No Data

ICE241220C170000

- 0.15

- +0.07+87.50%

- 5D

- Daily

News

Weekly Buzz: Tech stocks hit high scores on ominous day

Crude Oil in the USA closed up 1.8% on Friday and rose 6.1% this week.

In the early hours of the 14th, Beijing time, international crude oil prices rose on Friday, with USA WTI crude oil recording its first increase since the end of November. The market is evaluating the future supply and demand outlook for the crude oil market. The February delivery Brent crude oil futures price on the European Intercontinental Exchange increased by 1.08 dollars, a rise of 1.47%, closing at 74.49 dollars per barrel. The January delivery West Texas Intermediate (WTI) crude oil futures price on the New York Commodity Exchange rose by 1.27 dollars, an increase of 1.81%, closing at 71.29 dollars per barrel, the highest since November 7. WTI crude oil has cumulatively increased by more than 6.08% this week.

Market Mixed on Friday the 13th | Livestock

Intercontinental Exchange (NYSE:ICE) Could Be A Buy For Its Upcoming Dividend

Intercontinental Exchange To Go Ex-Dividend On December 16th, 2024 With 0.45 USD Dividend Per Share

Insider Sale: General Counsel of $ICE (ICE) Sells 955 Shares

Comments

Make Your Choice

Weekly Buzz

The market overall advanced on Friday. The news followed Nvidia's earnings on Wednesday night and Bitcoin's all-time highs.

Just past the Friday close at 4 pm ET, the $S&P 500 Index (.SPX.US)$ traded...

Just past 4 pm ET the $S&P 500 Index (.SPX.US)$ climbed 0.39% the $Dow Jones Industrial Average (.DJI.US)$ fell 0.13%, and the $Nasdaq Composite Index (.IXIC.US)$ climbed 0.60%.

$NVIDIA (NVDA.US)$ reports pulled the Dow lower,...

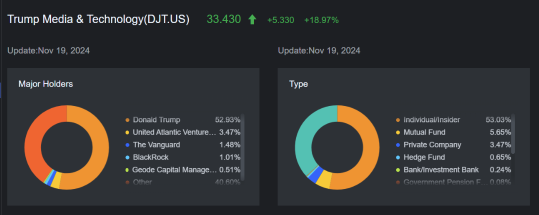

The stock of the company that's 53% owned by President-elect Donald Trump climbed to $32.78, erasing declines of as much as 5.5% earlier. $Bakkt Holdings (BKKT.US)$ s...

This has even Bigger Gain consequences!

This has even Bigger Gain consequences!

Space Dust : the bigs have their AI programs on full scalp. market can not crash as long as so much cash on the sidelines waiting for it.

is that ?

a.) conventional wisdom

b.) unconventional wisdom

c.) contrarian

d.) consensus

HuatLady : I’m keeping a careful watch on my portfolio, especially with a possible Santa rally ahead. While my main focus is on long-term growth, I’ll consider short-term opportunities that match my strategy. Since the market often sees a boost at year-end, I’m open to small, strategic tweaks if they seem worthwhile. I’ll likely hold off on any major shifts until January. My plan is to stay informed and adaptable while keeping the big picture in focus.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

102362254 : Sticking with my current portfolio is tempting, but I’m leaning toward some proactive moves. Recent market swings have opened up interesting opportunities in resilient sectors like tech and consumer discretionary. With signs of a soft economic landing and cooling inflation, a little adjustment now could really pay off if things keep trending in a positive direction

HuatEver : As the year wraps up, I will keep an eye on top growth stocks with strong potential, like$Amazon (AMZN.US)$ and $Shopify (SHOP.US)$ in e-commerce, where on-line shopping keeps growing. Tech stocks like $Alphabet-C (GOOG.US)$ and $Microsoft (MSFT.US)$ in cloud computing are also set to benefit from the need for data storage and AI.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Next in line worthed considering, are the dividend stocks like $Procter & Gamble (PG.US)$ and $Johnson & Johnson (JNJ.US)$ that provide steady income through regular dividends, adding a layer of safety in uncertain markets. This mix of stocks balances growth with stability, supporting both short- and long -term goals.

我只想赚个买菜钱 : ok

View more comments...