No Data

IEF iShares 7-10 Year Treasury Bond ETF

- 94.460

- -0.560-0.59%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

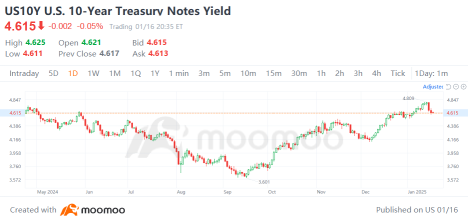

U.S. Treasury Yields Rise; Concerns About Stagflationary Risks Remain -- Market Talk

The US bond market is heavily betting on the return of the inflation beast. Will Friday's PCE reshape inflation expectations?

Under the dual pressure of inflation data and tariffs, the Federal Reserve insists on maintaining its current stance. Therefore, under the sticky inflation and tariff dilemma, Bonds market investors are betting on a steepening yield curve.

Rare! Inflow into USA Bonds ETF funds is approaching that of Stocks ETF, and AI Datacenter Bonds are popular.

As US stocks experience a significant correction, investors are turning to US Bonds for safe havens, with AI Datacenter related Bonds and short-term government bonds being favored by 'smart money'. In particular, 'ultra-short-term' government Fund, this year, the Inflow into ultra-short-term Bond ETFs accounts for over 40% of the total Inflow into Fixed Income ETFs.

Is the market currently exaggerating expectations of a recession in the USA?

Morgan Stanley believes that investors' panic over a USA economic recession is likely exaggerated, and the real economic slowdown has yet to fully manifest. There is still significant uncertainty (such as immigration policy) that has not materialized, and investors should focus on hard data, especially non-farm payroll data.

Fed's Balance Sheet Move: No Big Rate Drop in Sight -- Barron's

US Bonds' Best Gain This Month Comes as Fed Cut Bets Mount

Comments

The S&P 500 and DJIA de...

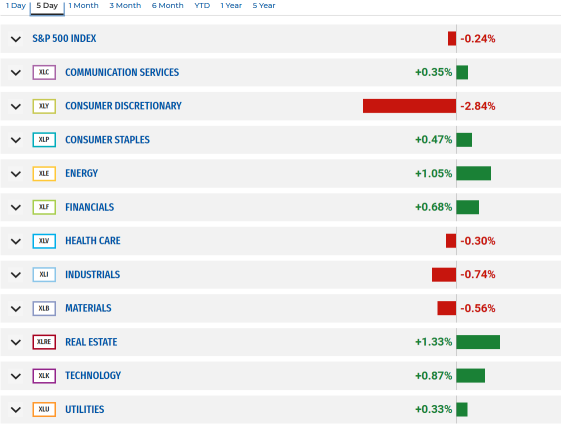

The recent strength in Treasury yields is largely attributed to robust economi...

For more - see Markers suggest a pullback could come - and if history repeats itself markets could fall 27%. Citi says 10%

DaisyDowner : I'm on my way to break some short computers... kick out some MF JAMS