No Data

US OptionsDetailed Quotes

IEFA241115P75000

- 1.80

- 0.000.00%

15min DelayTrading Oct 31 09:46 ET

0.00High0.00Low

0.00Open1.80Pre Close0 Volume46 Open Interest75.00Strike Price0.00Turnover21.98%IV1.33%PremiumNov 15, 2024Expiry Date0.82Intrinsic Value100Multiplier11DDays to Expiry0.99Extrinsic Value100Contract SizeAmericanOptions Type-0.5977Delta0.1383Gamma47.86Leverage Ratio-0.0459Theta-0.0116Rho-28.60Eff Leverage0.0498Vega

Intraday

- 5D

- Daily

News

Comments

Top 5 Holdings:

$Microsoft (MSFT.US)$ : Remains the heaviest holding, with approximately 67.68 million shares, valued at around $28.5 billion, accounting for 2.67% of the portfolio, representing a 2.90% increase from the previous quarter.

$Vanguard Value ETF (VTV.US)$ : Holding approximately 112 million shares, valued at approximately $18.2 billion, accounting for 1.71% of the portfolio, with an 8.40% inc...

$Microsoft (MSFT.US)$ : Remains the heaviest holding, with approximately 67.68 million shares, valued at around $28.5 billion, accounting for 2.67% of the portfolio, representing a 2.90% increase from the previous quarter.

$Vanguard Value ETF (VTV.US)$ : Holding approximately 112 million shares, valued at approximately $18.2 billion, accounting for 1.71% of the portfolio, with an 8.40% inc...

3

$WiMi Hologram Cloud (WIMI.US)$ $Ishares Trust Core Msci Eafe Etf (IEFA.US)$ $Petrochina (PTR.US)$ In the future, the AR / VR platform, 5G communication, cloud computing and the Internet of Things fields involved in the communication metaverse industry chain are expected to welcome investment opportunities.

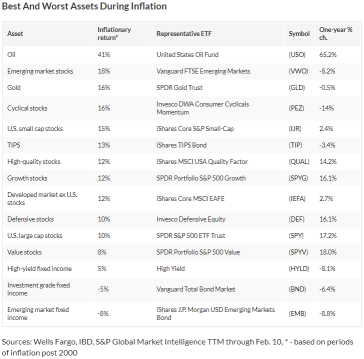

Wells Fargo looked at 15 major asset classes and calculated which ones did the best and worst during inflationary periods since 2000.

Here's the best asset to own when inflation.![]()

![]()

Oil's inflation-times rise is also more than any other major asset class the bank looked at. Oil's gain during inflationary periods is also roughly three-times higher than the average 12% rise of all 15 assets Wells Fargo studied.

$United States Oil Fund LP (USO.US)$ a major ETF t...

Here's the best asset to own when inflation.

Oil's inflation-times rise is also more than any other major asset class the bank looked at. Oil's gain during inflationary periods is also roughly three-times higher than the average 12% rise of all 15 assets Wells Fargo studied.

$United States Oil Fund LP (USO.US)$ a major ETF t...

49

21

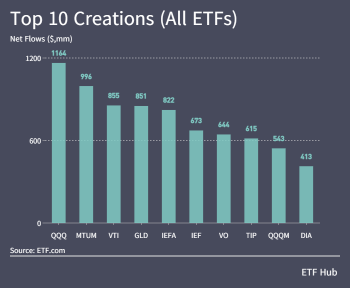

The U.S.-listed ETF industry added nearly $6.5 billion in fresh assets in a shortened trading week between Nov. 19 and Nov. 24, with defensive ETFs gaining steam to play among the large cap funds that tend to dominate inflows.![]()

![]()

Follow me to know more about ETFs![]()

Large caps, total market ETFs keep adding![]()

![]()

The $Invesco QQQ Trust (QQQ.US)$ led inflows on the period, with $1.16 billion added, while the $iShares MSCI USA Momentum Factor ETF (MTUM.US)$ and $Vanguard Total Stock Market ETF (VTI.US)$added $996 million and $855 million, respectively.

Fears over inflation in the U.S. sent some assets abroad, with the $Ishares Trust Core Msci Eafe Etf (IEFA.US)$ taking in $822 million.![]()

Defensive ETFs also peppered the top inflows list, with inflation in mind. The $SPDR Gold ETF (GLD.US)$ took in $851 million, while the $iShares TIPS Bond ETF (TIP.US)$ added $615 million.

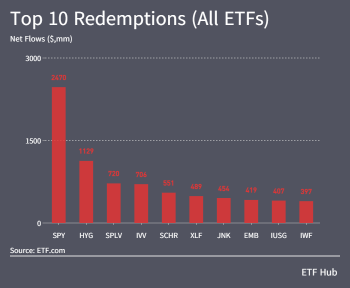

Growth, junk bonds hammered![]()

![]()

The $SPDR S&P 500 ETF (SPY.US)$ was the biggest loser from flows in the period, as investors pulled nearly $2.5 billion from the oldest ETF in the U.S. The $iShares Core S&P 500 ETF (IVV.US)$ found itself losing $706 million, as investors lessened their exposure to the index.![]()

![]()

High yield bonds were not in vogue either. The $Ishares Iboxx $ High Yield Corporate Bond Etf (HYG.US)$ saw $1.13 billion in outflows, while the $SPDR Bloomberg High Yield Bond ETF (JNK.US)$ lost $454 million.

Source: ETF.com

Follow me to know more about ETFs

Large caps, total market ETFs keep adding

The $Invesco QQQ Trust (QQQ.US)$ led inflows on the period, with $1.16 billion added, while the $iShares MSCI USA Momentum Factor ETF (MTUM.US)$ and $Vanguard Total Stock Market ETF (VTI.US)$added $996 million and $855 million, respectively.

Fears over inflation in the U.S. sent some assets abroad, with the $Ishares Trust Core Msci Eafe Etf (IEFA.US)$ taking in $822 million.

Defensive ETFs also peppered the top inflows list, with inflation in mind. The $SPDR Gold ETF (GLD.US)$ took in $851 million, while the $iShares TIPS Bond ETF (TIP.US)$ added $615 million.

Growth, junk bonds hammered

The $SPDR S&P 500 ETF (SPY.US)$ was the biggest loser from flows in the period, as investors pulled nearly $2.5 billion from the oldest ETF in the U.S. The $iShares Core S&P 500 ETF (IVV.US)$ found itself losing $706 million, as investors lessened their exposure to the index.

High yield bonds were not in vogue either. The $Ishares Iboxx $ High Yield Corporate Bond Etf (HYG.US)$ saw $1.13 billion in outflows, while the $SPDR Bloomberg High Yield Bond ETF (JNK.US)$ lost $454 million.

Source: ETF.com

49

4

Read more