chip. Micron Technology's HBM3E products will reportedly be supplied to NVIDIA and will be used in NVIDIA's H200 Tensor Core GPU, which is expected to begin shipping in the second quarter.

"Micron Technology has achieved the trifecta with this HBM3E milestone: time-to-market leadership, b...

"Micron Technology has achieved the trifecta with this HBM3E milestone: time-to-market leadership, b...

7

1

No comment yet

151425825 : New low, bring back Ivan Glasenberg as chair of board, Gary Nagle and crew brought Teck at the top of the cycle and only looked at selling out (woke culture). Need some mercenaries back at the top.