No Data

HMC Honda Motor

- 25.829

- +0.199+0.78%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Three key points to focus on in the morning session: Overseas flows are limited, with short-term trading being the main focus.

In the trading session before the 29th, three points should be noted. ■ Overseas participants have limited flow and focus on short-term trading. ■ Noritz Steel, upward revision of operating profit to 18.7 billion yen from 18 billion yen for 24/12. ■ Key materials for the morning session: canon inc-spons adr, Space One, the increase of launch sites in Wakayama and Kushimoto, aiming for 30 satellite truckings per year in the 30s. The Japanese stock market on the 29th is likely to experience a stagnant trend due to a lack of guiding materials, similar to the US market on the 28th.

Canon inc-spons adr, Kaga Electronics, etc. [List of stock materials from the newspaper]

*Canon Inc-spons adr Space One plans to expand its launch site in Kushimoto, Wakayama, with 30 satellite trucking missions per year in the 30s (Nikkan Kogyo, front page) - ○ *Uni-Chika plans to withdraw from textiles and focus on polymers, with the president stating, "We will carry out a plan for survival" (Nikkan Kogyo, front page) - ○ *Nisshinbo Holdings has appointed Yasushi Ishii as president, aiming to regain momentum in wireless and communications (Nikkan Kogyo, front page) - ○ *SoftBank Group is considering additional investments in OpenAI (Nikkan Kogyo, page 3) - ○ *Veru Inc call information from.

Production, Sales and Export Results for October, 2024

Nikkei average contribution ranking (pre-closing) ~ Nikkei average rebounds for the first time in three days, with To-Electric pushing up about 141 yen per share.

As of the close on the 28th, the number of advancing and declining stocks in the Nikkei average was 151 up, 72 down, and 2 unchanged. The Nikkei average rebounded for the first time in three days, closing at 38,295.13 yen, up 160.16 yen (+0.42%) from the previous day, with a trading volume estimate of 0.8 billion 40 million shares. On the 27th, the U.S. stock market fell. The dow inc ended down 138.25 dollars at 44,722.06 dollars, while the nasdaq closed down 115.10 points at 19,060.48.

Three key points to watch in the morning session - a market trend of increased stalemate amid limited participation from market players.

In the pre-market trading 28 days ago, attention should be focused on the following three points. ■ A strong consolidation in the market as market participants are limited. ■ Casio has downgraded its operating profit from 16 billion yen to 14 billion yen due to the impact of unauthorized access. ■ Key point in the pre-market: Panasonic HD is entering the North American water heater business in collaboration with a US distributor. ■ A strong consolidation in the market as market participants are limited. The Japanese stock market on the 28th is likely to start with heavy selling and then show strong consolidation amidst limited market participants.

Panasonic HD, Toyota, etc.

Panasonic HD <6752> to enter North American water heater business, partnering with US sales company (Nikkan Kogyo page 3) - ○ Mitsubishi Electric Corp. <6503> to unveil Quasi-Zenith Satellite 'Michibiki' 6, heading to space within the fiscal year (Nikkan Kogyo page 3) - ○ Sumitomo Corp. <8053> Considering investment in Yokado, expecting synergy effect in the capital region (Nikkan Kogyo page 3) - ○ Matsuya <8237> Integrating physical stores and digital platforms, expanding product lineup, targeting younger age groups (Nikkan Kogyo page 4) - ○ Itochu <8001> Forming a capital alliance with emission management startup, launching new business in decarbonization support

Comments

A federal judge ruled Google holds an illegal monopoly in the search and text advertising markets. The decision focused on Google’s exclusive search arrangements on Android and Apple devices, which the court said reinforced its dominance.

“Google is a monopolist, and it has acted as one to maintain its monopoly,” Judge Amit Mehta wrote in the decision. The ruling stems from combined antitrust suits filed by the Department of Justice and several states...

Honda to Pour $15 Billion into EV Factory in Ontario–the Largest Auto Investment in Canada's History

will NEVER reach CNBC or WSJ!!!!

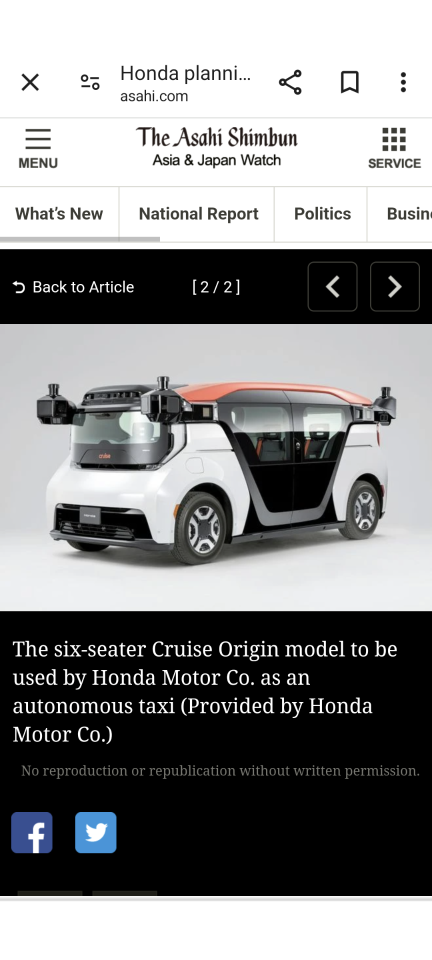

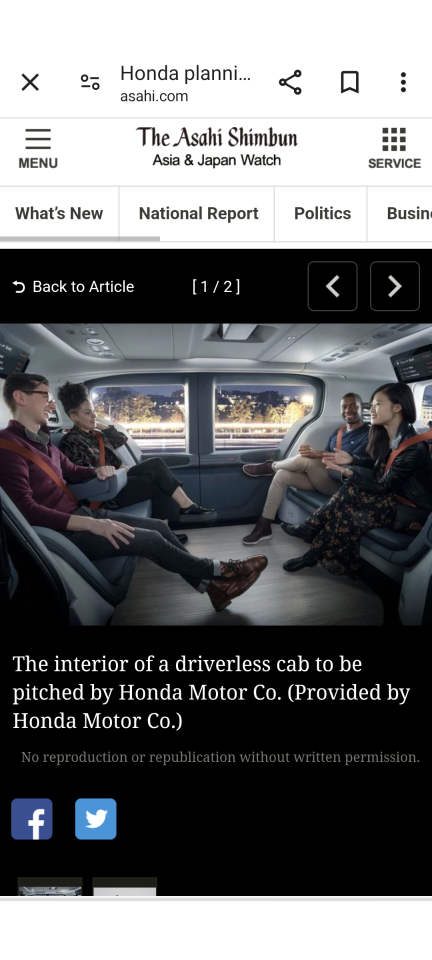

Honda Motor Co. plans to begin a driverless taxi service in central Tokyo in 2026 under a joint venture with General Motors of the United States.

Initially, several dozen self-driving taxis will be introduced, rising to 500 in phases, according to Honda’s Oct. 19 announcement.

It will mark the first commercial unmanned cab system in Japan by a leading automaker.

$Ryde Group (RYDE.US)$ $DoorDash (DASH.US)$ $Ryde Group (RYDE.US)$ $Lyft Inc (LYFT.US)$

Analysis

Price Target

No Data

Business Data

No Data