No Data

HYG Ishares Iboxx $ High Yield Corporate Bond Etf

- 79.645

- +0.185+0.23%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

U.S. Economy to Continue Growing Amid Tax Cuts, Deregulation -- Market Talk

Trump's Day 1 Executive Orders Target EVs, Inflation, Immigration. Here's What Could Come Next

Stock Gains Potentially Poised for Extension, Building Momentum

Stock Market's Roller-coaster Transition Into 2025 Reflects Volatile Interest Rates - Goldman Sachs

How high will US Treasury yields soar? Nomura: They could rise as high as 6% this year.

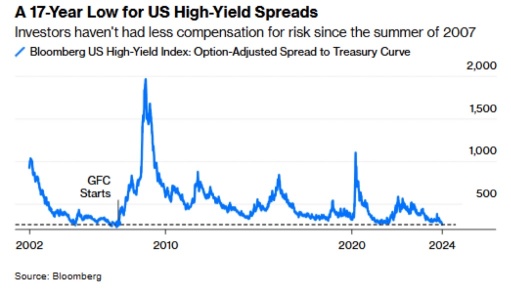

Nomura stated that from a long-term historical perspective, the 10-year U.S. Treasury yield is still relatively low compared to the two main driving factors of "CPI inflation rate" and "budget deficit": currently, the cyclically adjusted level of "CPI inflation rate + budget deficit (as a percentage of GDP)" is at its worst since 1960.

What are the major events worth paying attention to in the Futures market next week? What are the points of interest in each Sector?

Key data and events next week: China's one-year and five-year loan market Quote interest rates, Trump taking the oath of office as the new President of the USA, USA Martin Luther King Jr. Day, and several Exchanges adjusting trading hours........

Comments

On one of my last posts, I explained why I was ending. I said the path was set, Powell had chosen -

(from my post with this 👇)

In that post i highlighted some stocks (tesla) that did quite well. But that cycle has ende...

TWIMO (151403908) : interesting read. how long have you been worried and when did that worry increase?

iamiam OP TWIMO (151403908) : I have been worried for a long time, but not bearish. my worry increased in the summer, that's when I sold my longs.

TWIMO (151403908) iamiam OP : I ask around and listen to get a feel. Some are earning from entry years ago. Some are earning from knowing. Some are earning by hiding losses. Some only announced their wins. Most are carrying bags

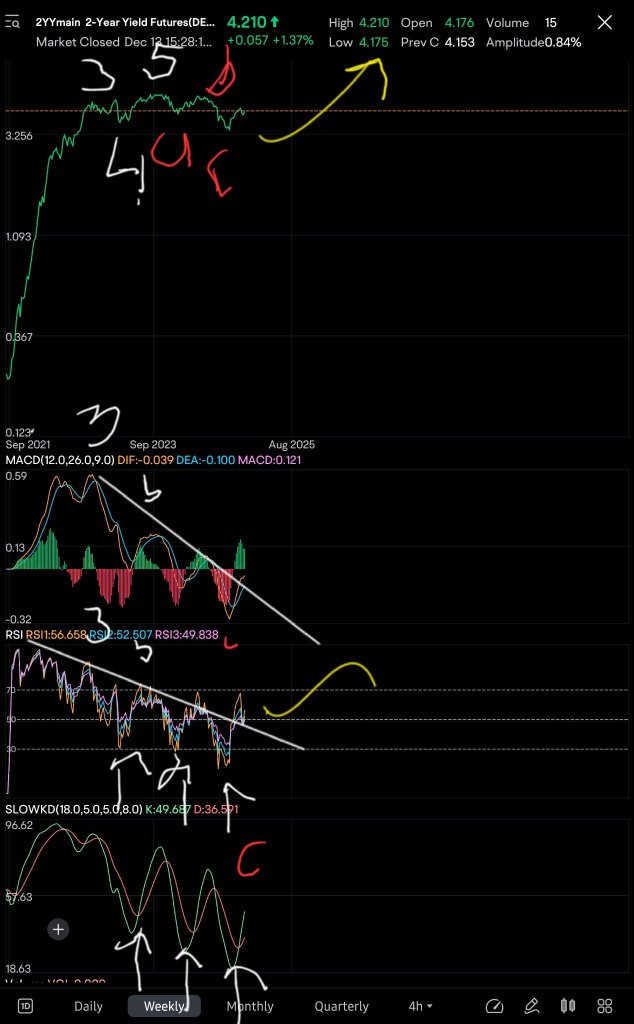

103706768 : Rule number 1 of bond trading, u dont trade using TA. Magical squiggly line TA indicators and so on doesnt work on bonds its dependent on FED rates and treasury auctions, bond yeilds are going up due to lack of demand at treasury auction. Currently bond yeilds have alrd inverted but the long awaited recession has yet to occur worse of all market is pricing in inflation going back up due to hot CPI/ consumer data while stocks are all going for all time high (this isnt normal yeild and stock tend to have counter relation). Now we can only wait and see is it the bond market thats wrong or the stock market thats wrong.

iamiam OP 103706768 : what does your comment offer?![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

I trade bonds based on squiggly lines and do quite well. I can draw squiggly lines and trend anything. whether you agree or not, that's on you and your 'rules'

enjoy your day