No Data

US Stock MarketDetailed Quotes

ICE Intercontinental Exchange

- 172.500

- -2.210-1.26%

Close Mar 31 16:00 ET

- 170.610

- -1.890-1.10%

Post 20:01 ET

99.11BMarket Cap36.09P/E (TTM)

173.535High171.290Low6.28MVolume172.820Open174.710Pre Close1.08BTurnover1.10%Turnover Ratio36.09P/E (Static)574.56MShares177.45052wk High3.58P/B98.34BFloat Cap122.87852wk Low1.80Dividend TTM570.11MShs Float177.450Historical High1.04%Div YieldTTM1.29%Amplitude5.367Historical Low172.317Avg Price1Lot Size

Full Hours

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Unit: --

Capital Trend

IntradayDayWeekMonth

No Data

News

Verizon, Coke and 8 Other Low Volatility Stocks for a Rocky Market -- Barrons.com

There's Reason For Concern Over Intercontinental Exchange, Inc.'s (NYSE:ICE) Price

Jim Cramer on Intercontinental Exchange (ICE): "Financial Stock That's Built to Last!"

Intercontinental Exchange Unveils NYSE Texas; Trump Media & Technology First To Join

BlackRock Follows the Financial Push to Texas With a Planned ETF

Trump Media Becomes First Stock to List on Newly Opened NYSE Texas

Comments

Stocks to Watch

Intercontinental Exchange Inc (ICE US) $Intercontinental Exchange (ICE.US)$

Daily Chart - [BULLISH ↗ **] ICE US has shaped a bullish breakout and as long as price is holding above 166.35 support, a bullish push higher towards 183.0 resistance is expected. A daily candlestick close above 183.0 resistance will push price higher to the next resistance at 189.7.

Alternatively: A daily candlestick closing below 166.35 support...

Intercontinental Exchange Inc (ICE US) $Intercontinental Exchange (ICE.US)$

Daily Chart - [BULLISH ↗ **] ICE US has shaped a bullish breakout and as long as price is holding above 166.35 support, a bullish push higher towards 183.0 resistance is expected. A daily candlestick close above 183.0 resistance will push price higher to the next resistance at 189.7.

Alternatively: A daily candlestick closing below 166.35 support...

+3

32

1

1

Happy weekend, investors! Welcome back to Weekly Buzz where we talk about the top ten buzzing stocks on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

The market overall advanced on Friday. The news followed Nvidia's earnings on Wednesday night and Bitcoin's all-time highs.

Just past the Friday close at 4 pm ET, the $S&P 500 Index (.SPX.US)$ traded...

Make Your Choice

Weekly Buzz

The market overall advanced on Friday. The news followed Nvidia's earnings on Wednesday night and Bitcoin's all-time highs.

Just past the Friday close at 4 pm ET, the $S&P 500 Index (.SPX.US)$ traded...

+11

99

43

21

The market climbed its best on Monday, with equities paling in comparison to the explosive first session of last week. The S&P 500 climbed while individual decliners brought down the Dow.

Just past 4 pm ET the $S&P 500 Index (.SPX.US)$ climbed 0.39% the $Dow Jones Industrial Average (.DJI.US)$ fell 0.13%, and the $Nasdaq Composite Index (.IXIC.US)$ climbed 0.60%.

$NVIDIA (NVDA.US)$ reports pulled the Dow lower,...

Just past 4 pm ET the $S&P 500 Index (.SPX.US)$ climbed 0.39% the $Dow Jones Industrial Average (.DJI.US)$ fell 0.13%, and the $Nasdaq Composite Index (.IXIC.US)$ climbed 0.60%.

$NVIDIA (NVDA.US)$ reports pulled the Dow lower,...

54

11

20

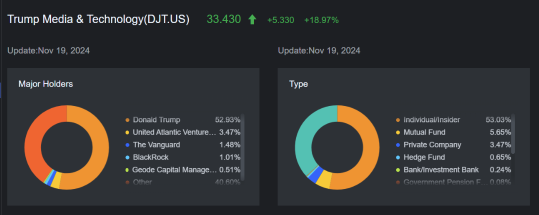

$Trump Media & Technology (DJT.US)$ shares jumped almost 17% Monday, erasing earlier declines after the Financial Times reported that the social media company is in talks to buy crypto trading venue Bakkt, owned by $Intercontinental Exchange (ICE.US)$.

The stock of the company that's 53% owned by President-elect Donald Trump climbed to $32.78, erasing declines of as much as 5.5% earlier. $Bakkt Holdings (BKKT.US)$ s...

The stock of the company that's 53% owned by President-elect Donald Trump climbed to $32.78, erasing declines of as much as 5.5% earlier. $Bakkt Holdings (BKKT.US)$ s...

33

4

32

Read more

This has even Bigger Gain consequences!

This has even Bigger Gain consequences!

Cui Nyonya Kueh : Tomorrow got class??