No Data

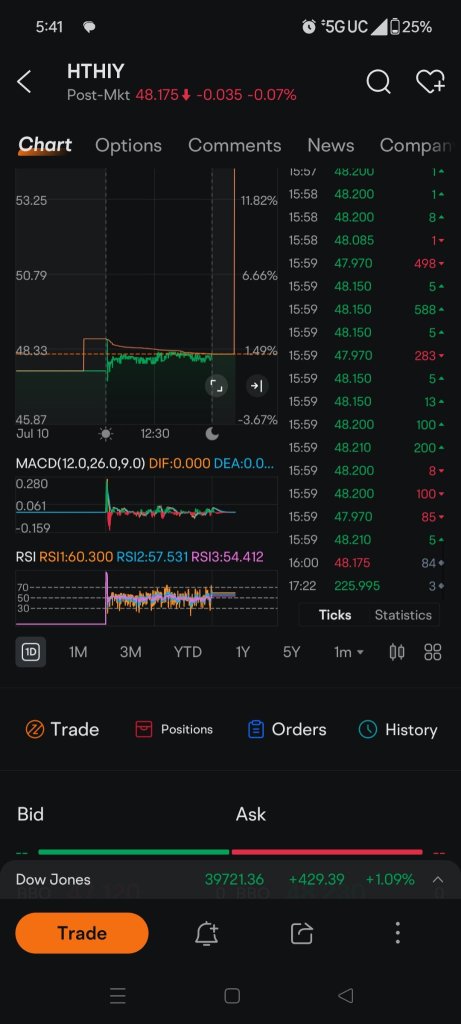

HTHIY Hitachi (ADR)

- 23.340

- -0.620-2.59%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

No Data

Trade Overview

Capital Trend

No Data

News

Hitachi Construction Machinery Americas Announces New Executive Team

The Nikkei average is down about 1,250 yen, and after a round of selling, the decline has somewhat narrowed in the morning session on the 31st.

On the 31st at around 10:03 AM, the Nikkei average stock price was fluctuating around 35,870 yen, approximately 1,250 yen lower than the previous weekend. At 9:22 AM, it reached 35,574.61 yen, down by 1,545.72 yen. It is the first time in six and a half months that it has dropped to the 35,000 yen range during trading hours since September 17 of last year. In the local market on the 28th, both the Dow Inc and Nasdaq Composite Index fell for the third consecutive day. The U.S. February PCE (Personal Consumption Expenditures) Index, excluding Energy and food, is projected to be on the market.

The Nikkei index fell by 227 yen, marking a pullback after three days, with regional bank stocks being sought after, while the TOPIX rose for the third consecutive day = 27th afternoon session.

On the 27th, the Nikkei average stock price in the afternoon session fell by 227 yen and 32 sen from the previous day to 37,799 yen and 97 sen, marking a decline for the first time in three days. Meanwhile, the TOPIX (Tokyo Stock Price Index) rose by 2.58 points to 2,815.47 points, continuing its upward trend for three consecutive days. There was a predominant sell-off from the morning, and the Nikkei average reached a low of 37,556 yen and 75 sen, down 470 yen and 54 sen at 9:06 AM. Concerns over the 25% tariff on imported Autos by the U.S. government and declines in Semiconductors stocks have also weighed on the market. Additionally, the lack of significant market cues has contributed to the situation.

Japanese Automakers Plunge on Trump's 25% Tariff Announcement

On the 26th, the ADR trends show that Shin-Etsu, Advantest, Murata Manufacturing, etc., are down in yen conversion value.

On the 26th, the American Depositary Receipts (ADRs) showed a general decline compared to the Tokyo closing prices on the same day when converted into yen. Converted into yen, companies like Shin-Etsu Chemical <4063.T>, Advantest <6857.T>, Murata Manufacturing <6981.T>, JAL <9201.T>, and SoftBank Group <9984.T> were lower. Hitachi <6501.T>, Toyota <7203.T>, NINTENDO CO LTD <7974.T>, Tokyo Electron <8035.T>, and Nitori Holdings <9843.T> also displayed weakness. Provided by Wealth Advisor.

Hitachi and Sumitomo Chemicals are utilizing AI to reduce and optimize energy consumption. They have begun verification in actual factories for the practical implementation of an automated production planning system.

Hitachi and Sumitomo Chemicals utilize AI to reduce and optimize Energy consumption. Verification has begun in real factories for the practical implementation of an automated production planning system. To view this news release in PDF format, Adobe Acrobat Reader is required. The information listed in this news release (product prices, product specifications, service content, release dates, contact information, URLs, etc.) is accurate as of the announcement date. It may be changed without notice, and the search date may differ from the information.

Comments

What's up with the ticker?

3 shares bought at 225 and the price jumps to 226 per Robinhood?

Monsta327 : Bro I bought this the other day because it pops up after hours. Nobody at Robinhood can explain why I can’t trade it after hours. Says it dosent trade after hours but that’s when it moves. Idk somebody smarter than me needs to help haha! I thought I found a slick one.

IDKWTFIMDOING OP Monsta327 : When I dug deeper, it has something to do with a trader overseas going through an American Depository or something like that. The rate hasn't been exchanged yet.