US Stock MarketDetailed Quotes

HCC Warrior Met Coal

- 56.250

- +0.610+1.10%

Close Jan 23 16:00 ET

- 55.500

- -0.750-1.33%

Post 16:55 ET

2.94BMarket Cap7.75P/E (TTM)

58.105High55.600Low707.05KVolume55.600Open55.640Pre Close39.98MTurnover1.38%Turnover Ratio6.11P/E (Static)52.31MShares75.33752wk High1.41P/B2.89BFloat Cap49.97052wk Low0.31Dividend TTM51.38MShs Float75.337Historical High0.55%Div YieldTTM4.50%Amplitude5.605Historical Low56.542Avg Price1Lot Size

Warrior Met Coal Stock Forum

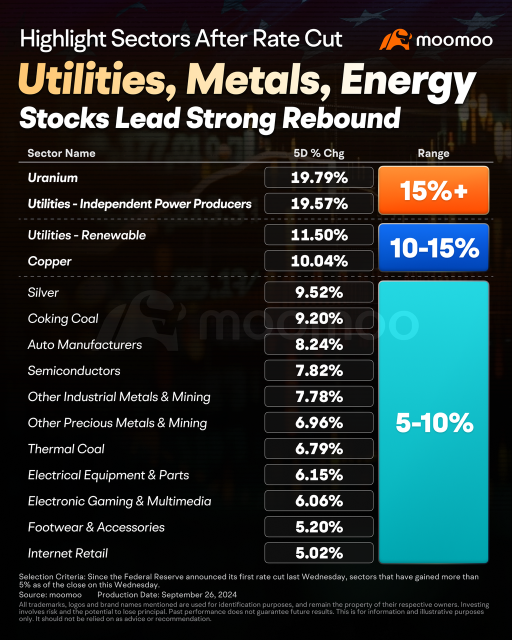

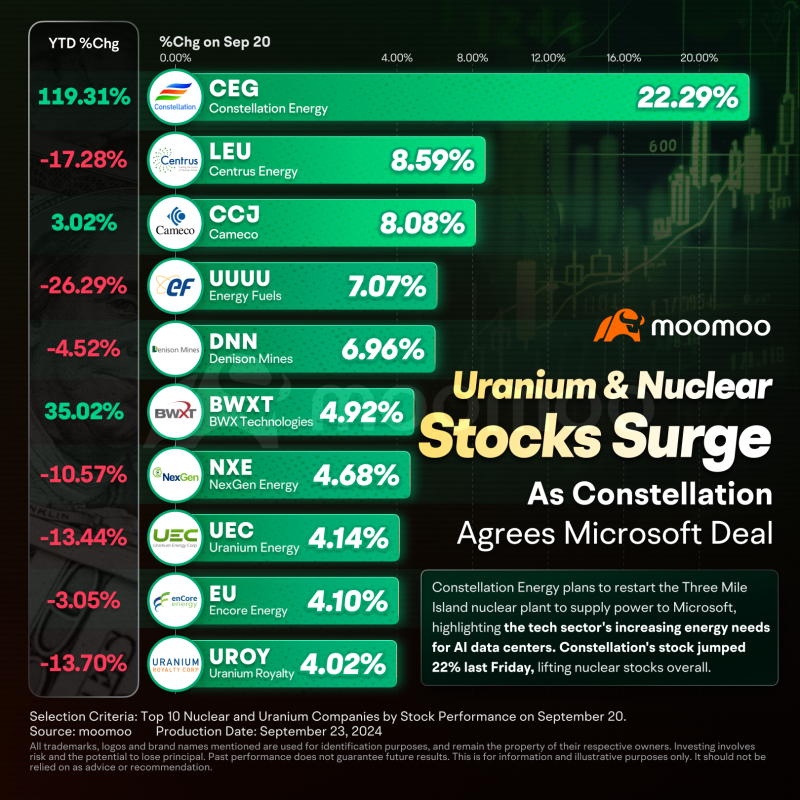

US stocks surged last week, driven by easing policies. The Federal Reserve cut interest rates by 50 basis points last Wednesday, its first reduction in four years. On Tuesday, China's central bank announced significant rate cuts and several financial support measures.

In the week following the Fed’s rate cut, utilities, metals, and energy stocks led gains in the US market. $Utilities - Independent Power Producers (LIST2462.US)$ and �����...

In the week following the Fed’s rate cut, utilities, metals, and energy stocks led gains in the US market. $Utilities - Independent Power Producers (LIST2462.US)$ and �����...

+5

30

2

18

MAYDAY!!!

🤣 hahaha, my favorite gif 🤣

🎵 Here's where the story ends

It's that little souvenir of a terrible year

Which makes my eyes feel sore

It's that little souvenir of a terrible year

Surprise, surprise, surprise 🎵

I'm going to try and get a post out. I'm really uncomfortable and sore, but there are some big moves and big news ahead.

A little Sundays to start the day

As I said, I'm fresh out of the hospital again. I've been oversleeping and much too tired 😫. I feel gu...

🤣 hahaha, my favorite gif 🤣

🎵 Here's where the story ends

It's that little souvenir of a terrible year

Which makes my eyes feel sore

It's that little souvenir of a terrible year

Surprise, surprise, surprise 🎵

I'm going to try and get a post out. I'm really uncomfortable and sore, but there are some big moves and big news ahead.

A little Sundays to start the day

As I said, I'm fresh out of the hospital again. I've been oversleeping and much too tired 😫. I feel gu...

loading...

21

4

3

A quick post. I was working on a longer one but i threw my back out and so i covered myself in icy hot and fell asleep 🤣

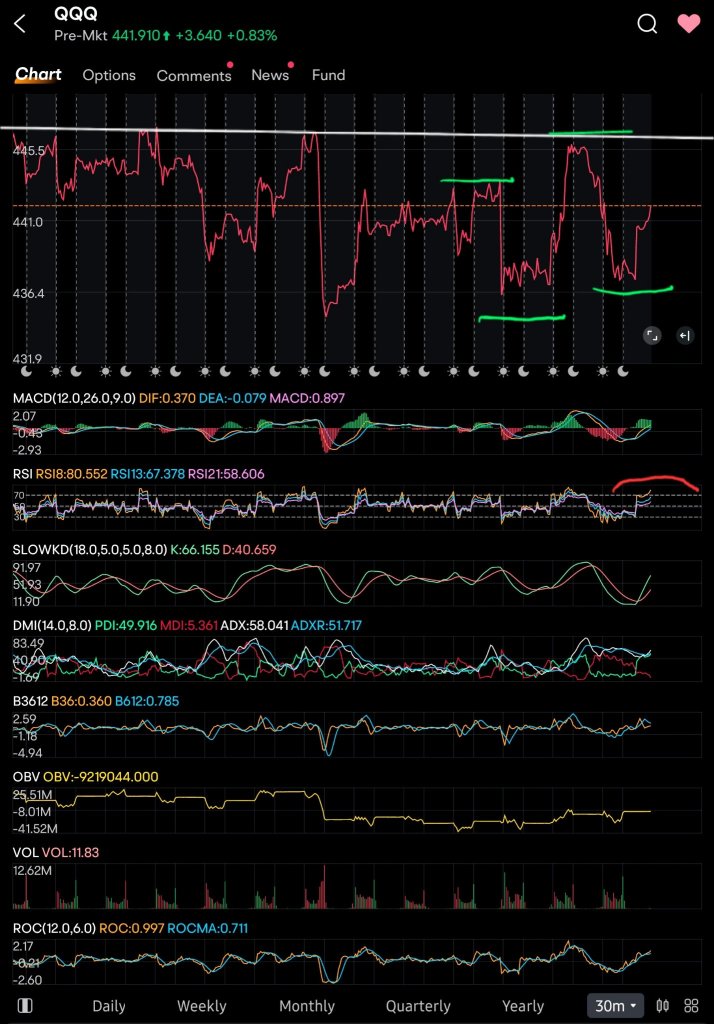

I wanted to get a post out because we are at a pivitol area in the markets. I still expect a larger drop coming, I would watch for Israel to hit nuclear facilities in Iran, which would lead to more selling as it would show an escalation and a nuclear element. Powell speaks on Tuesday. Powell has been dovish because he has to. he must talk down inflation because ...

I wanted to get a post out because we are at a pivitol area in the markets. I still expect a larger drop coming, I would watch for Israel to hit nuclear facilities in Iran, which would lead to more selling as it would show an escalation and a nuclear element. Powell speaks on Tuesday. Powell has been dovish because he has to. he must talk down inflation because ...

+8

Unsupported feature.

Please use the mobile app.

24

17

1

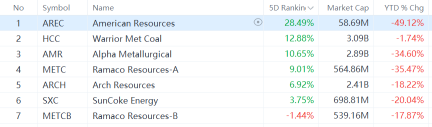

Warrior Met Coal's falling ROCE trend is concerning. Despite reinvestment, returns are declining. The current trends suggest a low chance of it becoming a multi-bagger.

Warrior Met Coal's low P/E ratio may indicate the investment community's weak outlook on the company's future growth, limiting its potential for significant share price hikes.

1

An insider's decision to sell shares at a lower price may indicate they see the higher valuation as unfair. The alignment of company's leaders and shareholders exists, but recent insider inactivity calls for caution.

$Warrior Met Coal (HCC.US)$ but this company obviously is not affected by the turn away from coal to more cleaner energy sources! Many coal companies have shit down do to the shift away from it having said that coal is technically still in high demand especially in countries like China who is the biggest coal using country! This chart is healthy and climbing since like 2020 and doesnt look to slow down anytime soon! A...

CEO Walt Scheller attributes boost in sales volumes to strong global demand, while acknowledging impact on average net selling price due to Pacific Basin freight differentials. He notes PLV Index price rise is due to supply disruptions and high demand.

1

Upgrades

• $AmerisourceBergen (ABC.US)$ : Deutsche Bank Upgrades to Buy from Hold - PT $178 (from $167)

• $Arch Resources(Delisted) (ARCH.US)$ : Jefferies Upgrades to Buy From Hold - PT $225 (from $160)

• $BHP Group Ltd (BHP.US)$ : Jefferies Upgrades to Buy From Hold - PT $82 (from $72)

• $Peabody Energy (BTU.US)$ : Jefferies Upgrades to Buy From Hold - PT $36 (from $25)

• $Warrior Met Coal (HCC.US)$ : Jefferies Upgrades to Buy From Hold - PT $50 (from $36)

• $Liberty Global-A (LBTYA.US)$ : Berenbe...

• $AmerisourceBergen (ABC.US)$ : Deutsche Bank Upgrades to Buy from Hold - PT $178 (from $167)

• $Arch Resources(Delisted) (ARCH.US)$ : Jefferies Upgrades to Buy From Hold - PT $225 (from $160)

• $BHP Group Ltd (BHP.US)$ : Jefferies Upgrades to Buy From Hold - PT $82 (from $72)

• $Peabody Energy (BTU.US)$ : Jefferies Upgrades to Buy From Hold - PT $36 (from $25)

• $Warrior Met Coal (HCC.US)$ : Jefferies Upgrades to Buy From Hold - PT $50 (from $36)

• $Liberty Global-A (LBTYA.US)$ : Berenbe...

6

10

Overall order flow was mixed on Wednesday, likely leaned net bearish on the day. Hedge funds and momentum players continue to chase $Apple (AAPL.US)$ higher for some exposure ahead of earnings. Institutional put sweepers were a bit more aggressive than we've been seeing in selective names but it is hard to put much weight on the put action during a monthly expiration week and the start of earnings season.

Similar to market breadth, the flow has been pretty...

Similar to market breadth, the flow has been pretty...

10

2

11

No comment yet

its not bad if you hold it. it's just not my thing. too many swaps and derivatives for my liking.

its not bad if you hold it. it's just not my thing. too many swaps and derivatives for my liking.

105087587 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

joemamaa : nice