No Data

HMC Honda Motor

- 26.230

- +0.050+0.19%

- 26.520

- +0.290+1.11%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Today's flows: 11/22 Mitsubishi UFJ Financial Group saw an inflow of JPY¥ 6.82 billion, Seven & i Holdings saw an outflow of JPY¥ 5.18 billion

On November 22nd, the TSE Main Market saw an inflow of JPY¥ 701.58 billion and an outflow of JPY¥ 692.74 billion.$Mitsubishi UFJ Financial Group(8306.JP)$, $Disco(6146.JP)$ and $Fast Retailing(9983.

European Car Sales Flat in October, EVs Gain Ground, ACEA Says

Nikkei average contribution ranking (pre-close) ~ Nikkei average rebounds for the first time in 3 days, with Fast Retailing and Toshibha Electric pushing up about 113 yen with 2 stocks.

As of the market close on the 22nd, the number of rising and falling stocks in the Nikkei Average was 172 rising, 50 falling, and 3 unchanged. The Nikkei Average rebounded, closing the morning session at 38,415.32 yen, up 389.15 yen (+1.02%) from the previous day (with an estimated volume of 0.8 billion 10 million shares). On the 21st, the US stock market rose. The dow inc was up 461.88 dollars at 43,870.35 dollars, and the nasdaq finished trading up 6.28 points at 18,972.42. Geopolitical risks are escalating.

The Nikkei average starts up 120 yen, with companies like Sakura and Recruit HD rising.

[Nikkei Stock Average ・ TOPIX (Table)] Nikkei Average; 38,146.98; +120.81 TOPIX; 2,688.84; +6.03 [Opening Overview] On the 22nd, the Nikkei Average started trading with a rebound of 120.81 yen to 38,146.98 yen, up for the first time in three days. The previous day, the U.S. stock market rose. The Dow Jones Industrial Average closed at 43,870.35, up 461.88 points, and the Nasdaq closed at 18,972.42, up 6.28 points. Geopolitical risk concerns eased at the opening.

Three key points to focus on in the morning session: individual investors are shifting funds to australian small/mid cap stocks.

There are three points to focus on in the trading session on the 22nd.

ADR Japanese stock rankings - overall buying dominance including Orient Land, Chicago at 38,230 yen, 190 yen higher than Osaka.

Japanese stocks of ADR (american depositary receipt) compared to the Tokyo Stock Exchange (calculated at 154.51 yen per dollar), such as Orion Land <4661>, Mitsubishi Corporation <8058>, komatsu <6301>, Disco <6146>, Tokyo Electron <8035>, SoftBank Group <9984>, Mizuho Financial Group <8411>, have risen, with buying pressure prevailing overall. The settlement price of the Chicago Nikkei 225 futures is 38,230 yen, which is 190 yen higher than during the Osaka day session. The US stock market has risen, with the dow inc gaining 461.88 dollars.

Comments

A federal judge ruled Google holds an illegal monopoly in the search and text advertising markets. The decision focused on Google’s exclusive search arrangements on Android and Apple devices, which the court said reinforced its dominance.

“Google is a monopolist, and it has acted as one to maintain its monopoly,” Judge Amit Mehta wrote in the decision. The ruling stems from combined antitrust suits filed by the Department of Justice and several states...

Honda to Pour $15 Billion into EV Factory in Ontario–the Largest Auto Investment in Canada's History

will NEVER reach CNBC or WSJ!!!!

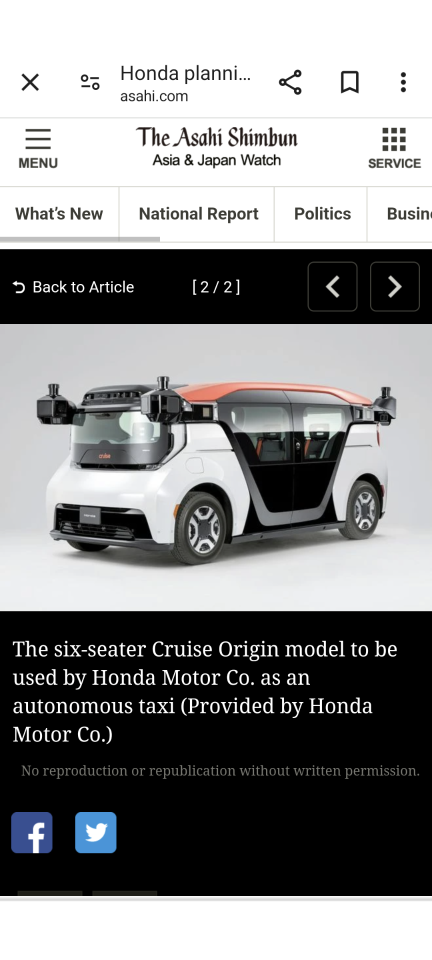

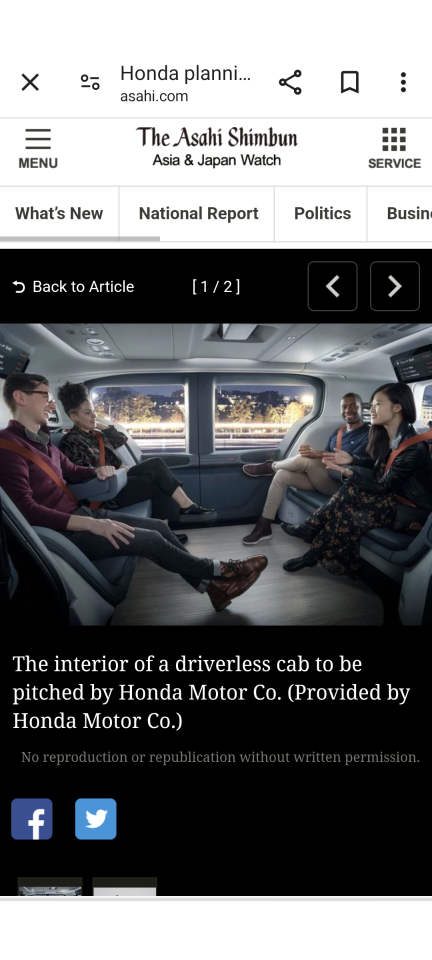

Honda Motor Co. plans to begin a driverless taxi service in central Tokyo in 2026 under a joint venture with General Motors of the United States.

Initially, several dozen self-driving taxis will be introduced, rising to 500 in phases, according to Honda’s Oct. 19 announcement.

It will mark the first commercial unmanned cab system in Japan by a leading automaker.

$Ryde Group (RYDE.US)$ $DoorDash (DASH.US)$ $Ryde Group (RYDE.US)$ $Lyft Inc (LYFT.US)$

Analysis

Price Target

No Data

Business Data

No Data