No Data

IVV241129P566000

- 5.00

- 0.000.00%

- 5D

- Daily

News

U.S. stocks have risen over 20% for two consecutive years. What can be expected for next year? Learn from history: strong returns are stable!

① The s&p 500 index surged 26% in 2023 and is expected to rise by 27% this year. Carson Group predicts that next year, the roi for U.S. stocks will exceed the average annual return of around 10%. ② Research shows that since 1950, there have been six instances where the s&p 500 index achieved positive returns in the third year after increasing by 20% or more in two consecutive years.

China has taken the lead! Wall Street strategists: the next "Trump trade" may be outside of the USA.

①When looking to the future, Jay Pelosky, the founder and global strategist of the New York investment consulting firm TPW Advisory, has insights that differ from many mainstream market views; ②He believes that Trump's victory might ultimately serve as an important catalyst - driving the usa market to end its long-standing excellent performance.

In the past 24 hours, three major events are currently detonating the global market!

In the past 24 hours, investors in various fields including the stock market, bond market, foreign exchange market, and csi commodity equity index market have identified key “themes” affecting their respective markets. And behind all these market trends, it can actually be attributed to three major events.

US stocks closed: The Dow Jones rose nearly 1% to a new high, while nvidia and Tesla fell sharply against the trend.

① The nasdaq china golden dragon index rose by 0.44%; ② bitcoin fell back, microstrategy dropped more than 4%; ③ international oil prices plummeted, conocophillips fell by 5%; ④ California plans to introduce electric autos purchase subsidies, with Tesla being excluded.

IVV ETF Climbs 0.3%

Riskiest Stocks Jump as History Says Get In Before Parties Start

Comments

First, this projection is based on technical tools—it's not just a random guess pulled out of thin air.

Here, I’m using the Equidistant Channel to predict a potential target for the S&P 500.

What is an Equidistant Channel?

An Equidistant Channel in technical analysis is a charting tool used to i...

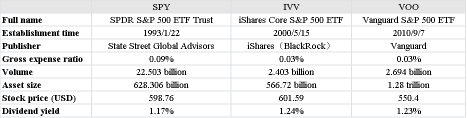

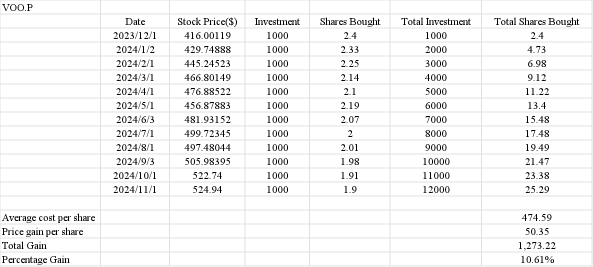

When considering index investment strategies, especially for large-cap stocks in the U.S. stock market, Exchange-Traded Funds (ETFs) that track the Standard & Poor's 500 Index (S&P 500 Index) are a popular choice among many investors.

The $S&P 500 Index (.SPX.US)$was created by Standard & Poor's in 1957. It is a market-capitalization-weighted index that incl...

Every day since Trump won the US election, the US Fed Funds Futures have suggested that we should also expect less and less US interest rates cuts are ahead. And now Donald Trump’s Republican Party looks set to control the US Congress, meaning Trump has...